OPEN-SOURCE SCRIPT

更新済 Smoothed Heikin Ashi Trend on Chart - TraderHalai

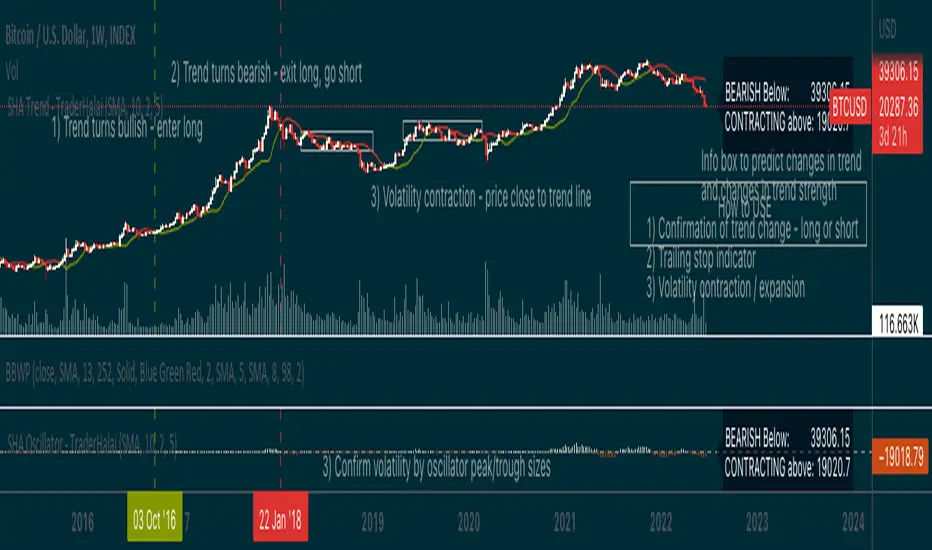

This indicator is a predictive tool using Heikinashi to calculate shifts in trade direction.

It works by reverse-engineering the regular candle stick closing price required, to flip the Heiken Ashi candle from Red to Green and vice-versa.

Below, is an earlier indicator that I released and created. This plots this price as an oscillator, which allows traders to get a predictive indicator of a trend change.

This indicator extends upon this functionality by adding a smoothing function to the reverse-engineered regular candle stick closing price, to reduce the choppiness of signals. It also plots the indicator on the chart to allow for easier visual confirmation.

How to use

1) As a directional bias - Bullish or bearish

2) Volatility expansion/contraction - further distance from line means volatility expansion - am planning to release an oscillator version also

3) Trailing stop loss - once you are in a trade

Other Features

Final note - Open Source

I am releasing this as open-source for the benefit of the community and to allow further development, scrutiny and criticism. Please feel free to use this indicator as you see fit. If you do use this indicator to create another script, feel free to drop me a note, as I would be highly interested in your idea.

Thanks, and Enjoy!

It works by reverse-engineering the regular candle stick closing price required, to flip the Heiken Ashi candle from Red to Green and vice-versa.

Below, is an earlier indicator that I released and created. This plots this price as an oscillator, which allows traders to get a predictive indicator of a trend change.

This indicator extends upon this functionality by adding a smoothing function to the reverse-engineered regular candle stick closing price, to reduce the choppiness of signals. It also plots the indicator on the chart to allow for easier visual confirmation.

How to use

1) As a directional bias - Bullish or bearish

2) Volatility expansion/contraction - further distance from line means volatility expansion - am planning to release an oscillator version also

3) Trailing stop loss - once you are in a trade

Other Features

- Select a moving average period and smoothing calculation method (e.g. SMA / EMA)

- Non-repaint mode for backtesting and use/integration with higher timeframes

Final note - Open Source

I am releasing this as open-source for the benefit of the community and to allow further development, scrutiny and criticism. Please feel free to use this indicator as you see fit. If you do use this indicator to create another script, feel free to drop me a note, as I would be highly interested in your idea.

Thanks, and Enjoy!

リリースノート

Added some spicy smoothing options for Hull Moving Average, Volume Weighted Moving Average and RSI moving averageリリースノート

Enjoy :)リリースノート

: Update info box text to include volatility to assess trend strengthリリースノート

Cleanupリリースノート

Add back in smoothing methodsリリースノート

Add back in smoothing method drop downリリースノート

Just dropped another MASSIVE update to source code! Including the following new features:1) Choice between Heikin Ashi Reverse Function and Heikin Ashi Better Candle Reverse Function (see below)

2) Ability to plot use smoothing on Volatility Pivot price, this is super useful to gauge volatility expansion / contraction. This is essentially an on-chart version of HAVP (Heikin Ashi Volatility Percentile)

3) Ehler smoothing options for Volatility Pivot Price - Three Pole Ehler Smoother, Three Pole Buttersworth, Two Pole Ehler Smoother and Two Pole Buttersworth (see below for description)

4) General Code Cleanup

Explanation of new features:

What are Heiken Ashi "better" candles?

The "better formula" was proposed in an article/memo by BNP-Paribas (In Warrants & Zertifikate, No. 8, August 2004 (a monthly German magazine published by BNP Paribas, Frankfurt), there is an article by Sebastian Schmidt about further development (smoothing) of Heikin-Ashi chart.)

They proposed to use the following :

(Open+Close)/2+(((Close-Open)/( High-Low ))*ABS((Close-Open)/2))

instead of using :

haClose = (O+H+L+C)/4

According to that document the HA representation using their proposed formula is better than the traditional formula.

Three pole Ehlers Butterworth

The 3 pole Ehlers Butterworth (as well as the Two pole Butterworth) are both superior alternatives to the EMA and SMA . They aim at producing less lag whilst maintaining accuracy. The 2 pole filter will give you a better approximation for price, whereas the 3 pole filter has superior smoothing.

Three pole Ehlers smoother

The 3 pole Ehlers smoother works almost as close to price as the above mentioned 3 Pole Ehlers Butterworth. It acts as a strong baseline for signals but removes some noise. Side by side, it hardly differs from the Three Pole Ehlers Butterworth but when examined closely, it has better overshoot reduction compared to the 3 pole Ehlers Butterworth.

Two pole Ehlers Butterworth

The 2 pole Ehlers Butterworth (as well as the three pole Butterworth mentioned above) is another filter that cuts out the noise and follows the price closely. The 2 pole is seen as a faster, leading filter over the 3 pole and follows price a bit more closely. Analysts will utilize both a 2 pole and a 3 pole Butterworth on the same chart using the same period, but having both on chart allows its crosses to be traded.

Two pole Ehlers smoother

A smoother version of the Two pole Ehlers Butterworth. This filter is the faster version out of the 3 pole Ehlers Butterworth. It does a decent job at cutting out market noise whilst emphasizing a closer following to price over the 3 pole Ehlers.

リリースノート

Delete unnecessary 'Bars Lookback' parameterオープンソーススクリプト

TradingViewの精神に則り、この作者はスクリプトのソースコードを公開しているので、その内容を理解し検証することができます。作者に感謝です!無料でお使いいただけますが、このコードを投稿に再利用する際にはハウスルールに従うものとします。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、この作者はスクリプトのソースコードを公開しているので、その内容を理解し検証することができます。作者に感謝です!無料でお使いいただけますが、このコードを投稿に再利用する際にはハウスルールに従うものとします。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。