OPEN-SOURCE SCRIPT

更新済 CCI BB

This indicator is the idea of giorno_4_16.

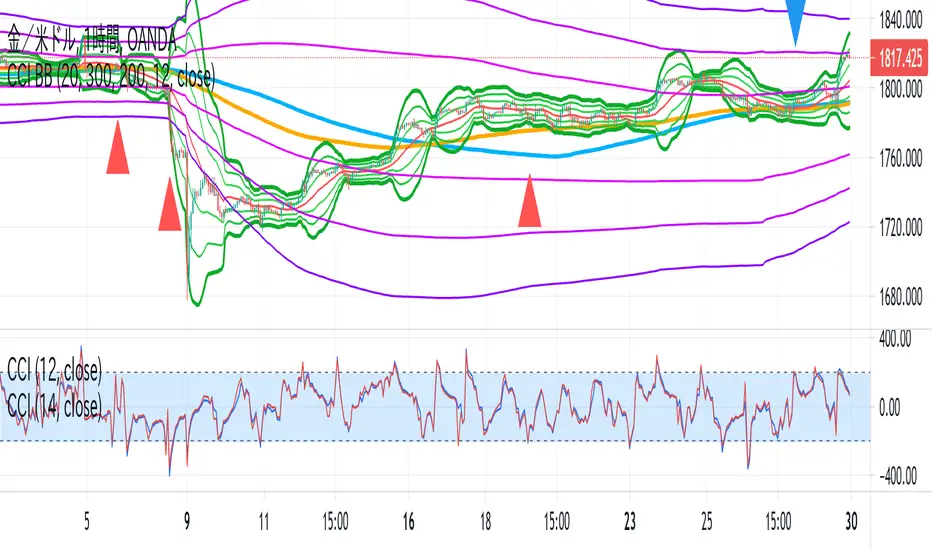

It shows some indicator lines in your main chart as following:

You should put CCI (12, 14) into your separated chart to use the idea.

It shows arrows for registance trading when:

When CCI crossovers -200, you can condisider buying.

When CCI crossunders 200, you can condisider selling.

You should use this indicator in 1H or 4H.

When an arrow appears in 1H, change timeframe to 4H and check the slope of BB20.

If the slope is gentle, take-profit target is MA20 of 1H.

If the slope is steep(ex. CCI crossovers -200 and 4H BB20 go up steeply), take-profit target is BB20 2sigma of 1H.

It shows some indicator lines in your main chart as following:

- SMA300, EMA200

- BB 20 1,2,3sigma and middle

- BB 300 1,2,3sigma and middle

You should put CCI (12, 14) into your separated chart to use the idea.

It shows arrows for registance trading when:

- CCI(12) crossovers -200 or corssunders 200 in recent 6bars,

- and the price crosses indicator line of SMA200, EMA200 and BB300 1,2,3sigma.

When CCI crossovers -200, you can condisider buying.

When CCI crossunders 200, you can condisider selling.

You should use this indicator in 1H or 4H.

When an arrow appears in 1H, change timeframe to 4H and check the slope of BB20.

If the slope is gentle, take-profit target is MA20 of 1H.

If the slope is steep(ex. CCI crossovers -200 and 4H BB20 go up steeply), take-profit target is BB20 2sigma of 1H.

リリースノート

The new version can change the lengths of BB, MA, CCI and source of CCI.オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。