OPEN-SOURCE SCRIPT

更新済 Liquidity Indicator

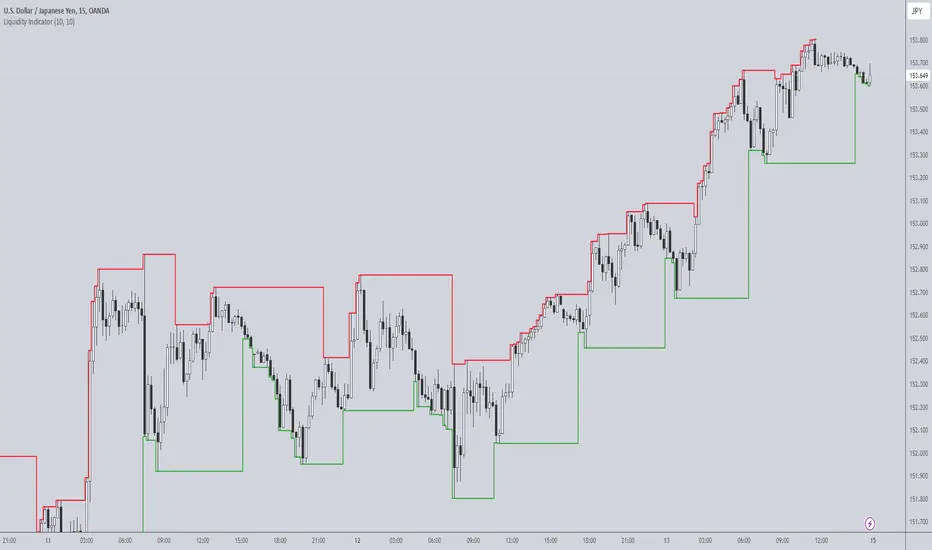

The Liquidity Indicator helps identify key price levels where liquidity may be concentrated by highlighting local highs and local lows on the chart. These levels are calculated using a lookback period to determine the highest and lowest points in the recent price action.

Local Highs: Displayed as red lines, these indicate recent peaks where price has experienced rejection or a possible reversal point.

Local Lows: Displayed as green lines, these represent recent troughs where price may find support or experience a bounce.

This indicator is useful for spotting potential areas of interest for price reversal or continuation, as high liquidity zones may lead to more significant price movements.

Key Features:

Adjustable lookback period to define the scope for identifying local highs and lows.

Continuous plotting without any time restrictions, providing real-time insights into liquidity conditions.

Alerts available for when a local high or local low is detected, enabling timely market analysis.

Use Case:

This indicator can be used in conjunction with other technical analysis tools or strategies to help identify significant price levels where liquidity could impact price action. It is suitable for both intraday and swing traders looking for key price zones where potential reversals or continuations might occur.

Local Highs: Displayed as red lines, these indicate recent peaks where price has experienced rejection or a possible reversal point.

Local Lows: Displayed as green lines, these represent recent troughs where price may find support or experience a bounce.

This indicator is useful for spotting potential areas of interest for price reversal or continuation, as high liquidity zones may lead to more significant price movements.

Key Features:

Adjustable lookback period to define the scope for identifying local highs and lows.

Continuous plotting without any time restrictions, providing real-time insights into liquidity conditions.

Alerts available for when a local high or local low is detected, enabling timely market analysis.

Use Case:

This indicator can be used in conjunction with other technical analysis tools or strategies to help identify significant price levels where liquidity could impact price action. It is suitable for both intraday and swing traders looking for key price zones where potential reversals or continuations might occur.

リリースノート

The ability to create separate lookback periods for the upper and lower liquidity lines has been added.リリースノート

The ability to create separate lookback periods for the upper and lower liquidity lines has been added.オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。