🔎 Intro / Overview

___________________________________________________________

📌 How to Use

___________________________________________________________

🎯 Trading Plan

___________________________________________________________

📊 Chart Explanation

___________________________________________________________

👀 Observation

___________________________________________________________

❗ Why It Matters?

___________________________________________________________

🎯 Conclusion

___________________________________________________________

⚠️ Disclaimer

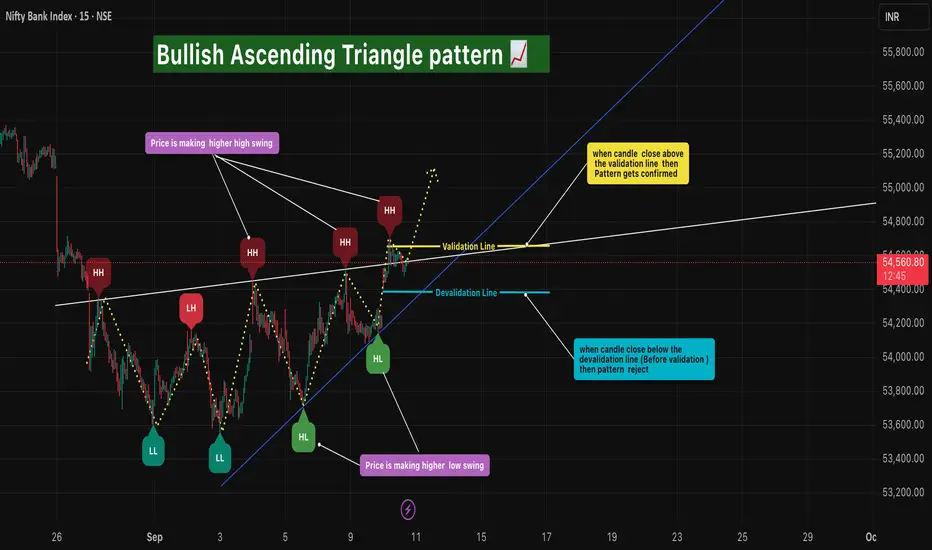

- The Bullish Ascending Triangle is a continuation pattern that signals strength in an uptrend 📈.

- It forms as price creates Higher Highs and Higher Lows in sequence, compressing toward a breakout level.

- This structure shows buyers stepping in at higher levels while sellers gradually weaken, often leading to a bullish breakout.

___________________________________________________________

📌 How to Use

- Identify a prior uptrend → the base condition for Ascending Triangle.

- Price consolidates by forming Higher Lows and retesting the same resistance level.

- Validation → Mark the close of candle that break upper trend line

- Devalidation → Swing Low ( when any candle break the upper trend line).

- Entry → Confirmed only when price closes above the Validation level.

- Stop Loss → Swing Low (Candle break the upper trend line ).

- Target → Equal to the measured height of the triangle or 1R multiples.

___________________________________________________________

🎯 Trading Plan

- Entry → On breakout close above Validation level.

- Stop Loss → Swing Low (Candle break the upper trend line ).

- Target → Conservative 1R, Moderate 2R,

- Remaining lots → Trail using ATR, Fibonacci, or structural swing highs.

___________________________________________________________

📊 Chart Explanation

- Price starts in an uptrend.

- Forms a sequence of Higher Highs and Higher Lows.

- Resistance holds flat at the top, forming the Ascending Triangle shape 🔺.

- Breakout above the Higher High Validation line triggers entry ✅.

- Swing Low = Devalidation ⛔.

- Target 1 achieved 🎯, trailing used for further upside 🚀.

___________________________________________________________

👀 Observation

- Works best as a continuation pattern in established uptrends.

- A strong bullish breakout candle adds conviction.

- Sideways/choppy markets may cause false breakouts → validation rules filter them.

- Volume confirmation strengthens the setup.

___________________________________________________________

❗ Why It Matters?

- Represents buyer dominance with sellers weakening over time.

- Provides a clear breakout entry with strict SL and TP.

- Helps traders capture trending moves while minimizing false signals.

- Rule-based framework improves discipline and consistency.

___________________________________________________________

🎯 Conclusion

- The Bullish Ascending Triangle Pattern is a reliable continuation signal for trend traders.

- By combining Higher Highs, Higher Lows, and breakout confirmation, traders can enter with confidence, manage risk, and trail profits effectively.

- 🔥 Patterns don’t predict. Rules protect. 🚀

___________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

ノート

On 11 September, 2025 (12:15) ⏰, the Entry was successfully validated ✅. - 📌 Stop Loss (SL) → Swing Low = 54,400.00

- 🎯 Target 1 → 1x of Stop Loss distance = 55,022.20

The setup is now active with structured risk management.

ノート

-🎯 The projected target of 55,065 has been successfully achieved today.

-📈 This target was anticipated on 10 September during the pattern validation.

-🔄 Remaining positions can now be managed with a trailing stop to protect profits while allowing further upside potential.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。