INVITE-ONLY SCRIPT

更新済 Universal Valuation System

Overview 🔍

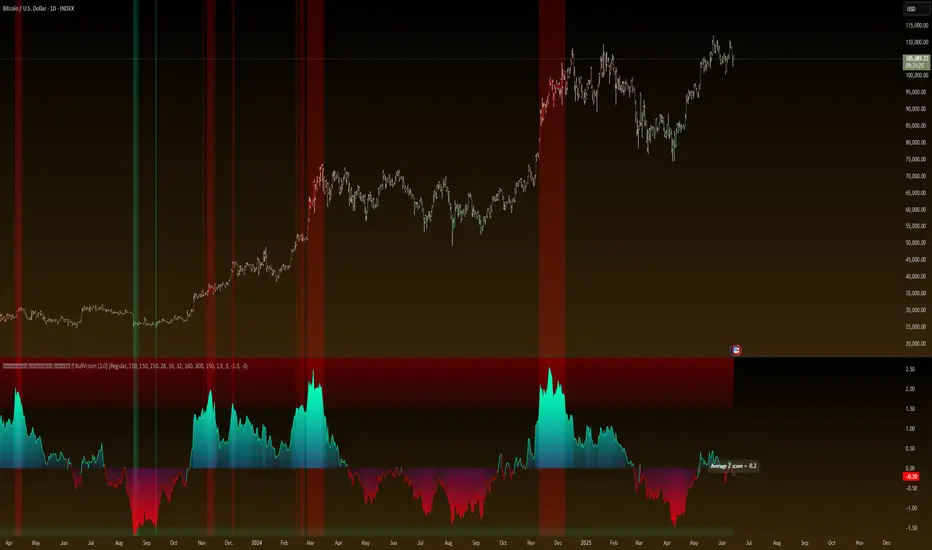

The Universal Valuation System (UVS) is an advanced valuation-focused indicator that provides insights into whether an asset is statistically overvalued or undervalued, helping traders understand where an asset sits within its historical value range. Unlike trend indicators, UVS emphasizes value analysis through a unique combination of performance ratios and statistical metrics, synthesizing this data into an overall Z-score. This score reflects the asset’s position within a typical normal distribution curve, allowing traders to make data-driven decisions based on historical valuation patterns.

Normal Distribution: A Statistical Foundation for Valuation 📊

The UVS leverages the normal distribution model as its core statistical framework. In a normal distribution, values tend to cluster around a central mean, with predictable probabilities for deviation. In financial markets, this means that most price or valuation levels hover around an average range, while extreme highs or lows are less frequent.

Under normal distribution:

Using Z-scores, UVS calculates where current valuation metrics fall relative to this distribution, identifying overvalued (above-average) or undervalued (below-average) zones. This helps traders interpret an asset’s relative value, showing whether it is more likely to revert toward its mean or is experiencing an exceptional deviation.

Key Components and Ratios in UVS 🔀

UVS includes a range of valuation metrics that work together to determine the Z-score:

Sharpe Ratio: Measures return relative to risk, offering insight into the quality of returns.

Sortino Ratio: Focuses on downside deviation, helping gauge negative returns’ impact.

Omega Ratio: Assesses the likelihood of gains versus losses, providing a risk-adjusted performance measure.

Crosby Ratio: Examines volatility patterns, adding dimension to the valuation signal.

VWAP (Volume-Weighted Average Price) Z-Score: Assesses price relative to volume, highlighting valuation when volume supports price movements.

Price ROC Z-Score: Uses the rate of price change to give a volatility-adjusted price movement signal.

By averaging these ratios, UVS forms a composite Z-score representing an overall valuation signal. This Z-score directly reflects the asset’s position within its historical distribution, indicating whether it’s in a typical, overbought, or oversold range.

DCA (Dollar-Cost Averaging) Application with UVS 💵

The UVS provides powerful insights for those using Dollar-Cost Averaging (DCA) by signaling periods when an asset may be overvalued or undervalued relative to its historical distribution. This model-based approach helps traders strategically adjust their DCA timing:

Valuation Zone Display and Accessibility 🌈

UVS includes several user-friendly display options, helping traders interpret its signals easily:

Composite Zone Highlighting: Displays overbought and oversold zones with color gradients, clearly visualizing statistical extremes.

Ratio Breakdown: Allows users to view individual Z-scores for each component, understanding the specific contributions to the overall valuation signal.

Color Blindness Mode: Offers multiple color settings to ensure clear interpretation across different visual needs.

Summary: Structured Value Analysis for Informed DCA Decisions

UVS is designed to be a reliable tool for traders looking to anchor their DCA and valuation-based strategies in statistical reality. By identifying valuation zones within a normal distribution framework, UVS enables a disciplined approach to asset accumulation based on relative value rather than price trends.

Important Note: UVS does not predict future performance. It provides a statistical view of historical valuation, which should be supplemented with additional analysis and risk management practices. Past patterns do not guarantee future results.

The Universal Valuation System (UVS) is an advanced valuation-focused indicator that provides insights into whether an asset is statistically overvalued or undervalued, helping traders understand where an asset sits within its historical value range. Unlike trend indicators, UVS emphasizes value analysis through a unique combination of performance ratios and statistical metrics, synthesizing this data into an overall Z-score. This score reflects the asset’s position within a typical normal distribution curve, allowing traders to make data-driven decisions based on historical valuation patterns.

Normal Distribution: A Statistical Foundation for Valuation 📊

The UVS leverages the normal distribution model as its core statistical framework. In a normal distribution, values tend to cluster around a central mean, with predictable probabilities for deviation. In financial markets, this means that most price or valuation levels hover around an average range, while extreme highs or lows are less frequent.

Under normal distribution:

- 68% of values lie within one standard deviation of the mean.

- 95% of values lie within two standard deviations.

- 99.7% of values lie within three standard deviations.

Using Z-scores, UVS calculates where current valuation metrics fall relative to this distribution, identifying overvalued (above-average) or undervalued (below-average) zones. This helps traders interpret an asset’s relative value, showing whether it is more likely to revert toward its mean or is experiencing an exceptional deviation.

Key Components and Ratios in UVS 🔀

UVS includes a range of valuation metrics that work together to determine the Z-score:

Sharpe Ratio: Measures return relative to risk, offering insight into the quality of returns.

Sortino Ratio: Focuses on downside deviation, helping gauge negative returns’ impact.

Omega Ratio: Assesses the likelihood of gains versus losses, providing a risk-adjusted performance measure.

Crosby Ratio: Examines volatility patterns, adding dimension to the valuation signal.

VWAP (Volume-Weighted Average Price) Z-Score: Assesses price relative to volume, highlighting valuation when volume supports price movements.

Price ROC Z-Score: Uses the rate of price change to give a volatility-adjusted price movement signal.

By averaging these ratios, UVS forms a composite Z-score representing an overall valuation signal. This Z-score directly reflects the asset’s position within its historical distribution, indicating whether it’s in a typical, overbought, or oversold range.

DCA (Dollar-Cost Averaging) Application with UVS 💵

The UVS provides powerful insights for those using Dollar-Cost Averaging (DCA) by signaling periods when an asset may be overvalued or undervalued relative to its historical distribution. This model-based approach helps traders strategically adjust their DCA timing:

- Overvalued (Overbought) Zones:

- Undervalued (Oversold) Zones:

Valuation Zone Display and Accessibility 🌈

UVS includes several user-friendly display options, helping traders interpret its signals easily:

Composite Zone Highlighting: Displays overbought and oversold zones with color gradients, clearly visualizing statistical extremes.

Ratio Breakdown: Allows users to view individual Z-scores for each component, understanding the specific contributions to the overall valuation signal.

Color Blindness Mode: Offers multiple color settings to ensure clear interpretation across different visual needs.

Summary: Structured Value Analysis for Informed DCA Decisions

UVS is designed to be a reliable tool for traders looking to anchor their DCA and valuation-based strategies in statistical reality. By identifying valuation zones within a normal distribution framework, UVS enables a disciplined approach to asset accumulation based on relative value rather than price trends.

Important Note: UVS does not predict future performance. It provides a statistical view of historical valuation, which should be supplemented with additional analysis and risk management practices. Past patterns do not guarantee future results.

リリースノート

Updated to v6リリースノート

Updated code リリースノート

Visual update 招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、BullVisionCapitalに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

DM on TradingView or visit my website for direct access

🚀 Elevate your edge with institutional-grade indicators & full trading systems.

🔗 Access tools: linktr.ee/0xKazo

🔗 Access tools: linktr.ee/0xKazo

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、BullVisionCapitalに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

DM on TradingView or visit my website for direct access

🚀 Elevate your edge with institutional-grade indicators & full trading systems.

🔗 Access tools: linktr.ee/0xKazo

🔗 Access tools: linktr.ee/0xKazo

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。