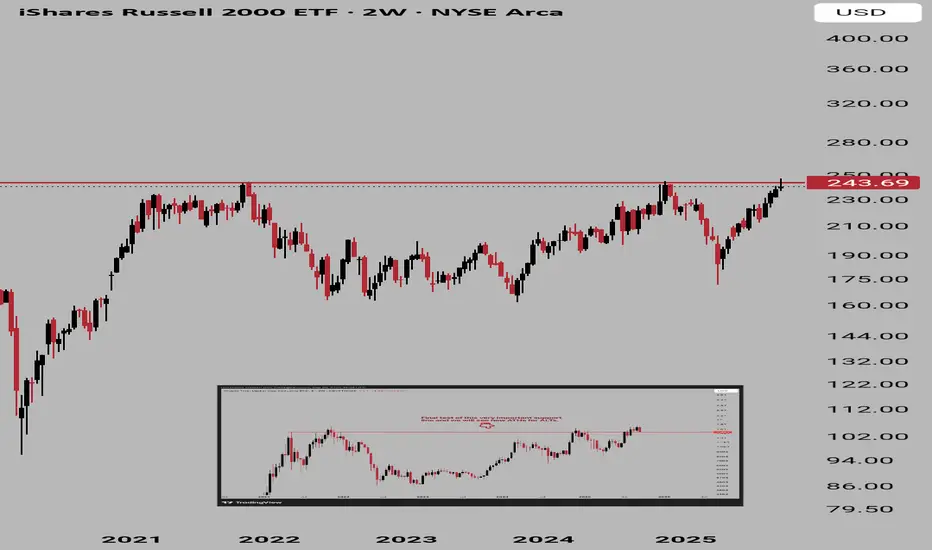

Risk-on vs risk-off assets → Both small-cap stocks (IWM) and altcoins (TOTAL2) are considered high-beta, speculative assets. They respond more aggressively to shifts in liquidity, interest rates, and risk appetite.

Liquidity sensitivity → When liquidity is abundant, both IWM and TOTAL2 rally harder than their large-cap counterparts (S&P 500 / Bitcoin). When liquidity tightens, they sell off harder too.

Market breadth / speculative phase → IWM is a gauge of U.S. market breadth (how smaller companies are doing), while TOTAL2 reflects risk-taking beyond Bitcoin. Both act as “speculative barometers.”

Macro correlation → In tightening cycles (higher rates, strong dollar), both tend to lag. In easing/liquidity cycles, they outperform and move almost in lockstep.

Liquidity sensitivity → When liquidity is abundant, both IWM and TOTAL2 rally harder than their large-cap counterparts (S&P 500 / Bitcoin). When liquidity tightens, they sell off harder too.

Market breadth / speculative phase → IWM is a gauge of U.S. market breadth (how smaller companies are doing), while TOTAL2 reflects risk-taking beyond Bitcoin. Both act as “speculative barometers.”

Macro correlation → In tightening cycles (higher rates, strong dollar), both tend to lag. In easing/liquidity cycles, they outperform and move almost in lockstep.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。