Fundamental

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

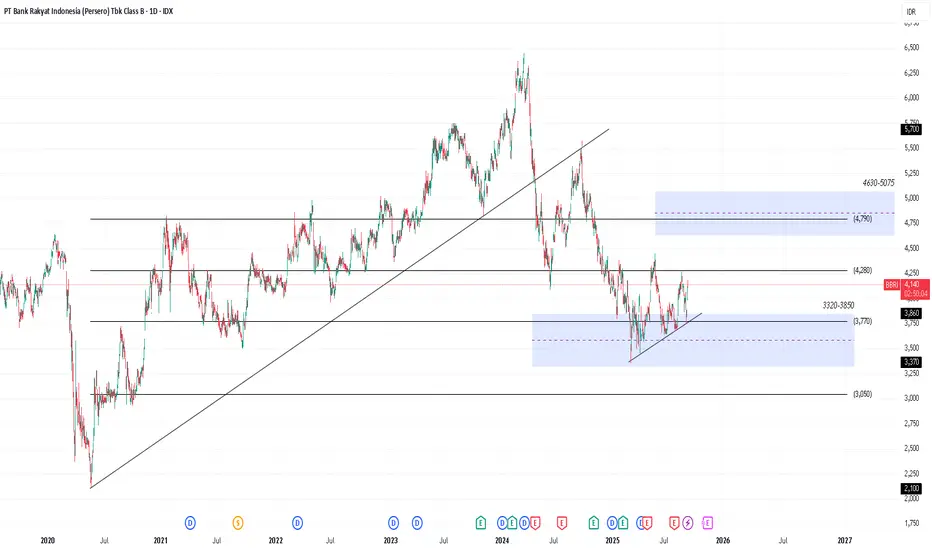

Technical

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

Technical

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。