INVITE-ONLY SCRIPT

更新済 Spiral Guide Algorithm [V2]

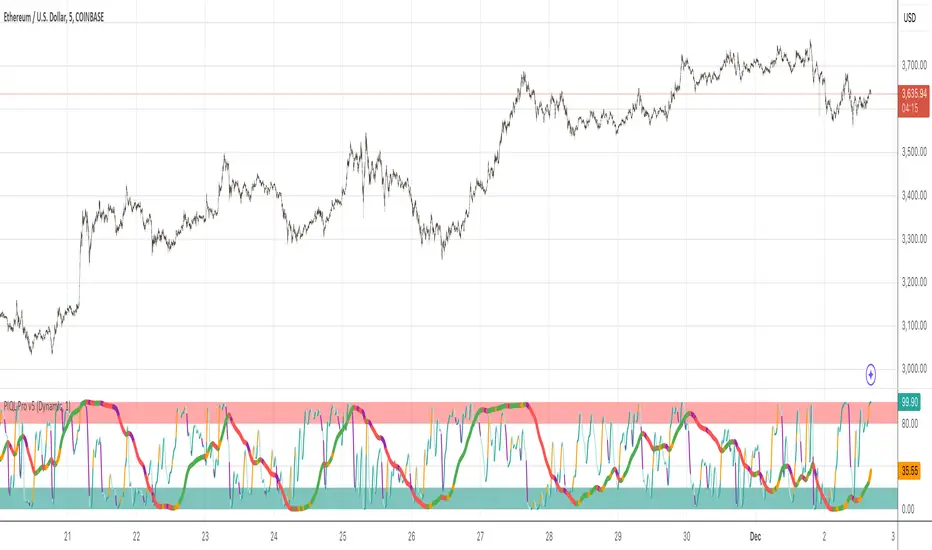

Spiral Guide Algorithm (SGA)

At its core, the Spiral Guide Algorithm is a low noise, un-bounded, oscillating cycle indicator designed to capture state change within a non-Gaussian distribution.

The idea, design, and application of the Spiral Guide Algorithm is rooted in first principles from four core areas of study, and in application proves to be an excellent trend following tool.

The Spiral Guide Algorithm produces and visualizes three principal components. Below we will cover each of those areas, as well as, how to apply this algorithm in trade analysis.

Principal Components

1. SGA Signal = waveform fundamental signal line

2. SGA Filtered Signal= finite impulse response filter of the SGA signal

3. SGA Histogram= delta between SGA signal and SGA filtered signal

Theory of Operation

1. Digital Signal Processing (DSP)

a. The SGA applies a DSP technique used in wireless transmission that decomposes a waveform into discrete components and then quantifies the interaction between each of those components.

2. Complex Systems Theory

a. In complex systems the tail often wags the dog and so SGA focuses not on the average of the distribution, but on the edges.

3. Game Theory

a. Positive feedback drives large changes from historical extremes, so targeting points of extreme oscillation offers the best chance of capturing large changes in the distribution.

4. Auction Theory

a. We know the auction process cycles between two phases:

i. At value

ii. Discovering value

b. SGA is designed to capture much of the “value discovery” phase between two “at value” areas.

Derivatives

1. When the SGA signal line is above 0 the time frame is up-trending

2. When the SGA signal line is below 0 the time frame is down-trending

3. A fundamental time frame shift is occurring when SGA signal line crosses 0

4. The ratio of SGA signal line time above 0 vs time below 0 will expose the current time frame bias (long, short, flat)

Application

1. Trades are signaled when the SGA signal line crosses the SGA filtered signal, and the trade is confirmed when the SGA filtered signal changes state.

2. Trades can be entered when the SGA signal line crosses 0.

3. SGA should align with the following before entering a trade: Structure, Cycles, Fractals.

4. The histogram is used for detecting divergence.

When and Where

1. Due to the large number of sample sets needed to calculate the SGA signal line, the SGA is designed for intraday charting.

2. Monitor multiple time frames around entry and exit time frame to satisfy the fractal requirements. As a rule, a 3-5x fractal above and below the entry and exit time frame is needed to align cycles.

3. For example:

a. Tick data or 1 second

b. 1 min

c. 5 min (entry/exit)

d. 15 min

4. This algorithm sees success in markets that are not mean reversion biased.

a. Trending markets with high volatility provide the best results.

At its core, the Spiral Guide Algorithm is a low noise, un-bounded, oscillating cycle indicator designed to capture state change within a non-Gaussian distribution.

The idea, design, and application of the Spiral Guide Algorithm is rooted in first principles from four core areas of study, and in application proves to be an excellent trend following tool.

The Spiral Guide Algorithm produces and visualizes three principal components. Below we will cover each of those areas, as well as, how to apply this algorithm in trade analysis.

Principal Components

1. SGA Signal = waveform fundamental signal line

2. SGA Filtered Signal= finite impulse response filter of the SGA signal

3. SGA Histogram= delta between SGA signal and SGA filtered signal

Theory of Operation

1. Digital Signal Processing (DSP)

a. The SGA applies a DSP technique used in wireless transmission that decomposes a waveform into discrete components and then quantifies the interaction between each of those components.

2. Complex Systems Theory

a. In complex systems the tail often wags the dog and so SGA focuses not on the average of the distribution, but on the edges.

3. Game Theory

a. Positive feedback drives large changes from historical extremes, so targeting points of extreme oscillation offers the best chance of capturing large changes in the distribution.

4. Auction Theory

a. We know the auction process cycles between two phases:

i. At value

ii. Discovering value

b. SGA is designed to capture much of the “value discovery” phase between two “at value” areas.

Derivatives

1. When the SGA signal line is above 0 the time frame is up-trending

2. When the SGA signal line is below 0 the time frame is down-trending

3. A fundamental time frame shift is occurring when SGA signal line crosses 0

4. The ratio of SGA signal line time above 0 vs time below 0 will expose the current time frame bias (long, short, flat)

Application

1. Trades are signaled when the SGA signal line crosses the SGA filtered signal, and the trade is confirmed when the SGA filtered signal changes state.

2. Trades can be entered when the SGA signal line crosses 0.

3. SGA should align with the following before entering a trade: Structure, Cycles, Fractals.

4. The histogram is used for detecting divergence.

When and Where

1. Due to the large number of sample sets needed to calculate the SGA signal line, the SGA is designed for intraday charting.

2. Monitor multiple time frames around entry and exit time frame to satisfy the fractal requirements. As a rule, a 3-5x fractal above and below the entry and exit time frame is needed to align cycles.

3. For example:

a. Tick data or 1 second

b. 1 min

c. 5 min (entry/exit)

d. 15 min

4. This algorithm sees success in markets that are not mean reversion biased.

a. Trending markets with high volatility provide the best results.

リリースノート

#Added Alerts for Each Tradable Condition of the SGAリリースノート

Added functionality to allow reference timeframe to be modified; allowing for multi-timeframe analysis on a single chart via stacked SGA indicatorsリリースノート

Added multi-timeframe functionality リリースノート

#Refactored most of the code#Added more functionality to adjust SGA indicator:

- Enable/disable SGA signal lines

- Enable/disable SGA histogram

- Divergence detection both positive and negative

- Redesigned histogram calculation to reduce false signals and increase tradeability

- SGA/Hist Max/Min enable/disable

- Long/Short Coloring

- SGA Fast

- SGA Very Fast

リリースノート

Added SGA filter control Corrected alert print output

リリースノート

Fixed scaling issue with OTFsリリースノート

- Improved Settings MenuAdded OTF Heat MapAdded New Alert FunctionsRe-factored Core RoutinesAdded Signal Stat BoxAdded Histogram Stat Box

リリースノート

Build 3.1 Hot Fix 1- Corrected Alert Logic

- Updated Alert Menu

リリースノート

- updated script to include only user requested features

- improved loading times

- LTS SGA Version

リリースノート

- Refactored most of of the code base

- Updated to Pinescript V5

- Updated Menu Section

- Added Liner Regression Channels

- Added SGA Prime Indicator

- Updated Alert Functionality

リリースノート

- Fixed SGA Prime issue caused by TV backend

リリースノート

- Added Strategy Visualizations

リリースノート

- Added SGA Trend Confirm Tool

- Removed Stat Boxes

リリースノート

- Updated SGA Trend Confirm

リリースノート

- Added SGA Prime plot label

リリースノート

- Added SGA Prime Strategy Settings & Alerts

リリースノート

- Added Trend Confirm Plots

[*} Updated Trend Confirm Function

リリースノート

- Corrected Data Input Formula

リリースノート

- Corrected bug in TC

リリースノート

- Added SGA TC Color Change Plots

リリースノート

- Corrected Trend Confirm Plots

- Added Rev Control

リリースノート

- Added Trend Confirm Alerts

- Removed SGA Crossing Zero Exit Filter

- Added Bot ID Selection In Settings

- Corrected Alerts "side":"exit" problem

リリースノート

- Updated TC Plot to Show When No Bias Present

リリースノート

Updated: - Re-organized menu structure

- Added SGA Prime forced alert

リリースノート

Update:- Unknown TV bug; reverting to build 1.2

リリースノート

- Removed unused plots due to hitting limit

- Re-organized menu structure

- Added SGA Prime forced alert

リリースノート

- Updated SGA Color Alerts

リリースノート

- refactored functions- removed extra code

リリースノート

- corrected indicator name招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、leeriderに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Unlock your success path with Prime IQ Labs!

Free Spiral Guide Algorithm (PIQL Pro v5) trial:

primeiqlabs.com/step/piql-pro-free-trial/

Join our FREE Discord server:

discord.gg/invite/primeiqlabs

Unlock your success path with Prime IQ Labs!

Get a FREE Spiral Guide Algorithm (PIQL Pro v5) trial:

primeiqlabs.com/step/piql-pro-free-trial/

Join our free Discord server:

discord.gg/invite/primeiqlabs

Get a FREE Spiral Guide Algorithm (PIQL Pro v5) trial:

primeiqlabs.com/step/piql-pro-free-trial/

Join our free Discord server:

discord.gg/invite/primeiqlabs

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、leeriderに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Unlock your success path with Prime IQ Labs!

Free Spiral Guide Algorithm (PIQL Pro v5) trial:

primeiqlabs.com/step/piql-pro-free-trial/

Join our FREE Discord server:

discord.gg/invite/primeiqlabs

Unlock your success path with Prime IQ Labs!

Get a FREE Spiral Guide Algorithm (PIQL Pro v5) trial:

primeiqlabs.com/step/piql-pro-free-trial/

Join our free Discord server:

discord.gg/invite/primeiqlabs

Get a FREE Spiral Guide Algorithm (PIQL Pro v5) trial:

primeiqlabs.com/step/piql-pro-free-trial/

Join our free Discord server:

discord.gg/invite/primeiqlabs

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。