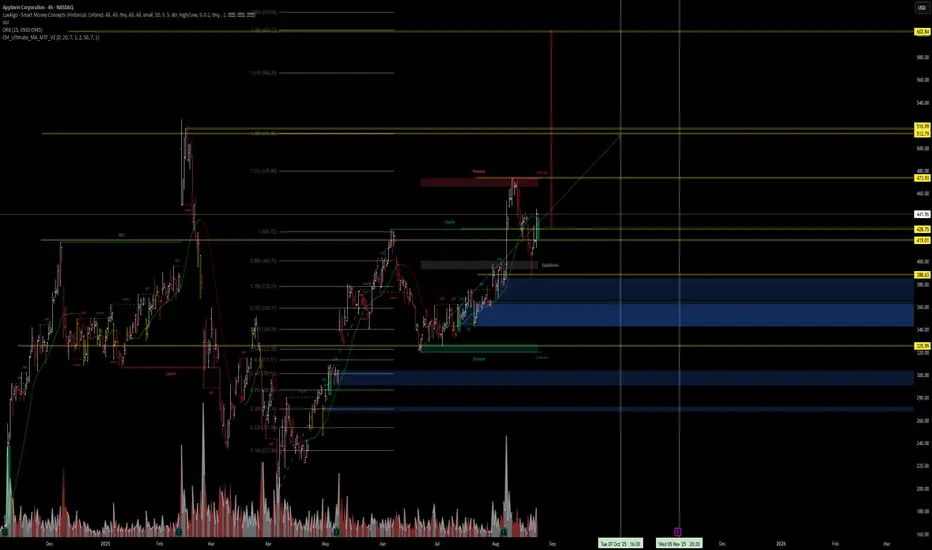

APP (AppLovin) — AI & Smart Money Bust Open Path to $500–$517

Body Text:

AppLovin appears primed for another leg higher—AI models, technical structure, and institutional flow all aligning bullish:

⮕ AI Forecast targets $497.93 (30-day) — logical first major resistance zone. Thru there, $512–$517 opens up as next supply/pumping zone.

⮕ Call sweeps at $462–$470 (Aug 29) show serious bullish wagers in motion.

⮕ Chart Structure: Reclaiming $428–$430 pivot (former supply now support). Cleanup through $473–$480 resistance could clear the way to $500+.

⮕ Fundamentals & Sentiment: Stellar Q2 beat and guidance raise; IBD comp rating now elite at 98; continued analyst upgrades and S&P inclusion talk add fuel.

Probabilistic Targets:

Base Case (~40%): Target zone $490–$500 — aligns with AI and near-term supply breakout.

Extended (~20%): Run to $512–$517 if momentum sustains and broader market holds.

Failure (~40%): Rejection below $428 pivot could re-test $400–$405 demand.

Trade Setup

Entry: $442

Stop-Loss: Ideally $430–$435 (under pivot)

Convert into scale-out or trailing above $497–$500

This is AI + Flow + Structure convergence — textbook and high-probability asymmetric setup.

#APP #TradingView #AITrading #OptionsFlow #BreakoutSetup #AppLovin #TechnicalAnalysis

Body Text:

AppLovin appears primed for another leg higher—AI models, technical structure, and institutional flow all aligning bullish:

⮕ AI Forecast targets $497.93 (30-day) — logical first major resistance zone. Thru there, $512–$517 opens up as next supply/pumping zone.

⮕ Call sweeps at $462–$470 (Aug 29) show serious bullish wagers in motion.

⮕ Chart Structure: Reclaiming $428–$430 pivot (former supply now support). Cleanup through $473–$480 resistance could clear the way to $500+.

⮕ Fundamentals & Sentiment: Stellar Q2 beat and guidance raise; IBD comp rating now elite at 98; continued analyst upgrades and S&P inclusion talk add fuel.

Probabilistic Targets:

Base Case (~40%): Target zone $490–$500 — aligns with AI and near-term supply breakout.

Extended (~20%): Run to $512–$517 if momentum sustains and broader market holds.

Failure (~40%): Rejection below $428 pivot could re-test $400–$405 demand.

Trade Setup

Entry: $442

Stop-Loss: Ideally $430–$435 (under pivot)

Convert into scale-out or trailing above $497–$500

This is AI + Flow + Structure convergence — textbook and high-probability asymmetric setup.

#APP #TradingView #AITrading #OptionsFlow #BreakoutSetup #AppLovin #TechnicalAnalysis

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。