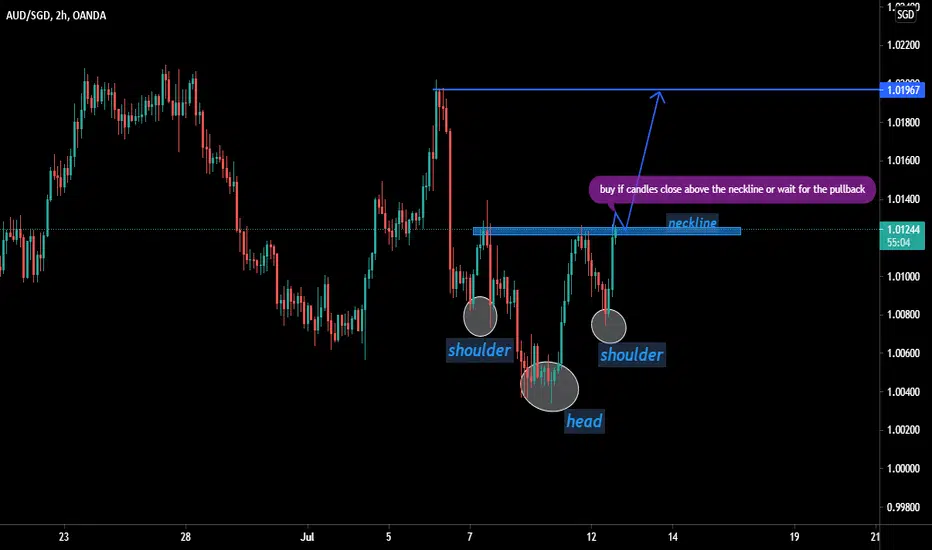

wait for the candle to close above the structure or neckline, wait for the pullback

The Bottom Line

Head and shoulders patterns occur on all time frames and can be seen visually. While subjective at times, the complete pattern provides entries, stops, and profit targets, making it easy to implement a trading strategy. The pattern is composed of a left shoulder, a head, then a right shoulder. The most common entry point is a breakout of the neckline, with a stop above (market top) or below (market bottom) the right shoulder. The profit target is the difference of the high and low with the pattern added (market bottom) or subtracted (market top) from the breakout price. The system is not perfect, but it does provide a method of trading the markets based on logical price movements.

The Bottom Line

Head and shoulders patterns occur on all time frames and can be seen visually. While subjective at times, the complete pattern provides entries, stops, and profit targets, making it easy to implement a trading strategy. The pattern is composed of a left shoulder, a head, then a right shoulder. The most common entry point is a breakout of the neckline, with a stop above (market top) or below (market bottom) the right shoulder. The profit target is the difference of the high and low with the pattern added (market bottom) or subtracted (market top) from the breakout price. The system is not perfect, but it does provide a method of trading the markets based on logical price movements.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。