OPEN-SOURCE SCRIPT

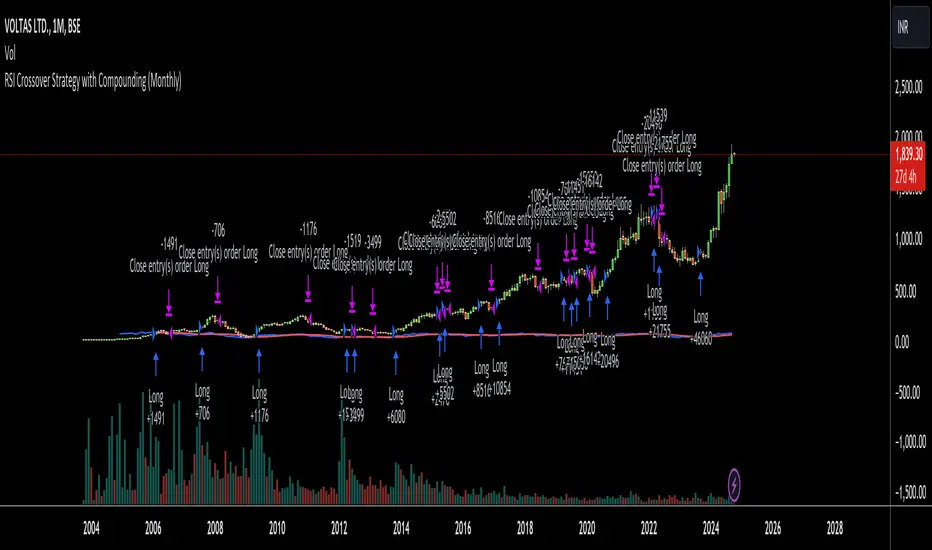

RSI Crossover Strategy with Compounding (Monthly)

Explanation of the Code:

Initial Setup:

The strategy initializes with a capital of 100,000.

Variables track the capital and the amount invested in the current trade.

RSI Calculation:

The RSI and its SMA are calculated on the monthly timeframe using request.security().

Entry and Exit Conditions:

Entry: A long position is initiated when the RSI is above its SMA and there’s no existing position. The quantity is based on available capital.

Exit: The position is closed when the RSI falls below its SMA. The capital is updated based on the net profit from the trade.

Capital Management:

After closing a trade, the capital is updated with the net profit plus the initial investment.

Plotting:

The RSI and its SMA are plotted for visualization on the chart.

A label displays the current capital.

Notes:

Test the strategy on different instruments and historical data to see how it performs.

Adjust parameters as needed for your specific trading preferences.

This script is a basic framework, and you might want to enhance it with risk management, stop-loss, or take-profit features as per your trading strategy.

Feel free to modify it further based on your needs!

Initial Setup:

The strategy initializes with a capital of 100,000.

Variables track the capital and the amount invested in the current trade.

RSI Calculation:

The RSI and its SMA are calculated on the monthly timeframe using request.security().

Entry and Exit Conditions:

Entry: A long position is initiated when the RSI is above its SMA and there’s no existing position. The quantity is based on available capital.

Exit: The position is closed when the RSI falls below its SMA. The capital is updated based on the net profit from the trade.

Capital Management:

After closing a trade, the capital is updated with the net profit plus the initial investment.

Plotting:

The RSI and its SMA are plotted for visualization on the chart.

A label displays the current capital.

Notes:

Test the strategy on different instruments and historical data to see how it performs.

Adjust parameters as needed for your specific trading preferences.

This script is a basic framework, and you might want to enhance it with risk management, stop-loss, or take-profit features as per your trading strategy.

Feel free to modify it further based on your needs!

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。