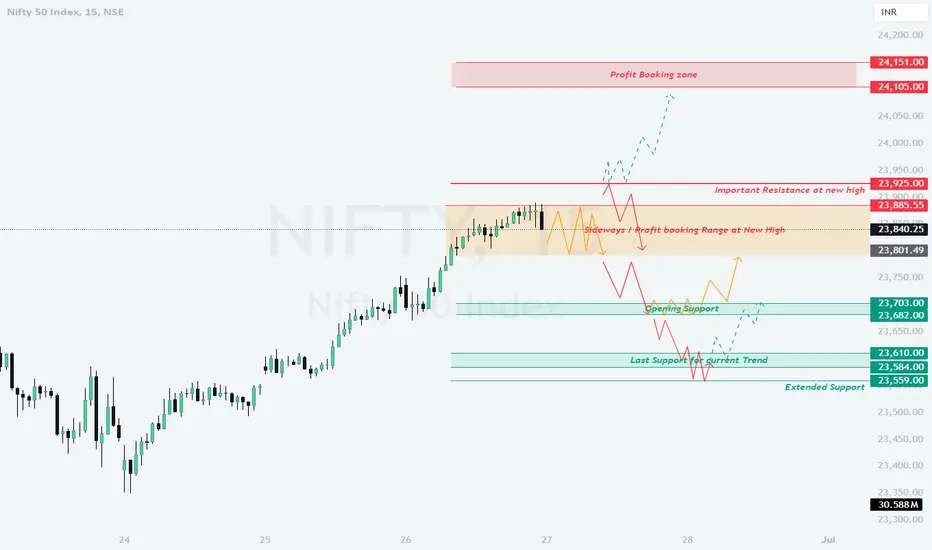

Here is a detailed trading plan for NIFTY Index on 27-Jun-2024 considering various opening scenarios. The plan includes steps for Gap Up, Flat, and Gap Down openings.

**Scenario 1: Gap Up Opening (100+ points)**

**Scenario 2: Flat Opening**

**Scenario 3: Gap Down Opening (100+ points)**

**Summary and Conclusion**

For 24-Jun-2024, closely monitor the key levels and price action for potential trading opportunities. In case of a gap up opening, watch the resistance zone and look for profit booking opportunities. For a flat opening, trade within the sideways range and look for breakout or breakdown signals. In the event of a gap down opening, focus on the support levels for potential reversals or continuation patterns.

**Disclaimer:** I am not a SEBI registered analyst. This plan is for educational purposes only and not an investment advice. Always conduct your own research and consult with a professional financial advisor before making any trading decisions.

Good luck with your trading on 27-Jun-2024!

**Scenario 1: Gap Up Opening (100+ points)**

- **Initial Action:** Monitor the price action and volume around the important resistance zone at 23,925.00 - 23,885.55.

- **Profit Booking Zone:** If the price sustains above 24,105.00, look for opportunities to book profits.

- **Resistance Rejection:** If the price faces rejection from the resistance zone (23,925.00 - 23,885.55), expect a pullback towards the opening support at 23,703.00 - 23,682.00.

- **Support Confirmation:** If the price holds above the opening support zone, consider entering long positions with a target towards the resistance zone again.

- **Breakdown:** If the price breaks below 23,682.00, expect a further decline towards the last support of the current trend at 23,610.00 - 23,584.00.

**Scenario 2: Flat Opening**

- **Initial Action:** Observe the price action and volume in the sideways and profit booking range (23,885.55 - 23,801.49).

- **Breakout Entry:** If the price breaks above 23,925.00 with strong volume, enter long positions targeting the profit booking zone (24,105.00 - 24,151.00).

- **Range Trading:** If the price remains in the sideways range (23,885.55 - 23,801.49), consider scalping opportunities within this range.

- **Support Test:** If the price drops towards the opening support (23,703.00 - 23,682.00), look for a reversal signal to enter long positions.

- **Breakdown:** If the price falls below 23,682.00, expect a move towards the last support of the current trend at 23,610.00 - 23,584.00.

**Scenario 3: Gap Down Opening (100+ points)**

- **Initial Action:** Evaluate the price action and volume around the opening support at 23,703.00 - 23,682.00.

- **Support Reversal:** If the price finds support and reverses from this zone, consider entering long positions targeting the sideways range at 23,801.49.

- **Breakdown Continuation:** If the price fails to hold the support and breaks below 23,682.00, prepare for a further decline towards the last support of the current trend at 23,610.00 - 23,584.00.

- **Extended Support:** In case of further weakness, watch the extended support zone at 23,559.00 for potential reversal opportunities.

- **Recovery Signal:** If a recovery signal appears above the last support zone, consider entering long positions targeting the opening support again.

**Summary and Conclusion**

For 24-Jun-2024, closely monitor the key levels and price action for potential trading opportunities. In case of a gap up opening, watch the resistance zone and look for profit booking opportunities. For a flat opening, trade within the sideways range and look for breakout or breakdown signals. In the event of a gap down opening, focus on the support levels for potential reversals or continuation patterns.

**Disclaimer:** I am not a SEBI registered analyst. This plan is for educational purposes only and not an investment advice. Always conduct your own research and consult with a professional financial advisor before making any trading decisions.

Good luck with your trading on 27-Jun-2024!

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。