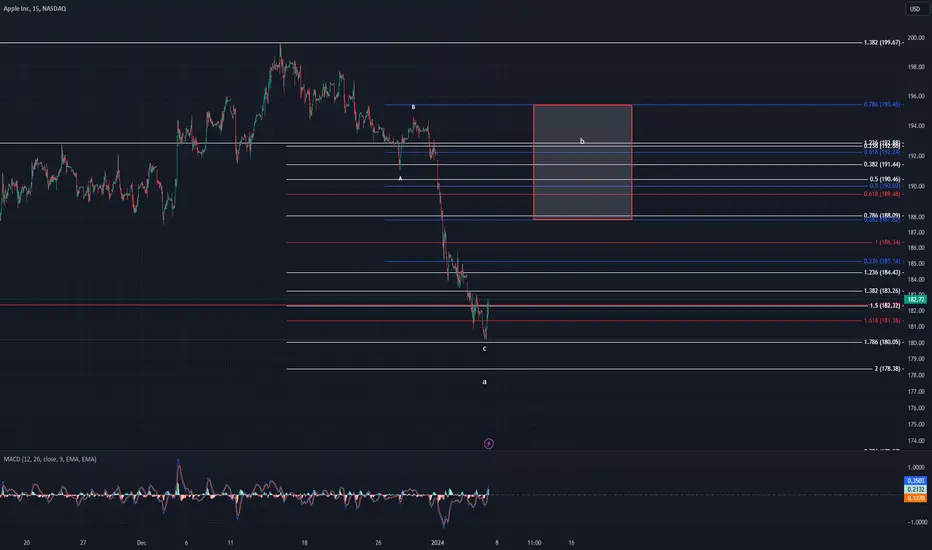

Yesterday, I called for us to drop to the 1.618 area and bounce higher for our b wave retrace. We dropped slightly under that just shy of the 1.786 fib. Price has since started to move up and looks headed for my next target box for b. After it carves out this retracement, I can then dial in targets for our c wave. Nothing is confirmed yet but looks to be following my forecast. If price behaves and ends in my target box, I may buy a couple puts for the fall. Time will tell.

Some of my posts contained some contraband yesterday and were removed. The text has been removed and I am just re-posting this bottom portion so y'all can still see the other information.

I was originally expecting another higher in Apple due to the fib levels we were at. The last two days seem to say otherwise, though. We have breached the 0.5 retracement fib this morning which is normally a red flag this wasn't wave (4). Breaching the prior wave 4 is the first sign we had showing the upside was cracking. Waking up this morning and seeing we tagged the prior wave 1 high with the MACD reading we have all but confirmed this. The confirmation will be a breach of $165.27 to the downside. If this is the correct count, and we have topped, then we are seeing the very first mechanisms of the Super Cycle wave (II) starting. That means we're beginning the consolidation of gains from 1982 up to last month. This will take years-decades to complete.

Looking at the structure alone we have an abc completed. Add fibs into the picture and I would like to see us get OML into the 1.618 fib @ $181.38 before a small retracement for wave b, but this is not required. The micro b I am expecting would "normally" go to the high $180's before the next c wave kicks in and sends us lower. One thing to always remember about corrective action is it is choppy and overlapping. This is obvious in the a-b waves at the beginning of this move down. It then made a 5-wave drop for it's c wave.

Once it starts its next retrace for wave b I will be able to dial in some retracement fibs to help narrow the target area. Wave b will normally be marked by overlapping/choppy price action. This is what I will be looking for today. Once the b wave completes, I expect the drop that follows to be strong much like this mini C wave. I can't be for certain without a completed b wave, but micro-wave c will most likely bottom in the $160 area. I am NOT saying this is the bottom before another rally. I am saying that would complete the first larger A wave within this cycle. Let's not get to ahead of ourselves though and take this one step at a time.

Some of my posts contained some contraband yesterday and were removed. The text has been removed and I am just re-posting this bottom portion so y'all can still see the other information.

I was originally expecting another higher in Apple due to the fib levels we were at. The last two days seem to say otherwise, though. We have breached the 0.5 retracement fib this morning which is normally a red flag this wasn't wave (4). Breaching the prior wave 4 is the first sign we had showing the upside was cracking. Waking up this morning and seeing we tagged the prior wave 1 high with the MACD reading we have all but confirmed this. The confirmation will be a breach of $165.27 to the downside. If this is the correct count, and we have topped, then we are seeing the very first mechanisms of the Super Cycle wave (II) starting. That means we're beginning the consolidation of gains from 1982 up to last month. This will take years-decades to complete.

Looking at the structure alone we have an abc completed. Add fibs into the picture and I would like to see us get OML into the 1.618 fib @ $181.38 before a small retracement for wave b, but this is not required. The micro b I am expecting would "normally" go to the high $180's before the next c wave kicks in and sends us lower. One thing to always remember about corrective action is it is choppy and overlapping. This is obvious in the a-b waves at the beginning of this move down. It then made a 5-wave drop for it's c wave.

Once it starts its next retrace for wave b I will be able to dial in some retracement fibs to help narrow the target area. Wave b will normally be marked by overlapping/choppy price action. This is what I will be looking for today. Once the b wave completes, I expect the drop that follows to be strong much like this mini C wave. I can't be for certain without a completed b wave, but micro-wave c will most likely bottom in the $160 area. I am NOT saying this is the bottom before another rally. I am saying that would complete the first larger A wave within this cycle. Let's not get to ahead of ourselves though and take this one step at a time.

Go to ewtdaily.com for DETAILED DAILY UPDATES on 27 unique tickers and a daily zoom call with members to discuss latest analysis and get a 7-day FREE trial

Bonam Fortunam,

--Tyler

Bonam Fortunam,

--Tyler

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Go to ewtdaily.com for DETAILED DAILY UPDATES on 27 unique tickers and a daily zoom call with members to discuss latest analysis and get a 7-day FREE trial

Bonam Fortunam,

--Tyler

Bonam Fortunam,

--Tyler

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。