OPEN-SOURCE SCRIPT

更新済 Time of Day - Volatility Report

█ OVERVIEW

The indicator analyses the volatility and reports statistics by the time of day.

█ CONCEPTS

Around the world and at various times, different market participants get involved in the markets. How does this affect the market?

Knowing this gets you better prepared and improves your trading. Here are some ideas to explore:

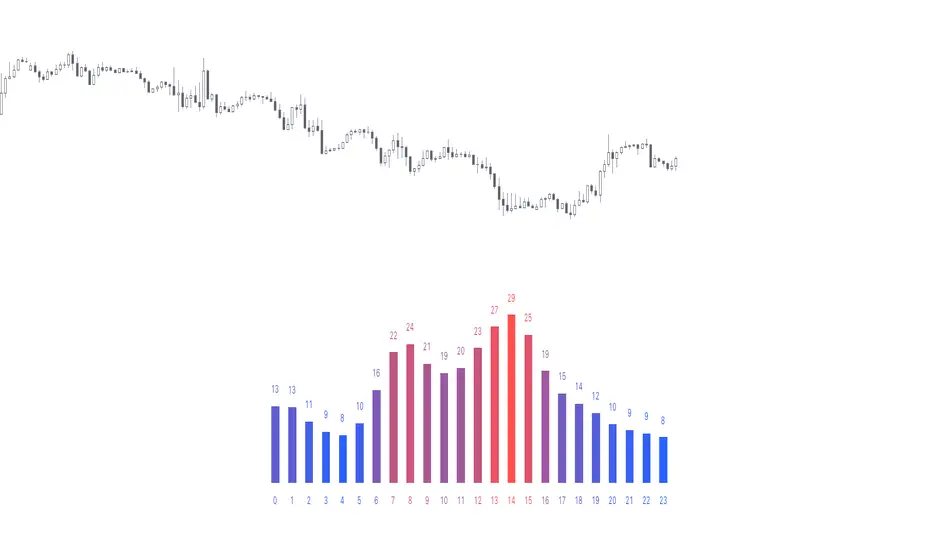

Bitcoin (UTC+0)

Gold (UTC+0)

Tesla, Inc. (UTC+0)

█ FEATURES

Selectable time zones

Display the statistics in your geographical time zone (or other market participants), the exchange time zone, or UTC+0.

Configurable outputs

Output the report statistics as mean or median.

█ HOW TO USE

Plot the indicator and visit the 1H timeframe.

█ NOTES

Gaps

The indicator includes the volatility from gaps.

Calculation

The statistics are not reported from absolute prices (does not favor trending markets) nor percentage prices (does not depict the different periods of volatility that markets can go through). Instead, the script uses the prices relative to the average range of previous days (daily ATR).

Extended trading session

The script analyses extended hours when activated on the chart.

Daylight Saving Time (DST)

The exchange time or geographical time zone selected may observe Daylight Saving Time. For example, TSLA always opens at 9:30 AM New York time but may see different opening times in another part of the globe (New York time corresponds to UTC-4 and UTC-5 during the year).

TSLA always opens at 9:30 AM New York time but may see different opening times in another part of the globe (New York time corresponds to UTC-4 and UTC-5 during the year).

The indicator analyses the volatility and reports statistics by the time of day.

█ CONCEPTS

Around the world and at various times, different market participants get involved in the markets. How does this affect the market?

Knowing this gets you better prepared and improves your trading. Here are some ideas to explore:

- When is the market busy and quiet?

- What time is it the most volatile?

- Which pairs in your watchlist are moving while you are actively trading?

- Should you adjust your trading time? Should you change your trading pairs?

- When does your strategy perform the best?

- What entry times do your winners have in common? What about the exit times of your losers?

- Is it worth keeping your trade open overnight?

Bitcoin (UTC+0)

Gold (UTC+0)

Tesla, Inc. (UTC+0)

█ FEATURES

Selectable time zones

Display the statistics in your geographical time zone (or other market participants), the exchange time zone, or UTC+0.

Configurable outputs

Output the report statistics as mean or median.

█ HOW TO USE

Plot the indicator and visit the 1H timeframe.

█ NOTES

Gaps

The indicator includes the volatility from gaps.

Calculation

The statistics are not reported from absolute prices (does not favor trending markets) nor percentage prices (does not depict the different periods of volatility that markets can go through). Instead, the script uses the prices relative to the average range of previous days (daily ATR).

Extended trading session

The script analyses extended hours when activated on the chart.

Daylight Saving Time (DST)

The exchange time or geographical time zone selected may observe Daylight Saving Time. For example,

リリースノート

v2- Added from-to date range filter

- Extended support to 30-minute and 15-minute charts

- Updated Pine to v6

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

🌟 Listed as "Trusted Pine Programmer"

👨💻 Coding services: sbtnc.dev/hire-pine-script-developer

🔒 Premium indicators: sbtnc.gumroad.com

☕️ Tip: buymeacoffee.com/sbtnc

👨💻 Coding services: sbtnc.dev/hire-pine-script-developer

🔒 Premium indicators: sbtnc.gumroad.com

☕️ Tip: buymeacoffee.com/sbtnc

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

🌟 Listed as "Trusted Pine Programmer"

👨💻 Coding services: sbtnc.dev/hire-pine-script-developer

🔒 Premium indicators: sbtnc.gumroad.com

☕️ Tip: buymeacoffee.com/sbtnc

👨💻 Coding services: sbtnc.dev/hire-pine-script-developer

🔒 Premium indicators: sbtnc.gumroad.com

☕️ Tip: buymeacoffee.com/sbtnc

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。