OPEN-SOURCE SCRIPT

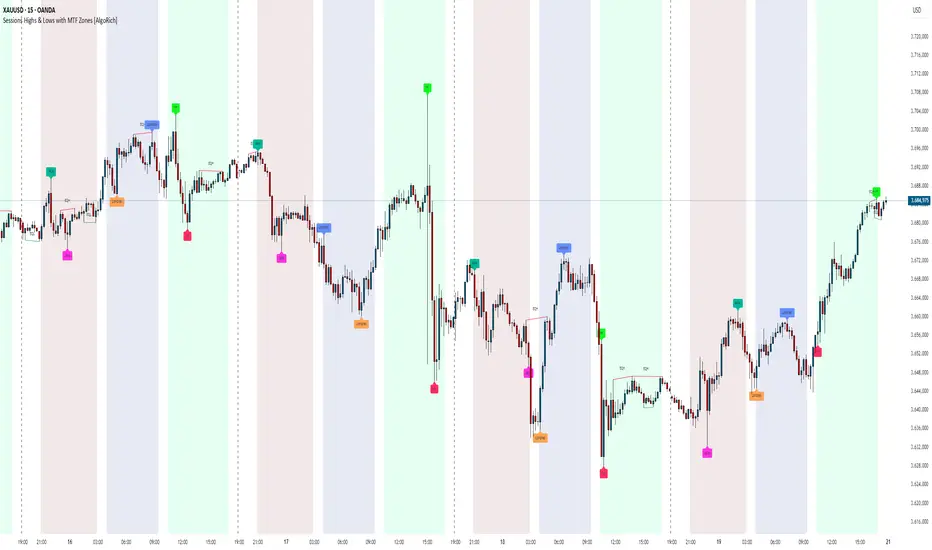

Sessions Highs & Lows with MTF Zones [AlgoRich]

Sessions Highs & Lows with MTF Zones [AlgoRich] — Description for Publication

What it does

This indicator marks and works with intra-session extremes and repeating liquidity zones:

Three configurable sessions (Asia / London / NY) with user-defined hours and colors. It shades the background during each session in your time zone (default UTC-3).

Session High/Low: while a session is open, it continuously updates its High/Low; when the session closes, it places labels at the exact bars where those extremes occurred (using the session name).

Equal Highs / Equal Lows (EQH / EQL) detection based on pivots and an ATR tolerance threshold. When two highs (or lows) are detected as “nearly equal,” it draws a line between them and tags EQH/EQL, highlighting potential liquidity/reaction areas.

How it works (under the hood)

The internal function f_sesion() checks whether a bar belongs to a session, whether it’s the start or end, and stores the session hi/lo and their bar_index. When the session ends, it creates the high/low labels.

Pivots are computed with ta.pivothigh / ta.pivotlow using pivotLength.

“Equality” between two extremes is decided by:

|Extreme1 − Extreme2| ≤ ATR(confluenceAtrLength) × threshold.

If Wait For Confirmation is enabled, the pivot must be fully formed (fewer signals, more robust). If disabled, it confirms with only 1 bar to the right (faster, more sensitive).

Parameters

General

UTC Zone: string like UTC-3 to evaluate session times correctly.

Session 1 / 2 / 3

Session name (e.g., Asia, London, NY).

Hours (format HHMM-HHMM, 24h).

Background shading ON/OFF and background color.

Label colors for the session’s High and Low.

Settings

Pivot Length: left/right bars to form a pivot.

ATR Length: ATR period used for the equality tolerance.

Threshold (0–1): ATR multiplier to decide whether two extremes are “equal” (e.g., 0.10 = difference ≤ 0.1 × ATR).

Wait For Confirmation: true = fully confirmed pivots; false = quicker confirmation (more anticipation, more noise).

Reading & suggested use

Session High/Low often act as liquidity references and potential resistance/support for the following session.

EQH/EQL can point to resting liquidity (areas prone to sweeps or breaks).

Use it as a map: combine these references with your plan (e.g., London/NY ORB, VWAP, order blocks).

What it does

This indicator marks and works with intra-session extremes and repeating liquidity zones:

Three configurable sessions (Asia / London / NY) with user-defined hours and colors. It shades the background during each session in your time zone (default UTC-3).

Session High/Low: while a session is open, it continuously updates its High/Low; when the session closes, it places labels at the exact bars where those extremes occurred (using the session name).

Equal Highs / Equal Lows (EQH / EQL) detection based on pivots and an ATR tolerance threshold. When two highs (or lows) are detected as “nearly equal,” it draws a line between them and tags EQH/EQL, highlighting potential liquidity/reaction areas.

How it works (under the hood)

The internal function f_sesion() checks whether a bar belongs to a session, whether it’s the start or end, and stores the session hi/lo and their bar_index. When the session ends, it creates the high/low labels.

Pivots are computed with ta.pivothigh / ta.pivotlow using pivotLength.

“Equality” between two extremes is decided by:

|Extreme1 − Extreme2| ≤ ATR(confluenceAtrLength) × threshold.

If Wait For Confirmation is enabled, the pivot must be fully formed (fewer signals, more robust). If disabled, it confirms with only 1 bar to the right (faster, more sensitive).

Parameters

General

UTC Zone: string like UTC-3 to evaluate session times correctly.

Session 1 / 2 / 3

Session name (e.g., Asia, London, NY).

Hours (format HHMM-HHMM, 24h).

Background shading ON/OFF and background color.

Label colors for the session’s High and Low.

Settings

Pivot Length: left/right bars to form a pivot.

ATR Length: ATR period used for the equality tolerance.

Threshold (0–1): ATR multiplier to decide whether two extremes are “equal” (e.g., 0.10 = difference ≤ 0.1 × ATR).

Wait For Confirmation: true = fully confirmed pivots; false = quicker confirmation (more anticipation, more noise).

Reading & suggested use

Session High/Low often act as liquidity references and potential resistance/support for the following session.

EQH/EQL can point to resting liquidity (areas prone to sweeps or breaks).

Use it as a map: combine these references with your plan (e.g., London/NY ORB, VWAP, order blocks).

オープンソーススクリプト

TradingViewの精神に則り、この作者はスクリプトのソースコードを公開しているので、その内容を理解し検証することができます。作者に感謝です!無料でお使いいただけますが、このコードを投稿に再利用する際にはハウスルールに従うものとします。

Comunidad de Trading híbrido

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、この作者はスクリプトのソースコードを公開しているので、その内容を理解し検証することができます。作者に感謝です!無料でお使いいただけますが、このコードを投稿に再利用する際にはハウスルールに従うものとします。

Comunidad de Trading híbrido

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。