OPEN-SOURCE SCRIPT

New RSI

📌 New RSI

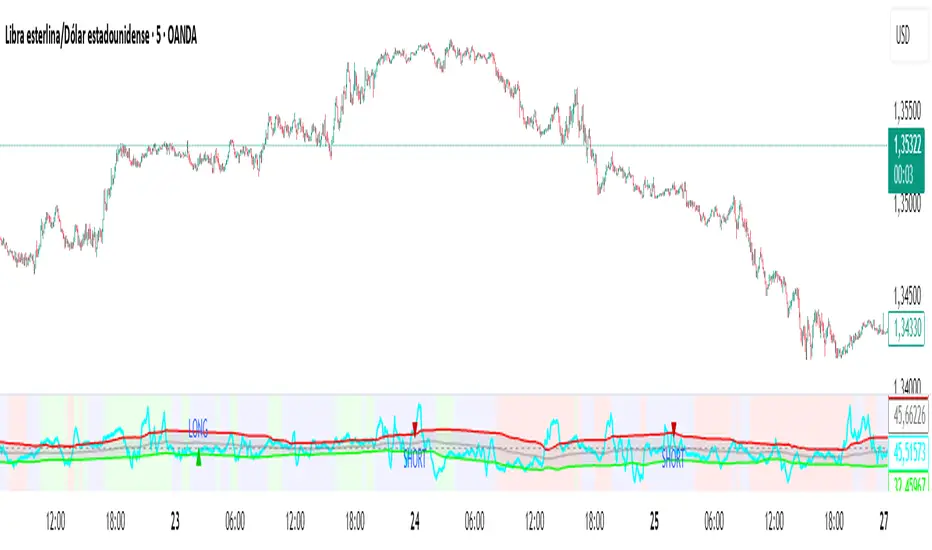

The New RSI is a modern, enhanced version of the classic RSI created in 1978 — redesigned for today’s fast-moving markets, where algorithmic trading and AI dominate price action.

This indicator combines:

Adaptive RSI: Adjusts its calculation length in real time based on market volatility, making it more responsive during high volatility and smoother during calm periods.

Dynamic Bands: Upper and lower bands calculated from historical RSI volatility, helping you spot overbought/oversold conditions with greater accuracy.

Trend & Regime Filters: EMA and ADX-based detection to confirm signals only in favorable market conditions.

Volume Confirmation: Signals appear only when high trading volume supports the move — green volume for bullish setups and red volume for bearish setups — filtering out weak and unreliable trades.

💡 How it works:

A LONG signal appears when RSI crosses above the lower band and the volume is high with a bullish candle.

A SHORT signal appears when RSI crosses below the upper band and the volume is high with a bearish candle.

Trend and higher timeframe filters (optional) can help improve precision and adapt to different trading styles.

✅ Best Use Cases:

Identify high-probability reversals or pullbacks with strong momentum confirmation.

Avoid false signals by trading only when volume validates the move.

Combine with your own support/resistance or price action strategy for even higher accuracy.

⚙️ Fully Customizable:

Adjustable RSI settings (length, volatility adaptation, smoothing)

Dynamic band sensitivity

Volume threshold multiplier

Higher timeframe RSI filter

Color-coded background for market regime visualization

This is not just another RSI — it’s a complete, next-gen momentum tool designed for traders who want accuracy, adaptability, and confirmation in every signal.

The New RSI is a modern, enhanced version of the classic RSI created in 1978 — redesigned for today’s fast-moving markets, where algorithmic trading and AI dominate price action.

This indicator combines:

Adaptive RSI: Adjusts its calculation length in real time based on market volatility, making it more responsive during high volatility and smoother during calm periods.

Dynamic Bands: Upper and lower bands calculated from historical RSI volatility, helping you spot overbought/oversold conditions with greater accuracy.

Trend & Regime Filters: EMA and ADX-based detection to confirm signals only in favorable market conditions.

Volume Confirmation: Signals appear only when high trading volume supports the move — green volume for bullish setups and red volume for bearish setups — filtering out weak and unreliable trades.

💡 How it works:

A LONG signal appears when RSI crosses above the lower band and the volume is high with a bullish candle.

A SHORT signal appears when RSI crosses below the upper band and the volume is high with a bearish candle.

Trend and higher timeframe filters (optional) can help improve precision and adapt to different trading styles.

✅ Best Use Cases:

Identify high-probability reversals or pullbacks with strong momentum confirmation.

Avoid false signals by trading only when volume validates the move.

Combine with your own support/resistance or price action strategy for even higher accuracy.

⚙️ Fully Customizable:

Adjustable RSI settings (length, volatility adaptation, smoothing)

Dynamic band sensitivity

Volume threshold multiplier

Higher timeframe RSI filter

Color-coded background for market regime visualization

This is not just another RSI — it’s a complete, next-gen momentum tool designed for traders who want accuracy, adaptability, and confirmation in every signal.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。