MAxRSI Signals [KedArc Quant]Description:

MAxRSI Indicator Marks LONG/SHORT signals from a Moving Average crossover and (optionally) confirms them with RSI. Includes repaint-safe confirmation, optional higher-timeframe (HTF) smoothing, bar coloring, and alert conditions.

Why combine MA + RSI

* The MA crossover is the primary trend signal (fast trend vs slow trend).

* RSI is a gate, not a second, separate signal. A crossover only becomes a trade signal if momentum agrees (e.g., RSI ≥ level for LONG, ≤ level for SHORT). This reduces weak crosses in ranging markets.

* The parts are integrated in one rule: *Crossover AND RSI condition (if enabled)* → plot signal/alert. No duplicated outputs or unrelated indicators.

How it works (logic)

* MA types: SMA / EMA / WMA / HMA (HMA is built via WMA of `len/2` and `len`, then WMA with `sqrt(len)`).

* Signals:

* LONG when *Fast MA crosses above Slow MA* and (if enabled) *RSI ≥ Long Min*.

* SHORT when *Fast MA crosses below Slow MA* and (if enabled) *RSI ≤ Short Max*.

* Repaint-safe (optional): confirms crosses on closed bars to avoid intrabar repaint.

* HTF (optional): computes MA/RSI on a higher timeframe to smooth noise on lower charts.

* Alerts: crossover alerts + state-flip (bull↔bear) alerts.

How to use (step-by-step)

1. Add to chart. Set MA Type, Fast and Slow (keep Fast < Slow).

2. Turn Use RSI Filter ON for confirmation (default: RSI 14 with 50/50 levels).

3. (Optional) Turn Repaint-Safe ON for close-confirmed signals.

4. (Optional) Turn HTF ON (e.g., 60 = 1h) for smoother signals on low TFs.

5. Enable alerts: pick “MAxRSI Long/Short” or “Bullish/Bearish State”.

Timeframe guidance

* Intraday (1–15m): EMA 9–20 fast vs EMA 50 slow, RSI filter at 50/50.

* Swing (1h–D): EMA 20 fast vs EMA 200 slow, RSI 50/50 (55/45 for stricter).

What makes it original

* Repaint-safe cross confirmation (previous-bar check) for reliable signals/alerts.

* HTF gating (doesn’t compute both branches) for speed and clarity.

* Warning-free MA helper (precomputes SMA/EMA/WMA/HMA each bar), HMA built from built-ins only.

* State-flip alerts and optional RSI overlay on price pane.

Built-ins used

`ta.sma`, `ta.ema`, `ta.wma`, (HMA built from these), `ta.rsi`, `ta.crossover`, `ta.crossunder`, `request.security`, `plot`, `plotshape`, `barcolor`, `alertcondition`, `input.*`, `math.*`.

Note: Indicator only (no orders). Test settings per symbol. Not financial advice.

⚠️ Disclaimer

This script is provided for educational purposes only.

Past performance does not guarantee future results.

Trading involves risk, and users should exercise caution and use proper risk management when applying this strategy.

指数移動平均 (EMA)

Anrazzi - EMAs/ATR - 1.0.2Description:

The Anrazzi - EMAs/ATR indicator is a versatile tool for technical traders looking to monitor multiple moving averages alongside the Average True Range (ATR) on any chart. Designed for simplicity and customization, it allows traders to visualize up to six moving averages with configurable type, color, and length, while keeping real-time volatility information via ATR directly on the chart.

This indicator is perfect for spotting trends, identifying support/resistance zones, and gauging market volatility for intraday or swing trading strategies.

Key Features:

Supports up to six independent moving averages (MA1 → MA6)

Each MA is fully customizable:

Enable/disable individually

Type: EMA or SMA

Length

Color

ATR Display:

Custom timeframe

Color and position configurable

Adjustable multiplier

Compact and organized settings for easy configuration

Lightweight and efficient code for smooth chart performance

Watermark

Inputs / Settings:

MA Options: MA1 → MA6 (Enable/Disable, Type, Length, Color)

Additional Settings: ATR (Enable, Timeframe, Color, Multiplier)

How to Use:

Enable the moving averages you want to track

Configure type, length, and color for each MA

Enable ATR if needed and adjust settings

Watch MAs plotted dynamically and ATR in bottom-right corner

Recommended For:

Day traders and swing traders

Trend-following strategies

Volatility analysis and breakout detection

Traders needing a compact multi-MA dashboard

Dynamic EMA Stack Support & ResistanceEvery trader needs reliable support and resistance — but static zones and lagging indicators won't cut it in fast-moving markets. This script combines a Fibonacci-based 5-EMA stacking system and left/right pivots that create dynamic support & resistance logic to uncover real-time structural shifts & momentum zones that actually adapt to price action. This isn’t just a mashup — it’s a complete built-from-the-ground-up support & resistance engine designed for scalpers, intraday traders, and trend followers alike.

🧠 🧠 🧠What It Does🧠 🧠 🧠

This script uses two powerful engines working in sync:

1️⃣ EMA Stack (5-EMA Framework)

Built on Fibonacci-based lengths: 5, 8, 13, 21, 34, (configurable) this stack identifies:

🔹 Bullish Stack: EMAs aligned from fastest to slowest (uptrend confirmation)

🔹 Bearish Stack: EMAs aligned inversely (downtrend confirmation)

🟡 Narrowing Zones: When EMAs compress within ATR thresholds → possible breakout or reversal zone

🎯 Labels identify key transitions like:

✅"Begin Bear Trend?"

✅"Uptrend SPRT"

✅"RES?" (resistance test)

2️⃣ Pivot-Based Projection Engine

Using classic Left/Right Bar pivot logic, the script:

📌 Detects early-stage swing highs/lows before full confirmation

📈 Projects horizontal S/R lines that adapt to market structure

🔁 Keeps lines active until a new pivot replaces them

🧩 Syncs beautifully with EMA stack for confluence zones

🎯🎯🎯Key Features for Traders🎯🎯🎯

✅ Trend Detection

→ EMA order reveals real-time bias (bullish, bearish, compression)

✅ Dynamic S/R Zones

→ Historical support/resistance levels auto-draw and extend

✅ Smart Labeling

→ “SPRT”, “RES”, and “Trend?” labels for live context + testing logic

✅ Custom Candle Coloring

→ Choose from Bar Color or Full Candle Overlay modes

✅ Scalper & Swing Compatible

→ Use fast confirmations for scalping or stack consistency for longer trends

⚙️⚙️⚙️How to Use⚙️⚙️⚙️

✅Use Top/Bottom (trend state) Line Colors to quickly read trend conditions.

✅Use Pivot-based support/resistance projections to anticipate where price might pause or reverse.

✅Watch for yellow/blue zones to prepare for volatility shifts/reversals.

✅Combine with volume or momentum indicators for added confirmation.

📐📐📐Customization Options📐📐📐

✅EMA lengths (5, 8, 13, 21, 34) — fully configurable - try 21,34,55, 89, 144 for longer term trend states

✅Left/Right bar pivot settings (default: 21/5)

✅Label size, visibility, and color themes

✅Toggle line and label visibility for clean layouts

✅“Max Bars Back” to control how deep history is scanned safely

🛠🛠🛠Built-In Safeguards🛠🛠🛠

✅ATR-based filters to stabilize compression logic

✅Guarded lookback (max_bars_back) to avoid runtime errors

✅Works on any asset, any timeframe

🏁🏁🏁Final Word🏁🏁🏁

This script is not just a visual tool, it’s a complete trend and structure framework. Whether you're looking for clean trend alignment, dynamic support/resistance, or early warning labels, this system is tuned to help you react with confidence — not hindsight.

Rembember, no single indicator should be used in isolation. For best results, combine it with price action analysis, higher-timeframe context, and complementary tools like trendlines, moving averages etc Use it as part of a well-rounded trading approach to confirm setups — not to define them alone.

💡💡💡Turn logic into clarity. Structure into trades. And uncertainty into confidence.💡💡💡

Dual Best MA Strategy AnalyzerDual Best MA Strategy Analyzer (Lookback Window)

What it does

This indicator scans a range of moving-average lengths and finds the single best MA for long crossovers and the single best MA for short crossunders over a fixed lookback window. It then plots those two “winner” MAs on your chart:

Best Long MA (green): The MA length that would have made the highest total profit using a simple “price crosses above MA → long; exit on cross back below” logic.

Best Short MA (red): The MA length that would have made the highest total profit using “price crosses below MA → short; exit on cross back above.”

You can switch between SMA and EMA, set the min/max length, choose a step size, and define the lookback window used for evaluation.

How it works (brief)

For each candidate MA length between Min MA Length and Max MA Length (stepping by Step Size), the script:

Builds the MA (SMA or EMA).

Simulates a naïve crossover strategy over the last Lookback Window candles:

Long model: enter on crossover, exit on crossunder.

Short model: enter on crossunder, exit on crossover.

Sums simple P&L in price units (no compounding, no fees/slippage).

Picks the best long and best short lengths by total P&L and plots those two MAs.

Note: Long and short are evaluated independently. The script plots MAs only; it doesn’t open positions.

Inputs

Min MA Length / Max MA Length – Bounds for MA search.

Step Size – Spacing between tested lengths (e.g., 10 tests 10, 20, 30…).

Use EMA instead of SMA – Toggle average type.

Lookback Window (candles) – Number of bars used to score each MA. Needs enough history to be meaningful.

What the plots mean

Best Long MA (green): If price crosses above this line (historically), that MA length produced the best long-side results over the lookback.

Best Short MA (red): If price crosses below this line (historically), that MA length produced the best short-side results.

These lines can change over time as new bars enter the lookback window. Think of them as adaptive “what worked best recently” guides, not fixed signals.

Practical tips

Timeframe matters: Run it on the timeframe you trade; the “best” length on 1h won’t match 1m or 1D.

Step size trade-off: Smaller steps = more precision but heavier compute. Larger steps = faster scans, coarser choices.

Use with confirmation: Combine with structure, volume, or volatility filters. This is a single-factor tester.

Normalization: P&L is in raw price units. For cross-symbol comparison, consider using one symbol at a time (or adapt the script to percent P&L).

Limitations & assumptions

No fees, funding, slippage, or position sizing.

Simple “in/out” on the next crossover; no stops/targets/filters.

Results rely on lookback choice and will repaint historically as the “best” length is re-selected with new data (the plot is adaptive, not forward-fixed).

The script tests up to ~101 candidates internally (bounded by your min/max/step).

Good uses

Quickly discover a recently effective MA length for trend following.

Compare SMA vs EMA performance on your market/timeframe.

Build a playbook: note which lengths tend to win in certain regimes (trending vs choppy).

Not included (by design)

Alerts, entries/exits, or a full strategy report. It’s an analyzer/overlay.

If you want alerts, you can add simple conditions like:

ta.crossover(close, plotLongMA) for potential long interest

ta.crossunder(close, plotShortMA) for potential short interest

Changelog / Notes

v1: Initial release. Array-based scanner, SMA/EMA toggle, adaptive long/short best MA plots, user-set lookback.

Disclaimer

This is educational tooling, not financial advice. Test thoroughly and use proper risk management.

Trend ChannelThis Trend Channel is designed to simplify how traders view trends, while also keeping track of potential shifts in trends with signals. It is designed for traders that prefer less over more.

The indicator can be used for trend following, trend reversals and confirmation in combination with price or other indicators.

At the core is one EMA and a smoothed volatility based channel around it.

The purpose of the channel is to avoid false signals on trend reclaim or trend loss and instead identify trend deviations.

The indicator also incorporates long and short EMA cross-over signals to recognize possible shifts in trend without having to overlay multiple EMAs and keep the chart cleaner.

Additionally the indicator fires warnings for potential false signals on golden/death crosses with a letter "W" above/below the signal candle. Those warnings are based on the distance between price and the crossover. When the distance is above a certain threshold the indicator fires a warning that price might mean revert.

Traders can customize all inputs in the settings.

Argentum Flag [AGP] Ver.2.5Central Purpose and Concept

The Argentum Flag script is a multifunctional tool that integrates and visualizes multiple key indicators to provide a detailed and unified perspective of the market. The core concept is to analyze price from different angles—volatility, volume, and momentum—to identify confluences and patterns that may be difficult to see with separate indicators. This "mashup" is not a simple fusion of indicators, but a strategic combination of tools that complement each other to offer a comprehensive view of asset behavior.

Components and Their Functionality

This script combines and visualizes the following elements:

EMA Percentage Bands (EMA Bands):

Uses an Exponential Moving Average (EMA) as a baseline.

Calculates and draws several volatility bands that deviate from the central EMA by fixed percentages (0.47%, 0.94%, 2.36%). These bands are inspired by Fibonacci ratios and the cyclical nature of the market.

The bands are colored with a dynamic gradient that reflects the current state of volatility.

Utility: These bands act as dynamic support and resistance areas. The price entering or exiting these zones can indicate a change in volatility or a possible exhaustion of the movement.

Volatility Signals (Vortex & Prime Signals):

The script generates visual signals when the price stays outside the volatility bands for a specific number of bars.

Vortex Signals (diamond ⍲): Appear when the price crosses and stays outside the Prime bands, suggesting a high volatility or a possible continuation of the trend.

Exit/Entry Signals (circle ⌾): Are activated when the price stays outside the Vortex bands, indicating an extreme extension of volatility. These can be interpreted as potential reversal or profit-taking zones.

Utility: They help traders quickly identify moments of high and low volatility and potential turning points in price action.

Volume Analysis (Volume Bar Colors):

The script changes the color of the bars based on the relationship between the current volume and the average volume over a 50-bar period.

Utility: This feature allows the trader to immediately visualize the strength behind a price movement. For example, a bullish candle with "extreme" volume suggests strong buying interest, while a bearish candle with "low" volume could indicate a weak correction.

Summary Tables (Dashboard):

EMA-Fibo Table: Displays the values of 12 EMAs based on the Fibonacci sequence (5, 8, 13, 21...) in an easy-to-access table. The background color of each value indicates if the current price is above (bullish) or below (bearish) that EMA.

Multi-Timeframe RSI Table: Displays the Relative Strength Index (RSI) values across multiple timeframes (from 1 minute to monthly). The text color changes to highlight if the RSI is in overbought (orange) or oversold (white) areas, according to the established levels.

Utility: These tables condense a large amount of data into a simple format, allowing traders to perform a quick, multi-timeframe market analysis without constantly switching charts.

How to Use the Script

This script is a contextual analysis tool that works best when its different components are combined. It is not a "buy and sell signal" system on its own, but a tool for informed decision-making.

Trend Identification: Use the EMA table to see the general trend direction across different timeframes. A price above most of the EMAs in the table suggests a bullish bias.

Volatility Reading: Observe the EMA bands. If the price stays within the bands, volatility is low. A strong move that breaks out of the bands, accompanied by an "extreme" volume color (blue), suggests strong momentum that could continue.

Momentum Analysis: Use the RSI table to confirm movements. An overbought 15m RSI could support a reversal signal from the Vortex bands, while a 1D RSI in a neutral zone may indicate that the main trend has not changed.

Signal Confirmation: Visual signals (diamond and circle) should not be used in isolation. They must be confirmed by volume analysis and dashboard readings. For example, an "Exit Signal" (circle) with low volume may be less reliable than one with high volume and a clear reversal candle.

Disclaimer

This script is for informational and educational purposes only. It is not financial advice, nor is it a recommendation to buy or sell any financial instrument. All trading involves risk, and past performance is not indicative of future results. The user is solely responsible for their own trading decisions.

Adaptive RSIFor traders who want more control, the indicator allows customization of RSI length, smoothing type, and Bollinger Band settings, making it adaptable to day trading, swing trading, and even long-term investing.

In short, this is more than just an RSI — it’s a complete momentum toolkit that combines clarity, flexibility, and advanced signal detection in one clean package.

Multipower Entry SecretMultipower Entry Secret indicator is designed to be the ultimate trading companion for traders of all skill levels—especially those who struggle with decision-making due to unclear or overwhelming signals. Unlike conventional trading systems cluttered with too many lines and confusing alerts, this indicator provides a clear, adaptive, and actionable guide for market entries and exits.

Key Points:

Clear Buy/Sell/Wait Signals:

The script dynamically analyzes price action, candle patterns, volume, trend strength, and higher time frame context. This means it gives you “Buy,” “Sell,” or “Wait” signals based on real, meaningful market information—filtering out the noise and weak trades.

Multi-Timeframe Adaptive Analysis:

It synchronizes signals between higher and current timeframes, ensuring you get the most reliable direction—reducing the risk of getting caught in fake moves or sudden reversals.

Automatic Support, Resistance & Liquidity Zones:

Key levels like support, resistance, and liquidity zones are auto-detected and displayed directly on the chart, helping you make precise decisions without manual drawing.

Real-Time Dashboard:

All relevant information, such as trend strength, market intent, volume sentiment, and the reason behind each signal, is neatly summarized in a dashboard—making monitoring effortless and intuitive.

Customizable & Beginner-Friendly:

Whether you’re a newcomer wanting straightforward guidance or a professional needing advanced customization, the indicator offers flexible options to adjust analysis depth, timeframes, sensitivity, and more.

Visual & Clutter-Free:

The design ensures that your chart remains clean and readable, showing only the most important information. This minimizes mental overload and allows for instant decision-making.

Who Will Benefit?

Beginners who want to learn trading logic, avoid common traps, and see the exact reason behind every signal.

Advanced traders who require adaptive multi-timeframe analytics, fast execution, and stress-free monitoring.

Anyone who wants to save screen time, reduce analysis paralysis, and have more confidence in every trade they take.

1. No Indicator Clutter

Intent:

Many traders get confused by charts filled with too many indicators and signals. This often leads to hesitation, missed trades, or taking random, risky trades.

In this Indicator:

You get a clean and clutter-free chart. Only the most important buy/sell/wait signals and relevant support/resistance/liquidity levels are shown. These update automatically, removing the “overload” and keeping your focus sharp, so your decision-making is faster and stress-free.

2. Exact Entry Guide

Intent:

Traders often struggle with entry timing, leading to FOMO (fear of missing out) or getting trapped in sudden market reversals.

In this Indicator:

The system uses powerful adaptive logic to filter out weak signals and only highlight the strongest market moves. This not only prevents you from entering late or on noise, but also helps avoid losses from false breakouts or whipsaws. You get actionable suggestions—when to enter, when to hold back—so your entries are high-conviction and disciplined.

3. HTF+LTF Logic: Multitimeframe Sync Analysis

Intent:

Most losing trades happen when you act only on the short-term chart, ignoring the bigger market trend.

In this Indicator:

Signals are based on both the current chart timeframe (LTF) and a higher (HTF, like hourly/daily) timeframe. The indicator synchronizes trend direction, momentum, and structure across both levels, quickly adapting to show you when both are aligned. This filtering results in “only trade with the bigger trend”—dramatically increasing your win rate and market confidence.

4. Auto Support/Resistance & Liquidity Zones

Intent:

Drawing support/resistance and liquidity zones manually is time-consuming and error-prone, especially for beginners.

In this Indicator:

The system automatically identifies and plots the most crucial support/resistance levels and liquidity zones on your chart. This is based on adaptive, real-time price and volume analysis. These zones highlight where major institutional activity, trap setups, or real breakouts/reversals are most likely, removing guesswork and giving you a clear reference for entries, exits, and stop placements.

5. Clear Action/Direction

Intent:

Traders need certainty—what does the market want right now? Most indicators are vague.

In this Indicator:

Your dashboard always displays in plain words (like “BUY”, “SELL”, or “WAIT”) what action makes sense in the current market phase. Whether it’s a bull trap, volume spike, wick reversal, or exhaustion—it’s interpreted and explained clearly. No more confusion—just direct, real-time advice.

6. For Everyone (Beginner to Pro)

Intent:

Most advanced indicators are overwhelming for new traders; simple ones lack depth for professionals.

In this Indicator:

It is simple enough for a beginner—just add it to the chart and instantly see what action to consider. At the same time, it includes advanced adaptive analysis, multi-timeframe logic, and customizable settings so professional traders can fine-tune it for their strategies.

7. Ideal Usage and User Benefits

Instant Decision Support:

Whenever you’re unsure about a trade, just look at the indicator’s suggestion for clarity.

Entry Learning:

Beginners get real-time “practice” by not only seeing signals, but also the reason behind them—improving your chart reading and market understanding.

Screen Time & Stress Reduction:

Clear, relevant information only; no noise, less fatigue, faster decisions.

Makes Trading Confident & Simple:

The smart dashboard splits actionable levels (HTF, LTF, action) so you never miss a move, avoid traps, and stay aligned with high-probability trades.

8. Advanced Input Settings (Smart Customization)

Explained with Examples:

Enable Wick Analysis:

Finds candles with strong upper/lower wicks (signs of rejection/buying/selling force), alerting you to hidden reversals and protecting from FOMO entries.

Enable Absorption:

Detects when heavy order flow from one side is “absorbed” by the other (shows where institutional buyers/sellers are likely active, helps spot fake breakouts).

Enable Unusual Breakout:

Highlights real breakouts—large volatility plus high volume—so you catch genuine moves and avoid random spikes.

Enable Range/Expansion:

Smartly flags sudden range expansions—when the market goes from quiet to volatile—so you can act at the start of real trends.

Trend Bar Lookback:

Adjusts how many bars/candles are used in trend calculations. Short (fast trades, more signals), long (more reliability, fewer whipsaws).

Bull/Bear Bars for Strong Trend Min:

Sets how many candles in a row must support a trend before calling it “strong”—prevents flipping signals, keeps you disciplined.

Volume MA Length:

Lets you adjust how many bars back volume is averaged—fine-tune for your asset and trading style for best volume signals.

Swing Lookback Bars:

Set how many bars to use for swing high/low detection—short (quick swing levels), long (stronger support/resistance).

HTF (Bias Window):

Decide which higher timeframe the indicator should use for big-picture market mood. Adjustable for any style (scalp, swing, position).

Adaptive Lookback (HTF):

Choose how much HTF history is used for detecting major extremes/zones. Quick adjust for more/less sensitivity.

Show Support/Resistance, Liquidity Zones, Trendlines:

Toggle them on/off instantly per your needs—keeps your chart relevant and tailored.

9. Live Dashboard Sections Explained

Intent HTF:

Shows if the bigger timeframe currently has a Bullish, Bearish, or Neutral (“Chop”) intent, based on strict volume/price body calculations. Instant clarity—no more guessing on trend bias.

HTF Bias:

Clear message about which side (buy/sell/sideways) controls the market on the higher timeframe, so you always trade with the “big money.”

Chart Action:

The central action for the current bar—Whether to Buy, Sell, or Wait—calculated from all indicator logic, not just one rule.

TrendScore Long/Short:

See how many candles in your chosen window were bullish or bearish, at a glance. Instantly gauge market momentum.

Reason (WHY):

Every time a signal appears, the “reason” cell tells you the primary logic (breakout, wick, strong trend, etc.) behind it. Full transparency and learning—never trade blindly.

Strong Trend:

Shows if the market is currently in a powerful trend or not—helping you avoid choppy, risky entries.

HTF Vol/Body:

Displays current higher timeframe volume and candle body %—helping spot when big players are active for higher probability trades.

Volume Sentiment:

A real-time analysis of market psychology (strong bullish/bearish, neutral)—making your decision-making much more confident.

10. Smart and User-Friendly Design

Multi-timeframe Adaptive:

All calculations can now be drawn from your choice of higher or current timeframe, ensuring signals are filtered by larger market context.

Flexible Table Position:

You can set the live dashboard/summary anywhere on the chart for best visibility.

Refined Zone Visualization:

Liquidity and order blocks are visually highlighted, auto-tuning for your settings and always cleaning up to stay clutter-free.

Multi-Lingual & Beginner Accessible:

With Hindi and simple English support, descriptions and settings are accessible for a wide audience—anyone can start using powerful trading logic with zero language barrier.

Efficient Labels & Clear Reasoning:

Signal labels and reasons are shown/removed dynamically so your chart stays informative, not messy.

Every detail of this indicator is designed to make trading both simpler and smarter—helping you avoid the common pitfalls, learn real price action, stay in sync with the market’s true mood, and act with discipline for higher consistency and confidence.

This indicator makes professional-grade market analysis accessible to everyone. It’s your trusted assistant for making smarter, faster, and more profitable trading decisions—providing not just signals, but also the “why” behind every action. With auto-adaptive logic, clear visuals, and strong focus on real trading needs, it lets you focus on capturing the moves that matter—every single time.

Set & Forget – AlexG Club – ChecklistThe Set & Forget – AlexG Club – Checklist is built to help traders apply the well-known Set and Forget strategy from the famous AlexG (falexg) and the G-Club community.

This indicator displays a clear, on-chart checklist table of trading confluences. Each confluence adds to a total score, making it easier to objectively evaluate whether a trade setup aligns with the AlexG / G-Club strategy.

✅ Features:

• Customizable confluence checklist (trend alignment, S/R levels, candlestick signals, momentum, etc.)

• Automatic scoring system to calculate the Set & Forget readiness of a trade

• Clean table visualization on your chart

• Flexible thresholds — you decide how many confluences equal a strong setup

🚀 How to Use:

Add the indicator to your chart.

Adjust the confluences to reflect your own AlexG / G-Club inspired checklist.

Use the total score to validate trades before you pull the trigger.

⚠️ Disclaimer: This indicator is for educational purposes only. It is not financial advice and does not guarantee profitability. Always manage your risk and test before using live.

Multiple Colored Moving AveragesMULTIPLE COLORED MOVING AVERAGES - USER GUIDE

DISCLAIMER

----------

Both the code and this documentation were created heavily using artificial intelligence. I'm lazy...

This indicator was inspired by repo32's "Moving Average Colored EMA/SMA" indicator. *

What is this indicator?

-----------------------

This is a TradingView indicator that displays up to 4 different moving averages on your chart simultaneously. Each moving average can be customized with different calculation methods, colors, and filtering options.

Why would I use multiple moving averages?

-----------------------------------------

- See trend direction across different timeframes at once

- Identify support and resistance levels

- Spot crossover signals between fast and slow MAs

- Reduce false signals with filtering options

- Compare how different MA types react to price action

What moving average types are available?

----------------------------------------

11 different types:

- SMA: Simple average, equal weight to all periods

- EMA: Exponential, more weight to recent prices

- WMA: Weighted, linear weighting toward recent data

- RMA: Running average, smooth like EMA

- DEMA: Double exponential, reduced lag

- TEMA: Triple exponential, even less lag

- HMA: Hull, fast and smooth combination

- VWMA: Volume weighted, includes volume data

- LSMA: Least squares, based on linear regression

- TMA: Triangular, double-smoothed

- ZLEMA: Zero lag exponential, compensated for lag

How do I set up the indicator?

------------------------------

Each MA has these settings:

- Enable/Disable: Turn each MA on or off

- Type: Choose from the 11 calculation methods

- Length: Number of periods (21, 50, 100, 200 are common)

- Smoothing: 0-10 levels of extra smoothing

- Noise Filter: 0-5% to ignore small changes

- Colors: Bullish (rising) and bearish (falling) colors

- Line Width: 1-5 pixels thickness

What does the smoothing feature do?

-----------------------------------

Smoothing applies extra calculations to make the moving average line smoother. Higher levels reduce noise but make the MA respond slower to price changes. Use higher smoothing in choppy markets, lower smoothing in trending markets.

What is the noise filter?

--------------------------

The noise filter ignores small percentage changes in the moving average. For example, a 0.3% filter will ignore any MA movement smaller than 0.3%. This helps eliminate false signals from minor price fluctuations.

When should I use this indicator?

---------------------------------

- Trend analysis: See if market is going up, down, or sideways

- Entry timing: Look for price bounces off MA levels

- Exit signals: Watch for MA slope changes or crossovers

- Support/resistance: MAs often act as dynamic levels

- Multi-timeframe analysis: Use different lengths for different perspectives

What are some good settings to start with?

-------------------------------------------

Conservative approach:

- MA 1: EMA 21 (short-term trend)

- MA 2: SMA 50 (medium-term trend)

- MA 3: SMA 200 (long-term trend)

- Low noise filtering (0.1-0.3%)

Active trading:

- MA 1: HMA 9 (very responsive)

- MA 2: EMA 21 (short-term)

- MA 3: EMA 50 (medium-term)

- Minimal or no smoothing

How do I interpret the colors?

------------------------------

Each MA changes color based on its direction:

- Bullish color: MA is rising (upward trend)

- Bearish color: MA is falling (downward trend)

- Gray: MA is flat or unchanged

What should I look for in crossovers?

-------------------------------------

- Golden Cross: Fast MA crosses above slow MA (bullish signal)

- Death Cross: Fast MA crosses below slow MA (bearish signal)

- Multiple crossovers in same direction can confirm trend changes

- Wait for clear separation between MAs after crossover

How do I use MAs for support and resistance?

---------------------------------------------

- In uptrends: MAs often provide support when price pulls back

- In downtrends: MAs may act as resistance on rallies

- Multiple MAs create support/resistance zones

- Stronger levels where multiple MAs cluster together

Can I use this with other indicators?

-------------------------------------

Yes, it works well with:

- Volume indicators for confirmation

- RSI or MACD for timing entries

- Bollinger Bands for volatility context

- Price action patterns for setup confirmation

What if I get too many signals?

-------------------------------

- Increase smoothing levels

- Raise noise filter percentages

- Use longer MA periods

- Focus on major crossovers only

- Wait for multiple MA confirmation

What if signals are too slow?

-----------------------------

- Reduce smoothing to 0

- Lower noise filter values

- Switch to faster MA types (HMA, ZLEMA, DEMA)

- Use shorter periods

- Focus on the fastest MA only

Which MA types work best in different markets?

----------------------------------------------

Trending markets: EMA, DEMA, TEMA (responsive to trends)

Choppy markets: SMA, TMA, HMA with smoothing (less whipsaws)

High volatility: Use higher smoothing and noise filtering

Low volatility: Use minimal filtering for better responsiveness

Do I need all the advanced features?

------------------------------------

No. Start with basic settings:

- Choose MA type and length

- Set colors you prefer

- Leave smoothing at 0

- Leave noise filter at 0

Add complexity only if needed to improve signal quality.

How do I know if my settings are working?

-----------------------------------------

- Backtest on historical data

- Paper trade the signals first

- Adjust based on market conditions

- Keep a trading journal to track performance

- Be willing to modify settings as markets change

Can I save different configurations?

------------------------------------

Yes, save different indicator templates in TradingView for:

- Different trading styles (scalping, swing trading)

- Different market conditions (trending, ranging)

- Different instruments (stocks, forex, crypto)

Stalonte EMA - Stable Long-Term EMA with AlertsStalonte EMA - The Adaptive & Stable EMA - Almost Eternal

Here's why you will love "Stalonte":

The Stalonte (Stable Long-Term EMA) is a highly versatile trend-following tool. Unlike standard EMAs with fixed periods, it uses a configurable smoothing constant (alpha), allowing traders to dial in the exact level of responsiveness and stability they need. Finding the "sweet spot" (e.g., alpha ~0.03) creates a uniquely effective moving average: it is smooth enough to filter out noise and identify safe, high-probability trends, yet responsive enough to provide actionable signals without extreme lag. It includes alerts for crossovers and retests.

Pros and Cons of the Stalonte EMA

Pros:

Unparalleled Adaptability: This is its greatest strength. The alpha input lets you seamlessly transform the indicator from an ultra-slow "trend-revealer" (low alpha) into a highly effective and "safe" trend-following tool (medium alpha, e.g., 0.03), all the way to a more reactive one.

Optimized for Safety & Signal Quality: As you astutely pointed out, with the proper setting (like 0.03), it finds the perfect balance. It provides a smoother path than a standard 20-50 period EMA, which reduces whipsaws and false breakouts, leading to safer, higher-confidence signals.

Superior Trend Visualization: It gives a cleaner and more intuitive representation of the market's direction than many conventional moving averages, making it easier to "see" the trend and stick with it.

Objective Dynamic Support/Resistance: The line created with a medium alpha setting acts as a powerful dynamic support in uptrends and resistance in downtrends, offering excellent areas for entries on retests with integrated alerts.

Cons:

Requires Calibration: The only "con" is that its performance is not plug-and-play; it requires the user to find their optimal alpha value for their specific trading style and the instrument they are trading. This demands a period of testing and customization, which a standard 50-period EMA does not.

Conceptual Hurdle: For traders only familiar with period-based EMAs, the concept of a "smoothing constant" can be initially confusing compared to simply setting a "length."

In summary:

The Stalonte EMA is not a laggy relic. It is a highly sophisticated and adaptable tool. Its design allows for precise tuning, enabling a trader to discover a setting that offers a superior blend of stability and responsiveness—a "sweet spot" that provides safer and often more effective signals than many traditional moving averages. Thank you for pushing for a more accurate and fair assessment.

Use Case Example:

You can combine it with classical EMAs to find the perfect entry.

RTC EMA/SMA Combo IndicatorRTC Combo indicator with 20 EMA, 50 EMA and 200 SMA

Primarily used for Market Structure purpose

EMA/SMA Zones 9, 21, 30, 50, 100, 200 + othersMeant for swing trading on the daily chart, feel free to copy and remove/add sections as you wish (Used chatGPT for a lot of it).

Stock Scoring SystemThe EMA Scoring System is designed to help traders quickly assess market trend strength and decide portfolio allocation. It compares price vs. key EMAs (21, 50, 100) and also checks the relative strength between EMAs. Based on these conditions, it assigns a score (-6 to +6) and a corresponding allocation percentage.

+6 Score = 100% allocation (strong bullish trend)

-6 Score = 10% allocation (strong bearish trend)

Scores in between represent intermediate trend strength.

📌 Key Features

✅ Scoring Model: Evaluates price vs. EMA alignment and EMA cross relationships.

✅ Allocation % Display: Converts score into suggested portfolio allocation.

✅ Background Highlighting: Green shades for bullish conditions, red shades for bearish.

✅ Customizable Table Position: Choose between Top Right, Top Center, Bottom Right, or Bottom Center.

✅ Toggleable EMAs: Show/Hide 21 EMA, 50 EMA, and 100 EMA directly from indicator settings.

✅ Simple & Intuitive: One glance at the chart tells you trend strength and suggested allocation.

📈 How It Works

Score Calculation:

Price above an EMA = +1, below = -1

Faster EMA above slower EMA = +1, else -1

Maximum score = +6, minimum = -6

Allocation Mapping:

+6 → 100% allocation

+4 to +5 → 100% allocation

+2 to +3 → 75% allocation

0 to +1 → 50% allocation

-1 to -2 → 30% allocation

-3 to -4 → 20% allocation

-5 to -6 → 10% allocation

Visual Output:

Table shows SCORE + Allocation %

Background color shifts with score (green for bullish, red for bearish)

⚠️ Disclaimer

This indicator is for educational purposes only. It does not constitute financial advice. Always backtest and combine with your own analysis before making trading decisions.

EMA Cross + KC Breakout + ATR StopThis uses an adjustable EMA Cross with an adjustable Keltner Channel breakout filter to identify trend breakouts for Long/Short entries. An adjustable ATR Stop is also provided for your entries.

EMA Cross Alert V666 [noFuck]EMA Cross Alert — What it does

EMA Cross Alert watches three EMAs (Short, Mid, Long), detects their crossovers, and reports exactly one signal per bar by priority: EARLY > Short/Mid > Mid/Long > Short/Long. Optional EARLY mode pings when Short crosses Long while Mid is still between them—your polite early heads-up.

Why you might like it

Three crossover types: s/m, m/l, s/l

EARLY detection: earlier hints, not hype

One signal per bar: less noise, more focus

Clear visuals: tags, big cross at signal price, EARLY triangles

Alert-ready: dynamic alert text on bar close + static alertconditions for UI

Inputs (plain English)

Short/Mid/Long EMA length — how fast each EMA reacts

Extra EMA length (visual only) — context EMA; does not affect signals

Price source — e.g., Close

Show cross tags / EARLY triangles / large cross — visual toggles

Enable EARLY signals (Short/Long before Mid) — turn early pings on/off

Count Mid EMA as "between" even when equal (inclusive) — ON: Mid counts even if exactly equal to Short or Long; OFF (default): Mid must be strictly between them

Enable dynamic alerts (one per bar close) — master alert switch

Alert on Short/Mid, Mid/Long, Short/Long, EARLY — per-signal alert toggles

Quick tips

Start with defaults; if you want more EARLY on smooth/low-TF markets, turn “inclusive” ON

Bigger lengths = calmer trend-following; smaller = faster but choppier

Combine with volume/structure/risk rules—the indicator is the drummer, not the whole band

Disclaimer

Alerts, labels, and triangles are not trade ideas or financial advice. They are informational signals only. You are responsible for entries, exits, risk, and position sizing. Past performance is yesterday; the future is fashionably late.

Credits

Built with the enthusiastic help of Code Copilot (AI)—massively involved, shamelessly proud, and surprisingly good at breakfasting on exponential moving averages.

EMA 21 & 78 - With Instrument Nameonly add EMA21 and 78, I saw the 21 and 78 period is the most favor period when trading with gold

Triple Tap Sniper Triple Tap Sniper v3 – EMA Retest Precision System

Triple Tap Sniper is a precision trading tool built around the 21, 34, and 55 EMAs, designed to capture high-probability retests after EMA crosses. Instead of chasing the first breakout candle, the system waits for the first pullback into the EMA21 after a trend-confirming cross — the spot where professional traders often enter.

🔑 Core Logic

EMA Alignment → Trend defined by EMA21 > EMA34 > EMA55 (bullish) or EMA21 < EMA34 < EMA55 (bearish).

Cross Detection → Signals are only armed after a fresh EMA cross.

Retest Entry → Buy/Sell signals fire only on the first retest of EMA21, with trend still intact.

Pro Filters →

📊 Higher Timeframe Confirmation: Aligns signals with larger trend.

📈 ATR Volatility Filter: Blocks weak signals in low-vol chop.

📏 EMA Spread Filter: Ignores tiny “fake crosses.”

🕯️ Price Action Filter: Requires a proper wick rejection for valid entries.

🚀 Why Use Triple Tap Sniper?

✅ Filters out most false signals from sideways markets.

✅ Focuses only on clean trend continuations after pullbacks.

✅ Beginner-friendly visuals (Buy/Sell labels) + alert-ready for automation.

✅ Flexible: works across multiple timeframes & asset classes (stocks, crypto, forex).

⚠️ Notes

This is a signal indicator, not a full strategy. For backtesting and optimization, convert to a strategy and adjust filters per market/timeframe.

No indicator guarantees profits — use with sound risk management.

EMA/VWAP SuiteEMA/VWAP Suite

Overview

The EMA/VWAP Suite is a versatile and customizable Pine Script indicator designed for traders who want to combine Exponential Moving Averages (EMAs) and Volume Weighted Average Prices (VWAPs) in a single, powerful tool. It overlays up to eight EMAs and six VWAPs (three anchored, three rolling) on the chart, each with percentage difference labels to show how far the current price is from these key levels. This indicator is perfect for technical analysis, supporting strategies like trend following, mean reversion, and VWAP-based trading.

By default, the indicator displays eight EMAs and a session-anchored VWAP (AVWAP 1, in fuchsia) with their respective percentage difference labels, keeping the chart clean yet informative. Other VWAPs and their bands are disabled by default but can be enabled and customized as needed. The suite is designed to minimize clutter while providing maximum flexibility for traders.

Features

- Eight Customizable EMAs: Plot up to eight EMAs with user-defined lengths (default: 3, 9, 19, 38, 50, 65, 100, 200), each with a unique color for easy identification.

- EMA Percentage Difference Labels: Show the percentage difference between the current price and each EMA, displayed only for visible EMAs when enabled.

- Three Anchored VWAPs: Plot VWAPs anchored to the start of a session, week, or month, with customizable source, offset, and band multipliers. AVWAP 1 (session-anchored, fuchsia) is enabled by default.

- Three Rolling VWAPs: Plot VWAPs calculated over fixed periods (default: 20, 50, 100), with customizable source, offset, and band multipliers.

- VWAP Bands: Optional upper and lower bands for each VWAP, based on standard deviation with user-defined multipliers.

- VWAP Percentage Difference Labels: Display the percentage difference between the current price and each VWAP, shown only for visible VWAPs. Enabled by default to show the AVWAP 1 label.

- Customizable Colors: Each VWAP has a user-defined color via input settings, with labels matching the VWAP line colors (e.g., AVWAP 1 defaults to fuchsia).

Flexible Display Options: Toggle individual EMAs, VWAPs, bands, and labels on or off to reduce chart clutter.

Settings

The indicator is organized into intuitive setting groups:

EMA Settings

Show EMA 1–8 : Toggle each EMA on or off (default: all enabled).

EMA 1–8 Length : Set the period for each EMA (default: 3, 9, 19, 38, 50, 65, 100, 200).

Show EMA % Difference Labels : Enable/disable percentage difference labels for all EMAs (default: enabled).

EMA Label Font Size (8–20) : Adjust the font size for EMA labels (default: 10, mapped to “tiny”).

Anchored VWAP 1–3 Settings

Show AVWAP 1–3 : Toggle each anchored VWAP on or off (default: AVWAP 1 enabled, others disabled).

AVWAP 1–3 Color : Set the color for each VWAP line and its label (default: fuchsia for AVWAP 1, purple for AVWAP 2, teal for AVWAP 3).

AVWAP 1–3 Anchor : Choose the anchor period (“Session,” “Week,” “Month”; default: Session for AVWAP 1, Week for AVWAP 2, Month for AVWAP 3).

AVWAP 1–3 Source : Select the price source (default: hlc3).

AVWAP 1–3 Offset : Set the horizontal offset for the VWAP line (default: 0).

Show AVWAP 1–3 Bands : Toggle upper/lower bands (default: disabled).

AVWAP 1–3 Band Multiplier : Adjust the standard deviation multiplier for bands (default: 1.0).

Rolling VWAP 1–3 Settings

Show RVWAP 1–3 : Toggle each rolling VWAP on or off (default: disabled).

RVWAP 1–3 Color : Set the color for each VWAP line and its label (default: navy for RVWAP 1, maroon for RVWAP 2, fuchsia for RVWAP 3).

RVWAP 1–3 Period Length : Set the period for the rolling VWAP (default: 20, 50, 100).

RVWAP 1–3 Source : Select the price source (default: hlc3).

RVWAP 1–3 Offset : Set the horizontal offset (default: 0).

Show RVWAP 1–3 Bands : Toggle upper/lower bands (default: disabled).

RVWAP 1–3 Band Multiplier : Adjust the standard deviation multiplier for bands (default: 1.0).

VWAP Label Settings

Show VWAP % Difference Labels : Enable/disable percentage difference labels for all VWAPs (default: enabled, showing AVWAP 1 label).

VWAP Label Font Size (8–20) : Adjust the font size for VWAP labels (default: 10, mapped to “tiny”).

How It Works

EMAs : Calculated using ta.ema(close, length) for each user-defined period. Percentage differences are computed as ((close - ema) / close) * 100 and displayed as labels for visible EMAs when show_ema_labels is enabled.

Anchored VWAPs : Calculated using ta.vwap(source, anchor, 1), where the anchor is determined by the selected timeframe (Session, Week, or Month). Bands are computed using the standard deviation from ta.vwap.

Rolling VWAPs : Calculated using ta.vwap(source, length), with bands based on ta.stdev(source, length).

Labels : Updated on each new bar (ta.barssince(ta.change(time) != 0) == 0) to show percentage differences. Labels are only displayed for visible EMAs/VWAPs to avoid clutter.

Color Matching: VWAP labels use the same color as their corresponding VWAP lines, set via input settings (e.g., avwap1_color for AVWAP 1).

Example Use Cases

- Trend Following: Use longer EMAs (e.g., 100, 200) to identify trends and shorter EMAs (e.g., 3, 9) for entry/exit signals.

- Mean Reversion: Monitor percentage difference labels to spot overbought/oversold conditions relative to EMAs or VWAPs.

- VWAP Trading: Use the default session-anchored AVWAP 1 for intraday trading, adding weekly/monthly VWAPs or rolling VWAPs for broader context.

- Intraday Analysis: Leverage the session-anchored AVWAP 1 (enabled by default) for day trading, with bands as support/resistance zones.

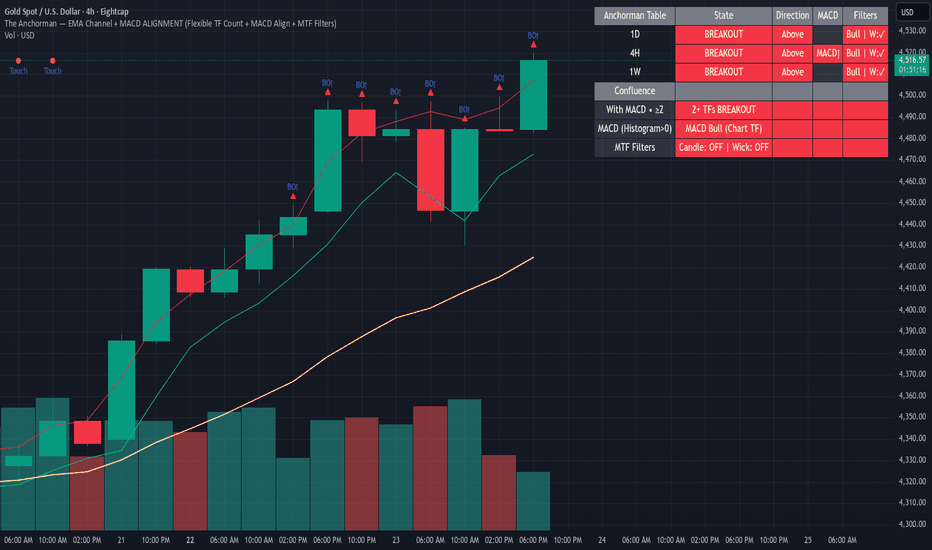

Anchorman - EMA Channel + EMA + MTF Status Table PRICE BREAKOUTUses a high/low EMA Channel to tell you when strong price breakouts are happening plus comes with a EMA to help follow the trend if you like. I designed it so it can alert you when a single TF touch happens or a breakout alignment on MTF happens (I recommend this) its up to you also its single alert so no need to do bullish or bearish signals just one signal will alert you when a breakout happens in EITHER direction.

Customizable EMA 10/20/50/100Customizable EMA indicator. Fully adjustable with inputs so you can change EMA lengths and colors directly from the indicator settings panel.

MEMA X-OL9+A. 5, 10, 20, 50 ema's

B. When the 10 goes below the 20 it has shades of red between the 10 and 20.

C. When there is a downward crossover, There will be a Red arrow pointing down.

D. When the 10 is moving closer (upward) towards the 20 it has orange shading. I use this to catch 10 over 20 crossovers.

E. When there is a crossover 10 over 20 it will shade green and have a gold arrow pointing upward. A little redundant, because you'll see the crossover from the shading.

F. Finally there will be smaller blue arrows that represent when there is a close of a candle, if it is lower than the prior candle.

All customizable and defaults should work.