Sometimes you don't need a ton of information.

Sometimes, it's just the right moment when a few facts come together, and you make up your mind.

That's the case now with Gold for me.

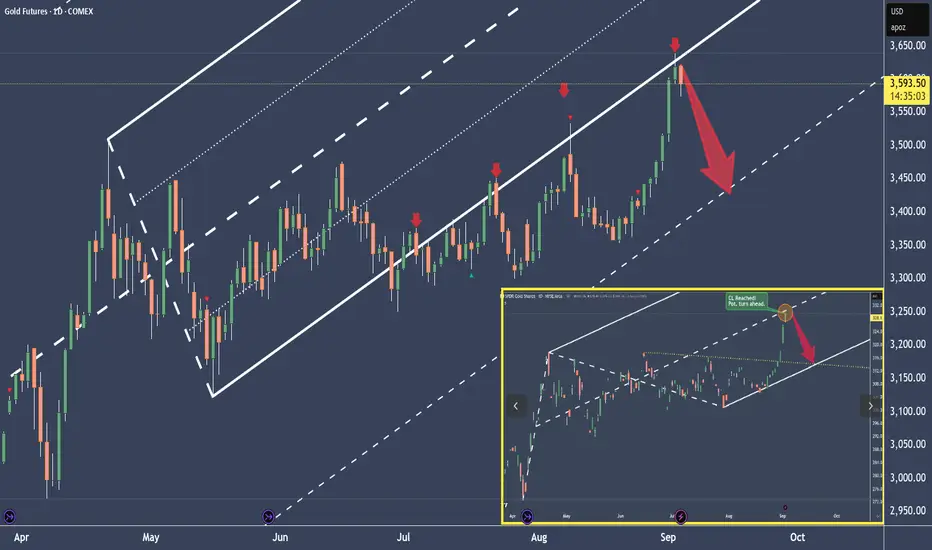

We know that the behavior changed when Gold left the Fork in July.

We also know that if price leaves a Fork, it's highly possible we’ll see a test/re-test at the L-MLH, the lower median line parallel.

Additionally, Allan H. Andrews, the inventor of the Median Lines/Forks, wrote back then that price could also crawl along the parallel line for a longer period. And if price can't manage to jump back into the Fork—regaining the trajectory of the slope—it will trade in the opposite direction sooner or later.

Last but not least: I checked GLD too. Surprisingly it reached the Centerline just yesterday (See screenshot in the right lower corner of the Chart). So price has a high tendency to turn in the opposite direction when balanced again.

So, there you have it.

I’m planning a short, with profits at the WL as my first target.

But what if it goes wrong, if price climbs higher?

Well, then I’ll probably get stopped out, which is nothing more than part of this business.

Any questions?

Don't hesitate to ask me. It's the only way humans learn—by asking questions.

Cheers

§8-)

Sometimes, it's just the right moment when a few facts come together, and you make up your mind.

That's the case now with Gold for me.

We know that the behavior changed when Gold left the Fork in July.

We also know that if price leaves a Fork, it's highly possible we’ll see a test/re-test at the L-MLH, the lower median line parallel.

Additionally, Allan H. Andrews, the inventor of the Median Lines/Forks, wrote back then that price could also crawl along the parallel line for a longer period. And if price can't manage to jump back into the Fork—regaining the trajectory of the slope—it will trade in the opposite direction sooner or later.

Last but not least: I checked GLD too. Surprisingly it reached the Centerline just yesterday (See screenshot in the right lower corner of the Chart). So price has a high tendency to turn in the opposite direction when balanced again.

So, there you have it.

I’m planning a short, with profits at the WL as my first target.

But what if it goes wrong, if price climbs higher?

Well, then I’ll probably get stopped out, which is nothing more than part of this business.

Any questions?

Don't hesitate to ask me. It's the only way humans learn—by asking questions.

Cheers

§8-)

トレード終了: ストップロスに到達

Toasted hehe...next.🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

✅ Wins & losses go hand in hand

🔱 Free E-Book: howtochart.com/forktradingblueprint

👉 YT: youtube.com/@howtochart

👉 Web: HowToChart.com

✅ Learn to make money

✅ Earn while learning

✅ Wins & losses go hand in hand

🔱 Free E-Book: howtochart.com/forktradingblueprint

👉 YT: youtube.com/@howtochart

👉 Web: HowToChart.com

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

✅ Wins & losses go hand in hand

🔱 Free E-Book: howtochart.com/forktradingblueprint

👉 YT: youtube.com/@howtochart

👉 Web: HowToChart.com

✅ Learn to make money

✅ Earn while learning

✅ Wins & losses go hand in hand

🔱 Free E-Book: howtochart.com/forktradingblueprint

👉 YT: youtube.com/@howtochart

👉 Web: HowToChart.com

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。