OPEN-SOURCE SCRIPT

conditional_returns

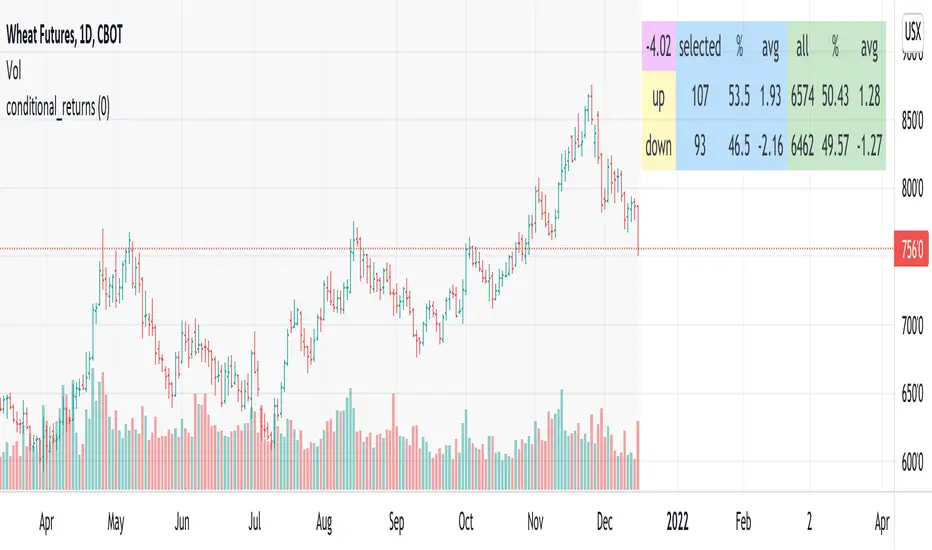

This script attempts to contextualize the instrument's latest return. It asks, "when a return of the same or greater magnitude occurred in the past, in the same direction, what was the following period's return?"

By default, the latest return is used. For example, on a daily chart, that would mean "today's" return. However, you can select any return you want using the "override" input.

The output table shows:

- The latest/override return, as a percentage. This is in the top left, fuchsia cell.

The first three, blue columns, show:

- The count of up and down (or positive and negative) next period returns. This shows you the sample size.

- The percentage of up/down next period returns.

- The average next-period return return, up and down, as percentages.

The next three, green columns show these same statistics, but for all returns--every period in the active date range is used. This data serves as a basis for comparison.

Note that you can select a custom date range with the "start" and "end" inputs. The corresponding area on the chart is shaded light grey, to show which data is used in the computations.

By default, the latest return is used. For example, on a daily chart, that would mean "today's" return. However, you can select any return you want using the "override" input.

The output table shows:

- The latest/override return, as a percentage. This is in the top left, fuchsia cell.

The first three, blue columns, show:

- The count of up and down (or positive and negative) next period returns. This shows you the sample size.

- The percentage of up/down next period returns.

- The average next-period return return, up and down, as percentages.

The next three, green columns show these same statistics, but for all returns--every period in the active date range is used. This data serves as a basis for comparison.

Note that you can select a custom date range with the "start" and "end" inputs. The corresponding area on the chart is shaded light grey, to show which data is used in the computations.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。