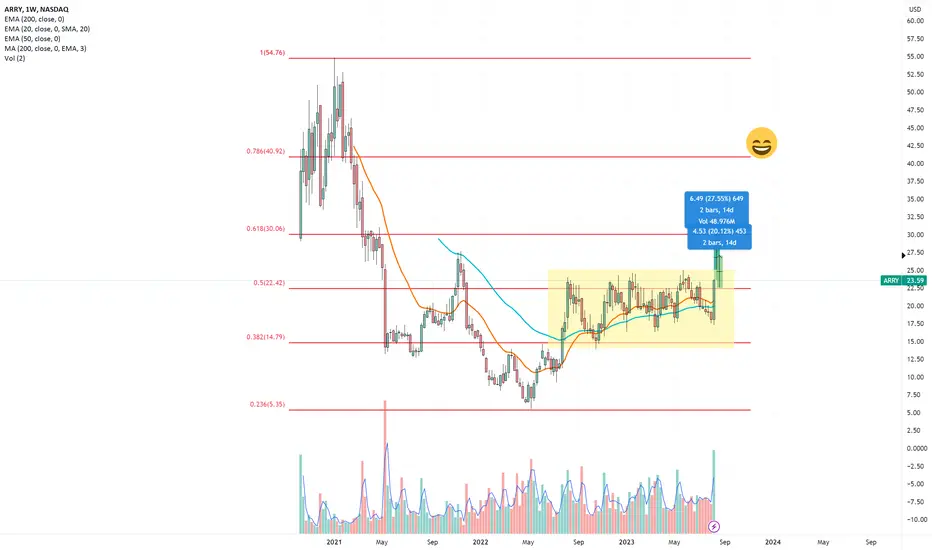

If all other market indicators are not significantly below average,  ARRY appears poised to emerge from a year-long consolidation as a leading supplier of renewable energy components. During the past week, it concluded trading above the 22.43% Fibonacci retracement level. This was a direct result of robust earnings stemming from a well-established global supply chain and a promising future demand for components in Solar Plant Systems.

ARRY appears poised to emerge from a year-long consolidation as a leading supplier of renewable energy components. During the past week, it concluded trading above the 22.43% Fibonacci retracement level. This was a direct result of robust earnings stemming from a well-established global supply chain and a promising future demand for components in Solar Plant Systems.

For further reference, you can check out this link: https://www.iea.org/data-and-statistics/charts/share-of-cumulative-power-capacity-by-technology-2010-2027

It's projected that the ARRY 's price will rise to $30, as numerous investment institutions' analysts have identified it as having potential for a higher trading value than its current level.

ARRY 's price will rise to $30, as numerous investment institutions' analysts have identified it as having potential for a higher trading value than its current level.

Highlighted in green are two strategies for trading

For further reference, you can check out this link: https://www.iea.org/data-and-statistics/charts/share-of-cumulative-power-capacity-by-technology-2010-2027

It's projected that the

Highlighted in green are two strategies for trading

トレード稼働中

Early longs taking profits. Some shorts closing trade.免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。