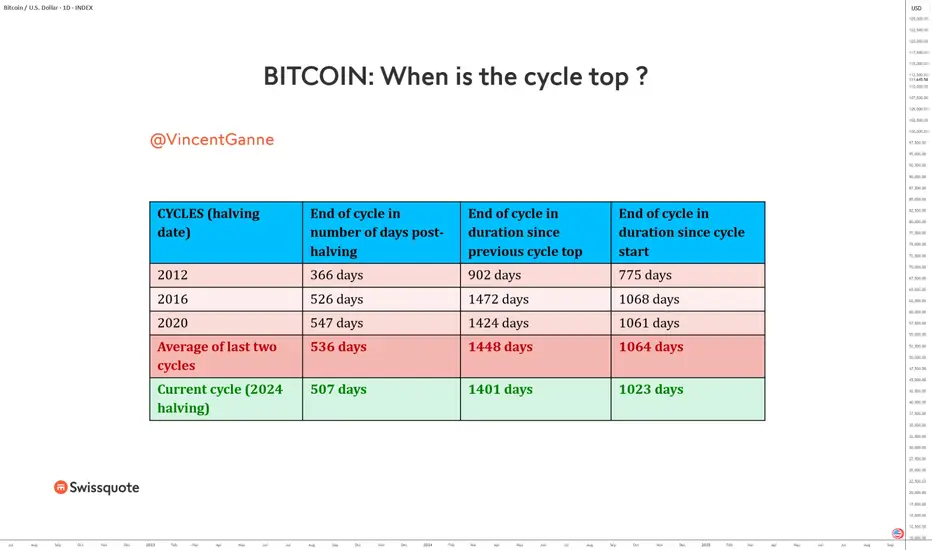

Did Bitcoin reach its cycle top on August 14 at USD 124,000? Some analysts think so. But this scenario still seems unlikely when compared to the average duration of the three previous cycles. The table provided in this analysis compares the length of our current cycle according to several criteria and contrasts them with the duration of the two prior cycles, with the first cycle being a particular case.

The analysis of Bitcoin’s previous cycles highlights certain temporal regularities, useful for attempting to anticipate the end of the ongoing cycle. The observation focuses on halving dates, key events that cut miners’ rewards in half and have historically influenced market dynamics.

In 2012, the cycle peaked 366 days after the halving, i.e., 902 days after the previous cycle top and 775 days after the cycle’s start.

The next cycle, in 2016, extended this pattern: 526 days post-halving, 1,472 days after the prior top, and 1,068 days since the beginning.

Finally, in 2020, the market peak occurred 547 days after the halving, 1,424 days after the previous cycle, and 1,061 days after its start.

The average of the last two cycles reveals a recurring pattern:

536 days after the halving,

1,448 days after the previous top,

1,064 days after the cycle’s start.

Applying these comparative data to the current cycle, which began with the 2024 halving, we now observe a timeline of 507 days post-halving, 1,401 days after the 2021 top, and 1,023 days since the start of the cycle. In other words, the market is already very close to historical averages, suggesting that the top of this cycle could occur within a relatively narrow time window, likely around mid-October.

Of course, history never repeats itself perfectly. Macroeconomic conditions, regulation, and institutional adoption all play essential roles in shaping the scale and duration of cycles. Nevertheless, statistical benchmarks from previous halvings provide valuable tools for identifying alert zones and better navigating the market’s critical phases.

Finally, there remains the possibility of a time-extended cycle, justified by a genuine monetary pivot from the US Federal Reserve (FED), which could align with Bitcoin’s historical timing averages, pointing more toward a cycle end in late November or December.

To be continued!

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

The analysis of Bitcoin’s previous cycles highlights certain temporal regularities, useful for attempting to anticipate the end of the ongoing cycle. The observation focuses on halving dates, key events that cut miners’ rewards in half and have historically influenced market dynamics.

In 2012, the cycle peaked 366 days after the halving, i.e., 902 days after the previous cycle top and 775 days after the cycle’s start.

The next cycle, in 2016, extended this pattern: 526 days post-halving, 1,472 days after the prior top, and 1,068 days since the beginning.

Finally, in 2020, the market peak occurred 547 days after the halving, 1,424 days after the previous cycle, and 1,061 days after its start.

The average of the last two cycles reveals a recurring pattern:

536 days after the halving,

1,448 days after the previous top,

1,064 days after the cycle’s start.

Applying these comparative data to the current cycle, which began with the 2024 halving, we now observe a timeline of 507 days post-halving, 1,401 days after the 2021 top, and 1,023 days since the start of the cycle. In other words, the market is already very close to historical averages, suggesting that the top of this cycle could occur within a relatively narrow time window, likely around mid-October.

Of course, history never repeats itself perfectly. Macroeconomic conditions, regulation, and institutional adoption all play essential roles in shaping the scale and duration of cycles. Nevertheless, statistical benchmarks from previous halvings provide valuable tools for identifying alert zones and better navigating the market’s critical phases.

Finally, there remains the possibility of a time-extended cycle, justified by a genuine monetary pivot from the US Federal Reserve (FED), which could align with Bitcoin’s historical timing averages, pointing more toward a cycle end in late November or December.

To be continued!

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。