OPEN-SOURCE SCRIPT

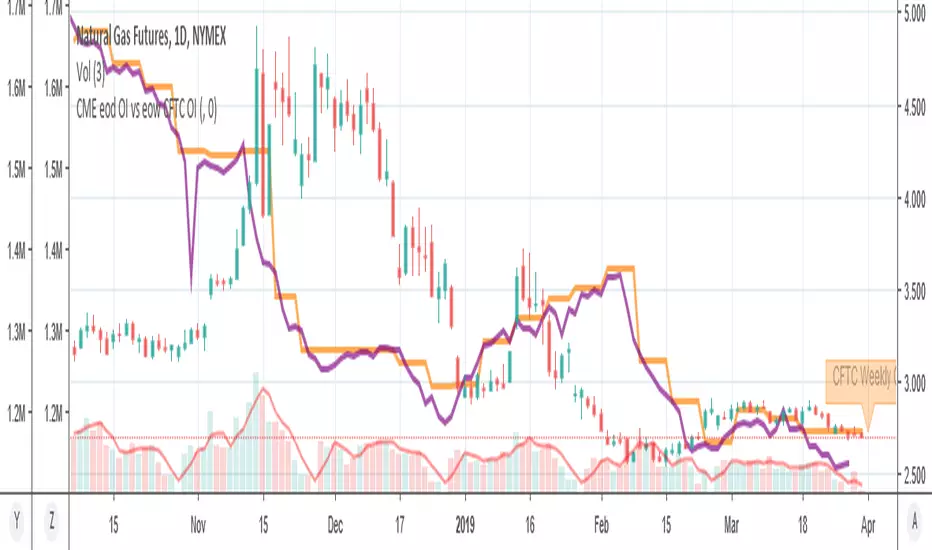

更新済 MY_CME eod OI vs CFTC eow OI

Daily e-o-d Open Interest as published by CME.

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

リリースノート

One can input a "preliminary" e-o-d Open Interest if published hereon CME sitecmegroup.com/market-data/volume-open-interest/metals-volume.html as the "final" data becomes available on tv quite late

リリースノート

fixed colorsリリースノート

fixed offset of CME "final" OI, -1 on weekends,-2 weektime, as OI should be public within the next day, and relates to the previous day. But noton weekends...anyway you get the meaningリリースノート

offset fixリリースノート

Cleaned code, now sums OI of the next 20 contracts. Good for gold and E-mini. WTI is not too suitable, as it has dozens of conracts active for the next 3/4 years .

リリースノート

Added new input "number of contracts"This script uses the QUANDL:CHRIS datasets, that records CME e-o-d data by quandl, and is exported daily to tradinview

The number of outstanding contracts CME differs from product to product

eg Gold has 16 oustanding contracts, E-mini has 4, NatGas has 43!

The scripts has max 20. You can add as many as you like in the source code,but toomuch typing for me

// NUMBER OF CONTRACTS

// eg:

// CME Vol and Open Interesst page eg. for GOLD:

// cmegroup.com/trading/metals/precious/gold_quotes_volume_voi.html?optid=7489&optionProductId=7488

// Totals Volume & OI (last line of table) are not exported by CME to quaandl

// CME data is recorded&exported daily by quandl.com to tradingview

// via the che CHRIS/CME datasets

// quandl.com/data/CHRIS

// Eg. Nat GAs cntract n. 20, field n. 7(OI)

// quandl.com/data/CHRIS/CME_NG20 (@quandl.com)

// this data is (should be) exported daily to tradinview

// tradingview.com/e/?symbol=QUANDL:CHRIS/CME_NG20|7 (TradingView)

// This script tries to sum all the fut cntrcts' Vol&OI to obtain a fair total

//

// Number of outstanding cntrcts per commodity differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// see doc by quandl:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

リリースノート

This latest version sets automatically the number of outstanding contracts' OI to sum upbasen on the ticker future code

data is taken from QUNDL:CHRIS/CME_ dataset

// Number of outstanding cntrcts per commodity CME differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// this script now gets the n.of outstandig cntrcts' OI to sum from the following table:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。