OPEN-SOURCE SCRIPT

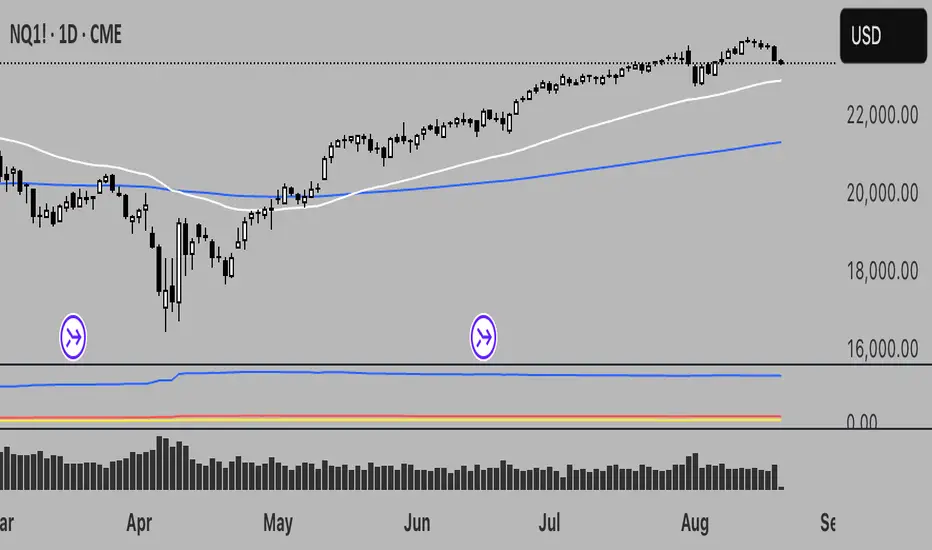

更新済 Realized Volatility (StdDev of Returns, %)

📌 Realized Volatility (StdDev of Returns, %)

This indicator measures realized volatility directly from price returns, instead of the common but misleading approach of calculating standard deviation around a moving average.

🔹 How it works:

Computes close-to-close log returns (the most common way volatility is measured in finance).

Calculates the standard deviation of these returns over a chosen lookback period (default = 200 bars).

Converts results into percentages for easier interpretation.

Provides three key volatility measures:

Daily Realized Vol (%) – raw standard deviation of returns.

Annualized Vol (%) – scaled by √250 trading days (market convention).

Horizon Vol (%) – volatility over a custom horizon (default = 5 days, i.e. weekly).

🔹 Why use this indicator?

Shows true realized volatility from historical returns.

More accurate than measuring deviation around a moving average.

Useful for traders analyzing risk, position sizing, and comparing realized vs implied volatility.

⚠️ Note:

It is best used on the Daily Chart!

By default, this uses log returns (which are additive and standard in quant finance).

If you prefer, you can easily switch to simple % returns in the code.

Volatility estimates depend on your chosen lookback length and may vary across timeframes.

This indicator measures realized volatility directly from price returns, instead of the common but misleading approach of calculating standard deviation around a moving average.

🔹 How it works:

Computes close-to-close log returns (the most common way volatility is measured in finance).

Calculates the standard deviation of these returns over a chosen lookback period (default = 200 bars).

Converts results into percentages for easier interpretation.

Provides three key volatility measures:

Daily Realized Vol (%) – raw standard deviation of returns.

Annualized Vol (%) – scaled by √250 trading days (market convention).

Horizon Vol (%) – volatility over a custom horizon (default = 5 days, i.e. weekly).

🔹 Why use this indicator?

Shows true realized volatility from historical returns.

More accurate than measuring deviation around a moving average.

Useful for traders analyzing risk, position sizing, and comparing realized vs implied volatility.

⚠️ Note:

It is best used on the Daily Chart!

By default, this uses log returns (which are additive and standard in quant finance).

If you prefer, you can easily switch to simple % returns in the code.

Volatility estimates depend on your chosen lookback length and may vary across timeframes.

リリースノート

Realized Volatility (StdDev of Returns, %)This indicator measures realized volatility directly from price returns, instead of the common but misleading approach of calculating standard deviation around a moving average.

🔹 How it works:

Computes close-to-close log returns (the most common way volatility is measured in finance).

Calculates the standard deviation of these returns over a chosen lookback period (default = 200 bars).

Converts results into percentages for easier interpretation.

Provides three key volatility measures:

Daily Realized Vol (%) – raw standard deviation of returns.

Annualized Vol (%) – scaled by √252 trading days (market convention).

Horizon Vol (%) – volatility over a custom horizon (default = 5 days, i.e. weekly).

🔹 Why use this indicator?

Shows true realized volatility from historical returns.

More accurate than measuring deviation around a moving average.

Useful for traders analyzing risk, position sizing, and comparing realized vs implied volatility.

⚠️ Note:

By default, this uses log returns, which are additive and standard in quant finance.

If you prefer, you can easily switch to simple % returns in the code.

Volatility estimates depend on your chosen lookback length and may vary across timeframes.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。