OPEN-SOURCE SCRIPT

更新済 Cheat Code

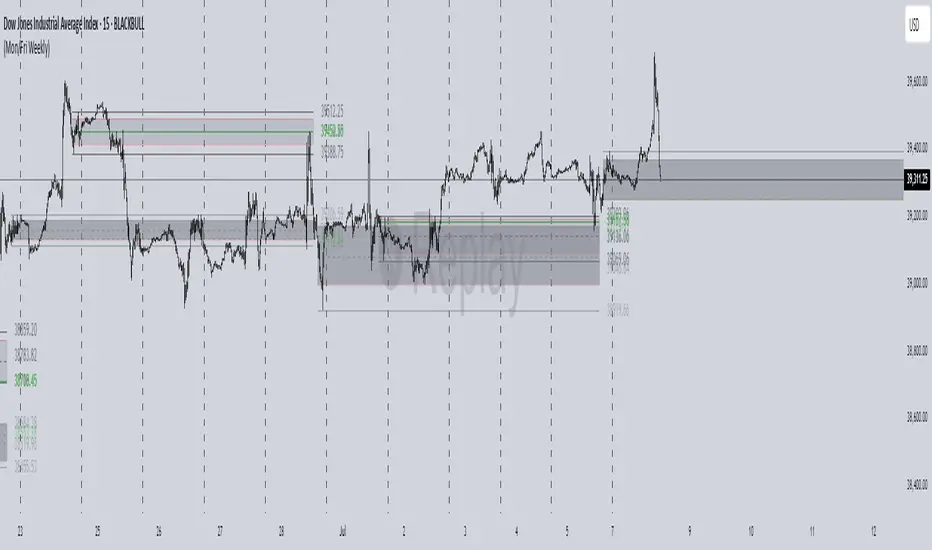

Why Monday & Friday

Monday evening (NY): frequently seeds the weekly expansion. Its DR/IDR often acts as a weekly “starter envelope,” useful for breakout continuation or fade back into the box plays as liquidity builds.

Friday evening (NY): often exposes end-of-week traps (run on stops into the close) and sets expectation boundaries into the following week. Carry these levels forward to catch Monday’s reaction to Friday’s closing structure.

Typical use-cases

Breakout & retest:

Price closes outside the Monday DR/IDR → look for retests of the band edge for continuation.

Liquidity sweep (“trap”) recognition:

Friday session wicks briefly beyond Friday DR/IDR then closes back inside → watch for mean reversion early next week.

Bias filter:

Above both Monday DR midline and Friday DR midline → bias long until proven otherwise; the inverse for shorts.

Session open confluence:

Reactions at the open line frequently mark decision points for momentum vs. fade setups.

(This is a levels framework, not a signals engine. Combine with your execution model: orderflow, S/R, session timing, or higher-TF bias.)

Inputs & styling (quick reference)

Display toggles (per day):

Show DR / IDR / Middle DR / Middle IDR

Show Opening Line

Show DR/IDR Box (choose DR or IDR as box source)

Show Price Labels

Style controls (per day):

Line width (1–4), style (Solid/Dashed/Dotted)

Independent colors for DR, IDR, midlines, open line

Box background opacity

Timezone:

Default America/New_York (changeable).

Optional on-chart warning if your chart TZ differs.

Practical notes

Works on intraday charts; levels are anchored using weekly timestamps for accuracy on any symbol.

Live updating: During the Mon/Fri calc windows, DR/IDR highs/lows and midlines keep updating until the session ends.

Clean drawings: Lines, box, and labels are created once per session and then extended/updated—efficient on resources even with long display windows.

Max elements: Script reserves ample line/box/label capacity for stability across weeks.

Monday evening (NY): frequently seeds the weekly expansion. Its DR/IDR often acts as a weekly “starter envelope,” useful for breakout continuation or fade back into the box plays as liquidity builds.

Friday evening (NY): often exposes end-of-week traps (run on stops into the close) and sets expectation boundaries into the following week. Carry these levels forward to catch Monday’s reaction to Friday’s closing structure.

Typical use-cases

Breakout & retest:

Price closes outside the Monday DR/IDR → look for retests of the band edge for continuation.

Liquidity sweep (“trap”) recognition:

Friday session wicks briefly beyond Friday DR/IDR then closes back inside → watch for mean reversion early next week.

Bias filter:

Above both Monday DR midline and Friday DR midline → bias long until proven otherwise; the inverse for shorts.

Session open confluence:

Reactions at the open line frequently mark decision points for momentum vs. fade setups.

(This is a levels framework, not a signals engine. Combine with your execution model: orderflow, S/R, session timing, or higher-TF bias.)

Inputs & styling (quick reference)

Display toggles (per day):

Show DR / IDR / Middle DR / Middle IDR

Show Opening Line

Show DR/IDR Box (choose DR or IDR as box source)

Show Price Labels

Style controls (per day):

Line width (1–4), style (Solid/Dashed/Dotted)

Independent colors for DR, IDR, midlines, open line

Box background opacity

Timezone:

Default America/New_York (changeable).

Optional on-chart warning if your chart TZ differs.

Practical notes

Works on intraday charts; levels are anchored using weekly timestamps for accuracy on any symbol.

Live updating: During the Mon/Fri calc windows, DR/IDR highs/lows and midlines keep updating until the session ends.

Clean drawings: Lines, box, and labels are created once per session and then extended/updated—efficient on resources even with long display windows.

Max elements: Script reserves ample line/box/label capacity for stability across weeks.

リリースノート

1. Sessions it tracksThis script is only about Monday evening and Friday evening trading sessions in America/New_York time:

Monday session: from 19:30 → 23:00 (NY time)

Friday session: from 19:30 → 23:00 (NY time)

It does not track the rest of the week.

2. What it measures inside each session

For each session, it calculates two ranges:

DR (Daily Range):

The session’s highest high and lowest low between 19:30–23:00.

IDR (Initial / Inside Range):

The range between the max(open, close) and min(open, close) of all the candles inside that session (basically the body extremes, ignoring wicks).

It also records:

The middle of the DR (avg(high, low)).

The middle of the IDR (avg(max(open,close), min(open,close))).

The opening price of the session (first bar at 19:30).

3. Drawing logic

It plots these ranges on your chart:

Box:

Draws a shaded box covering either the DR or IDR (your choice), extending beyond the session:

Monday’s box extends until Friday 18:00 of the same week.

Friday’s box extends until next Friday 18:00.

Lines:

Horizontal lines at:

DR high & low (and optional middle).

IDR high & low (and optional middle).

Session open price.

All lines extend until the end of the extension window.

Labels:

Price labels at the right edge of each line, if enabled.

Styles:

You can toggle each feature on/off (box, DR lines, IDR lines, midlines, open line, labels).

You can also choose colors, line styles (solid/dashed/dotted), and widths separately for Monday and Friday.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。