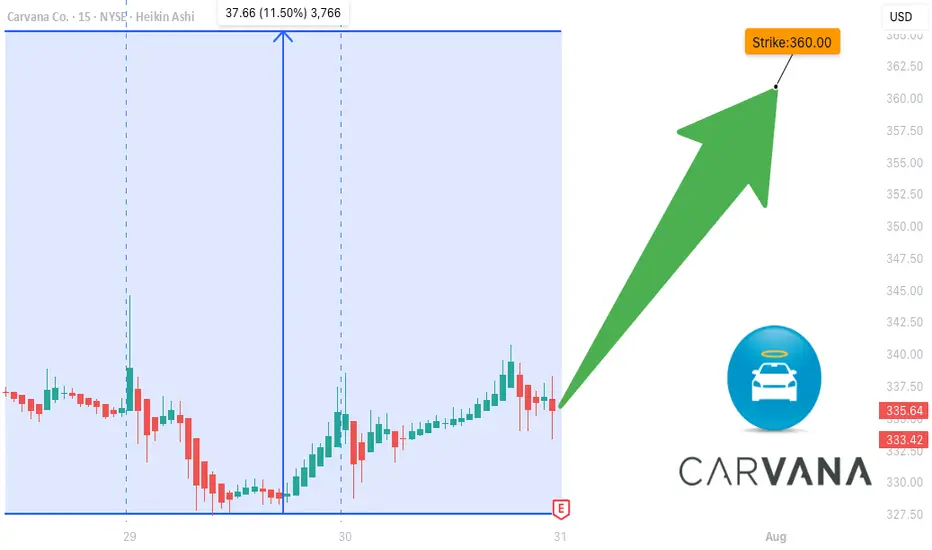

## 🚗 CVNA EARNINGS TRADE IDEA — July 30 (AMC)

**Carvana (CVNA)**

📊 **Bullish Confidence**: 85%

📈 **Earnings Play Setup**

💣 Big Volatility + Strong History = Explosive Potential

---

### ⚙️ FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +38.3% YoY

🔁 **8/8 EPS Beats** (114.5% avg surprise)

🟡 **Profit Margin**: 2.7% (Thin but improving)

⚠️ **Debt-to-Equity**: 344.78 (High leverage risk)

💬 **Sector Rotation**: Growth favors high-beta names

💡 **Beta**: 3.60 → Big post-earnings swings likely

---

### 📊 OPTIONS FLOW HEATMAP

🔥 Heavy Call Volume @ \$360–\$370

🟢 Bullish OI Stack

📉 Put/Call Skew: CALL DOMINANT

💥 IV Elevated = Lotto ticket pricing

---

### 📈 TECHNICALS

💵 Price: \$336.50

🧱 Resistance: \$343.68

📉 RSI: 44.5 (Neutral – Room to Run)

📊 200D MA: \$252.21 → Long-term bullish positioning

---

### 🔥 TRADE IDEA:

**CVNA 08/01 \$360 CALL**

🎯 **Entry**: \$11.25

🚀 **Target**: \$33.75 (200% ROI)

🛑 **Stop**: \$5.60

📊 **Size**: 1 contract

⏰ **Entry Timing**: Pre-Earnings Close (AMC play)

---

### 📉 RISK / REWARD

* 🟥 Max Loss: \$11.25

* 🟩 Profit Target: \$33.75

* ⚖️ RR Ratio: 1:3

* 💼 Portfolio Risk: 2–3%

---

### 🧠 STRATEGY INSIGHTS

✅ Historical beat rate = STRONG

✅ Bullish options skew = CONFIRMED

⚠️ High debt = risk, but momentum > fear

📌 Tip: If IV crushes post-earnings, exit fast. This is a *structured speculative play* — not a hold-and-hope.

---

📢 "Speculation is fine. Structure it."

💬 Tag a trader who *YOLOs with stop losses* 👇

\#CVNA #EarningsPlay #OptionsTrading #TradingView #HighBeta #LottoPlay #RiskManaged #CallOptions #BullishSetup #IVCrushProof #EcommerceStocks #EarningsSeason

Free Signals Based on Latest AI models💰: QuantSignals.xyz

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Free Signals Based on Latest AI models💰: QuantSignals.xyz

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。