The Stablecoin Dominance tool displays the evolution of the relative supply dominance of major stablecoins such as USDT, USDC, BUSD, DAI, and TUSD. Users can disable supported stablecoins to only show the supply dominance relative to the ones enabled. 🔶 USAGE The stablecoin space is subject to constant change due to new arriving stablecoins, regulation,...

█ Introduction and How it is Different The "Stablecoin Supply - Indicator" differentiates itself by focusing on the aggregate supply of major stablecoins—USDT, USDC, and DAI—rather than traditional price-based metrics. Its premise is that fluctuations in the total supply of these stablecoins can serve as leading indicators for broader market movements, offering...

STABLECOINS DEPEG FINDER With this script, you will be able to understand how DePeg in stablecoins USDT, USDC, and FDUSD can influence the TOTAL Market Cap. WHAT IS DEPEG? DePeg occurs when a stablecoin loses its peg. It can't maintain the $1.00 price for a while (or anymore). Traders can use DePeg for high-quality trading both in Crypto and Stablecoins....

Monitor the liquidity of the crypto market by tracking the capitalizations of the major Stablecoins. Stablecoin Liquidity (BSL) is an ideal tool for visualizing data on major Stablecoins. The number of Stablecoins in circulation is one of the best indices of liquidity within the crypto market. It’s an important metric to keep an eye on, as an increase in the...

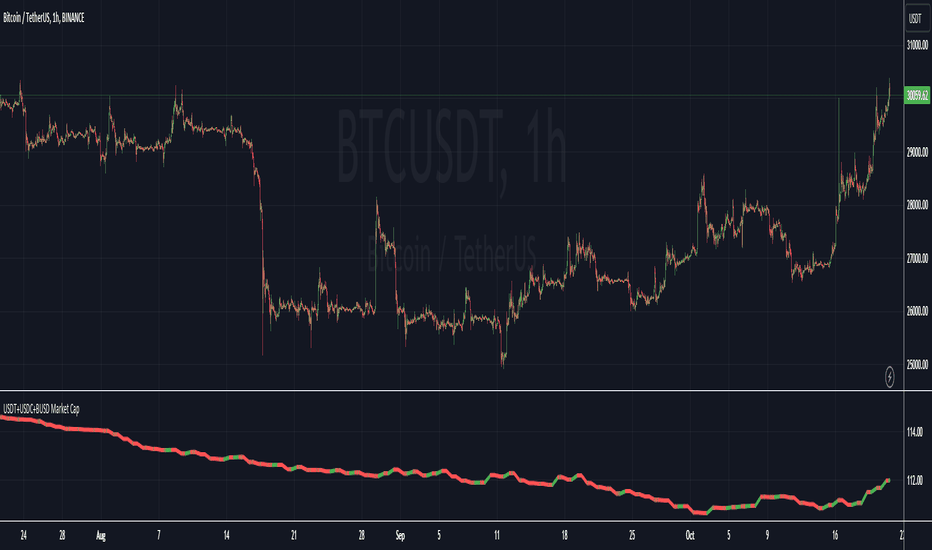

This Pine Script indicator visualizes the combined market capitalization of three prominent stablecoins: USDT, USDC, and BUSD, on a daily basis. It fetches the daily closing market caps of these stablecoins and sums them. The resulting line graph is displayed in its own separate pane below the main price chart. The line is color-coded: green on days when the...

The Stable Coin Dominance RSI evaluates the relative dominance of stable coins within the crypto ecosystem as compared to the total market cap. As stable coin dominance rises, it suggests that market participants are exiting out of crypto assets and into dollar pegged stable coins. The opposite is true inversely; as stable coin dominance diminishes, it suggests...

This indicator summarized 4 main stablecoin marketcap (USDT, USDC , BUSD, DAI). It is given that most of the transactions of cryptocurrencies are traded by stablecoins, and USDT, USDC , BUSD and DAI shared 90%+ of the stablecoins market capacity. Therefore, by summarizing these 4 main stablecoins total market capacity, can reflect the overall demand power. When...

This simple indicator combines all the currently available stable-coin dominance values into one percentage; the first of its kind public on TradingView ! If trading view adds more in the future I will add them as well, and feel free to leave suggestions in the comments below :)

The Stablecoin Supply Ratio (SSR) is the ratio between Bitcoin supply and the supply of stablecoins, denominated in BTC. When the SSR is low, the current stablecoin supply has more "buying power" to purchase BTC. It serves as a proxy for the supply/demand mechanics between BTC and USD.

Stablecoin Volume Flow into BTCUSD/BTC-Stablecoin pairings Exchanges Used Coinbase Kraken Bittrex Binance Huobi Bitstamp Gemini Bitfinex Our aim here is simple...to combine the overall volume flow from Fiat or stable currencies into the crypto-markets. This is the first portion of a series I plan to share involving a holistic...

This is a simple script that will visually show where buy and sell points occur based upon configurable price action. I wrote this purposefully to evaluate stablecoins and other narrow or fixed ranged markets where algorythms don't generally do well. Putple triangles, pointing up, are buy signals. Purple triangles, pointing down are sell signals Alert...

![Stablecoin Dominance [LuxAlgo] BTCUSD: Stablecoin Dominance [LuxAlgo]](https://s3.tradingview.com/e/eFfvbyw1_mid.png)

![Crypto Stablecoin Supply - Indicator [presentTrading] BTCUSD: Crypto Stablecoin Supply - Indicator [presentTrading]](https://s3.tradingview.com/j/J6yl9jUr_mid.png)

![Stablecoin Volume Flow [kingthies_] BTCUSD: Stablecoin Volume Flow [kingthies_]](https://s3.tradingview.com/y/YCGubt7H_mid.png)