In the dynamic landscape of financial markets, the Adaptive Trend Finder (log) stands out as an example of precision and professionalism. This advanced tool, equipped with a unique feature, offers traders a sophisticated approach to market trend analysis: the choice between automatic detection of the long-term or short-term trend channel.

Key Features:

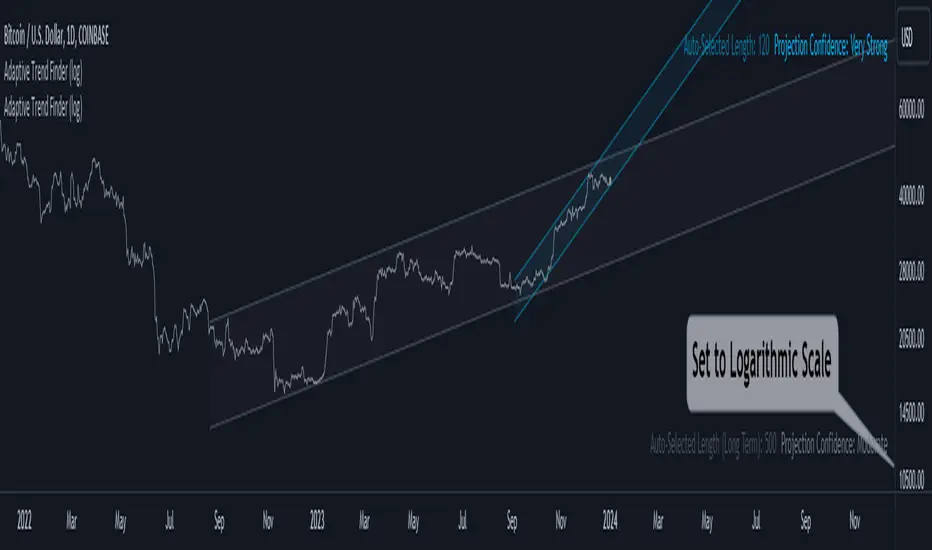

1. Choice Between Long-Term or Short-Term Trend Channel Detection: Positioned first, this distinctive feature of the Adaptive Trend Finder (log) allows traders to customize their analysis by choosing between the automatic detection of the long-term or short-term trend channel. This increased flexibility adapts to individual trading preferences and changing market conditions.

2. Autonomous Trend Channel Detection: Leveraging the robust statistical measure of the Pearson coefficient, the Adaptive Trend Finder (log) excels in autonomously locating the optimal trend channel. This data-driven approach ensures objective trend analysis, reducing subjective biases, and enhancing overall precision.

3. Precision of Logarithmic Scale: A distinctive characteristic of our indicator is its strategic use of the logarithmic scale for regression channels. This approach enables nuanced analysis of linear regression channels, capturing the subtleties of trends while accommodating variations in the amplitude of price movements.

4. Length and Strength Visualization: Traders gain a comprehensive view of the selected trend channel, with the revelation of its length and quantification of trend strength. These dual pieces of information empower traders to make informed decisions, providing insights into both the direction and intensity of the prevailing trend.

In the demanding universe of financial markets, the Adaptive Trend Finder (log) asserts itself as an essential tool for traders, offering an unparalleled combination of precision, professionalism, and customization. Highlighting the choice between automatic detection of the long-term or short-term trend channel in the first position, this indicator uniquely caters to the specific needs of each trader, ensuring informed decision-making in an ever-evolving financial environment.

Key Features:

1. Choice Between Long-Term or Short-Term Trend Channel Detection: Positioned first, this distinctive feature of the Adaptive Trend Finder (log) allows traders to customize their analysis by choosing between the automatic detection of the long-term or short-term trend channel. This increased flexibility adapts to individual trading preferences and changing market conditions.

2. Autonomous Trend Channel Detection: Leveraging the robust statistical measure of the Pearson coefficient, the Adaptive Trend Finder (log) excels in autonomously locating the optimal trend channel. This data-driven approach ensures objective trend analysis, reducing subjective biases, and enhancing overall precision.

3. Precision of Logarithmic Scale: A distinctive characteristic of our indicator is its strategic use of the logarithmic scale for regression channels. This approach enables nuanced analysis of linear regression channels, capturing the subtleties of trends while accommodating variations in the amplitude of price movements.

4. Length and Strength Visualization: Traders gain a comprehensive view of the selected trend channel, with the revelation of its length and quantification of trend strength. These dual pieces of information empower traders to make informed decisions, providing insights into both the direction and intensity of the prevailing trend.

In the demanding universe of financial markets, the Adaptive Trend Finder (log) asserts itself as an essential tool for traders, offering an unparalleled combination of precision, professionalism, and customization. Highlighting the choice between automatic detection of the long-term or short-term trend channel in the first position, this indicator uniquely caters to the specific needs of each trader, ensuring informed decision-making in an ever-evolving financial environment.

リリースノート

Tooltip addedリリースノート

Minor changesリリースノート

Color adjustmentリリースノート

Tooltips updatedリリースノート

Check out the latest optimized version of my TradingView script. It's faster, smoother, and packed with new features. Big thanks to an anonymous contributor for the help.

Explore the changes in the script and share your thoughts.

Appreciate your support!

リリースノート

minor upgradeリリースノート

Update:* Adjusting lengths, with the addition of intermediate lengths for increased precision.

* Text Size option

リリースノート

UpdateIn response to a request, I reverted to the color options from the original version, which were more functional.

リリースノート

Minor bug fixedリリースノート

inputs reorganizationリリースノート

Major UpdateThe code is really clean now.

After some big changes, the script runs smoothly with simplified calculations, revamped code, and a stronger structure, bringing optimized performance and exceptional speed.

リリースノート

Minor update: The long-term length range has been modified to prevent similarity with the default channel, and the term "Projection Confidence" has been replaced with "Trend Strength.the term "Projection Confidence" has been replaced with "Trend Strength.リリースノート

Minor update: The long-term length range has been modified to prevent similarity with the default channel, and the term "Projection Confidence" has been replaced with "Trend Strength.リリースノート

Minor updateリリースノート

Minor Update: I've added the option to choose the color of the Mid Line in the settings.リリースノート

The Annualized Return corresponding to the period of the Selected Trend drawn by the indicator has been added. This feature is currently displayed only in the Daily timeframe.リリースノート

Update: Added 'Small' text size for table.リリースノート

Shorttitle addedリリースノート

Major Update:This update introduces the 'Most Active Levels' feature.

Users can now visualize the price level with the highest trading activity within the trend channel.

This level is calculated based on either the number of price touches or trading volume.

To achieve this, the indicator divides the trend channel into multiple levels (user-defined).

リリースノート

Finally, I decided to revert the code to how it was previously. If you need to display the most active levels, use the 'Linear Regression Channel Ultimate' indicator separately.

リリースノート

Now updated for Pine Script v6オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

Plan the trade ⚡ Trade the plan

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

Plan the trade ⚡ Trade the plan

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。