OPEN-SOURCE SCRIPT

Position Size 📐 DT/ST (Today's Open)

💡 Purpose:

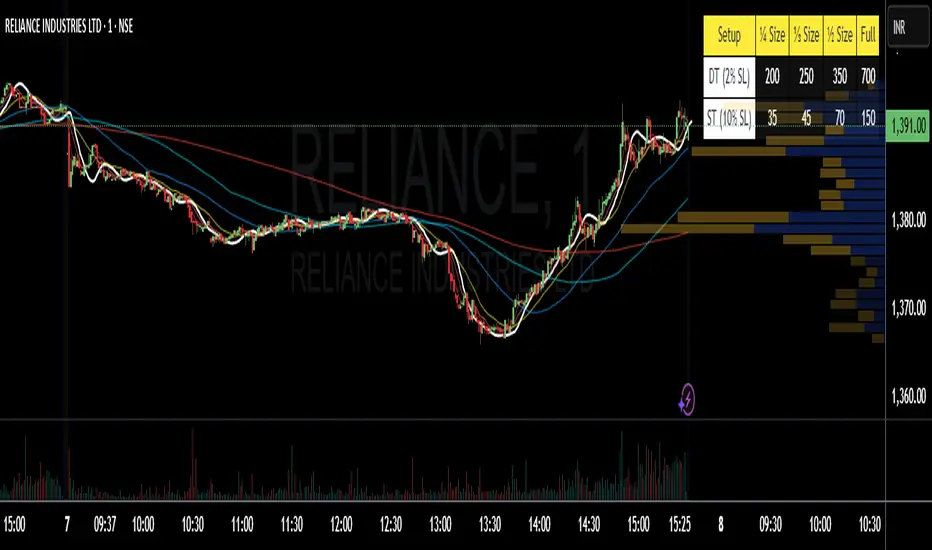

This indicator automatically calculates intraday (DT) and swing trading (ST) position sizes based on your account capital, risk per trade, and stop-loss percentage, using today’s daily open price as the entry price reference.

⚙️ Main Functionalities:

Dynamic Position Sizing

Calculates Full size position based on the maximum risk you allow per trade.

Breaks it down into ¼ Size, ⅓ Size, and ½ Size positions for flexible scaling.

Two Distinct Trading Styles:

DT (Day Trading) – Uses your specified intraday stop-loss % (default: 2%).

ST (Swing Trading) – Uses your specified swing stop-loss % (default: 10%).

Lot Size Rounding

Automatically rounds quantities to a chosen lot size (e.g., 1 for cash equity or futures lot size for derivatives).

Customizable Table Position

Display the table anywhere on your chart: Top Right, Top Left, Bottom Right, or Bottom Left.

Optimized for Dark or Light Themes

Yellow header with black text for visibility.

Blue row labels for strategy type.

Grey background with white text for calculated values.

Live Market Adaptation

All values update in real-time as today’s daily open price changes (on new daily candles).

Works for any symbol, asset class, or time frame.

🧮 Formula:

Position Size (Full) = Max Risk ₹ / (Price × StopLoss%)

¼, ⅓, and ½ Sizes = Scaled from Full size

📌 Ideal For:

Traders who want quick, ready-to-use position sizes right on their chart.

Those who follow fixed risk-per-trade and need fast decision-making without manual calculations.

This indicator automatically calculates intraday (DT) and swing trading (ST) position sizes based on your account capital, risk per trade, and stop-loss percentage, using today’s daily open price as the entry price reference.

⚙️ Main Functionalities:

Dynamic Position Sizing

Calculates Full size position based on the maximum risk you allow per trade.

Breaks it down into ¼ Size, ⅓ Size, and ½ Size positions for flexible scaling.

Two Distinct Trading Styles:

DT (Day Trading) – Uses your specified intraday stop-loss % (default: 2%).

ST (Swing Trading) – Uses your specified swing stop-loss % (default: 10%).

Lot Size Rounding

Automatically rounds quantities to a chosen lot size (e.g., 1 for cash equity or futures lot size for derivatives).

Customizable Table Position

Display the table anywhere on your chart: Top Right, Top Left, Bottom Right, or Bottom Left.

Optimized for Dark or Light Themes

Yellow header with black text for visibility.

Blue row labels for strategy type.

Grey background with white text for calculated values.

Live Market Adaptation

All values update in real-time as today’s daily open price changes (on new daily candles).

Works for any symbol, asset class, or time frame.

🧮 Formula:

Position Size (Full) = Max Risk ₹ / (Price × StopLoss%)

¼, ⅓, and ½ Sizes = Scaled from Full size

📌 Ideal For:

Traders who want quick, ready-to-use position sizes right on their chart.

Those who follow fixed risk-per-trade and need fast decision-making without manual calculations.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。