OPEN-SOURCE SCRIPT

Williams %R + Keltner chanells - indicator (AS)

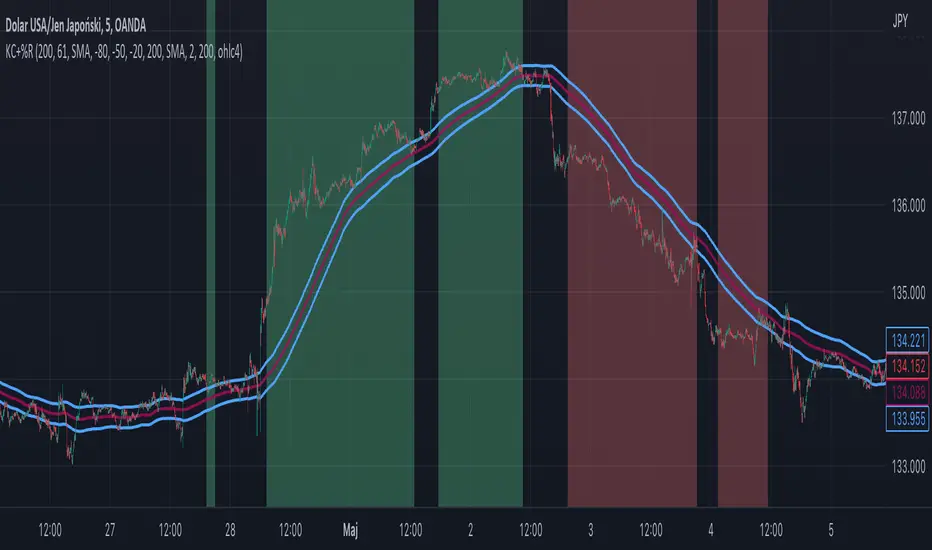

1)INDICATOR ---This indicator is a combination of Keltner channels and Williams %R.

It measures trend using these two indicators.

When Williams %R is overbought(above upper line (default=-20)) and Keltner lower line is below price indicator shows uptrend (green).

When Williams %R is oversold(below lower line (default=-80)) and Keltner upper line is above price indicator shows downtrend (red) .

Can be turned into a strategy quickly.

2) CALCULATIONS:

Keltner basis is a choosen type of moving average and upper line is basis + (ATR*multiplier). Same with lower but minus instead of plus so basiss – (ATR*multiplier)

Second indicator

Williams %R reflects the level of the close relative to the highest high for the lookback period

3)PLS-HELP-----Looking for tips, ideas, sets of parameters, markets and timeframes, rules for strategy -------OVERALL -every advice you can have

4) SIGNALS-----buy signal is when price is above upper KC and Williams %R is above OVB(-20). Short is exactly the other way around

5) CUSTOMIZATION:

-%R-------LENGTH/SMOOTHING/TYPE SMOOTHING MA

-%R-------OVS/MID/OVB -(MID-no use for now)

-KC -------LENGTH/TYPE OF MAIN MA

-KC-------MULTIPLIER,ATR LENGTH

-OTHER--LENGTH/TYPE OF MA - (for signal filters, not used for now)

-OTHER--SOURCE -src of calculations

-OTHER--OVERLAY - plots %R values for debugging etc(ON by default)

6)WARNING - do not use this indicator on its own for trading

7)ENJOY

It measures trend using these two indicators.

When Williams %R is overbought(above upper line (default=-20)) and Keltner lower line is below price indicator shows uptrend (green).

When Williams %R is oversold(below lower line (default=-80)) and Keltner upper line is above price indicator shows downtrend (red) .

Can be turned into a strategy quickly.

2) CALCULATIONS:

Keltner basis is a choosen type of moving average and upper line is basis + (ATR*multiplier). Same with lower but minus instead of plus so basiss – (ATR*multiplier)

Second indicator

Williams %R reflects the level of the close relative to the highest high for the lookback period

3)PLS-HELP-----Looking for tips, ideas, sets of parameters, markets and timeframes, rules for strategy -------OVERALL -every advice you can have

4) SIGNALS-----buy signal is when price is above upper KC and Williams %R is above OVB(-20). Short is exactly the other way around

5) CUSTOMIZATION:

-%R-------LENGTH/SMOOTHING/TYPE SMOOTHING MA

-%R-------OVS/MID/OVB -(MID-no use for now)

-KC -------LENGTH/TYPE OF MAIN MA

-KC-------MULTIPLIER,ATR LENGTH

-OTHER--LENGTH/TYPE OF MA - (for signal filters, not used for now)

-OTHER--SOURCE -src of calculations

-OTHER--OVERLAY - plots %R values for debugging etc(ON by default)

6)WARNING - do not use this indicator on its own for trading

7)ENJOY

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。