How to Identify a Trend in a Chart?

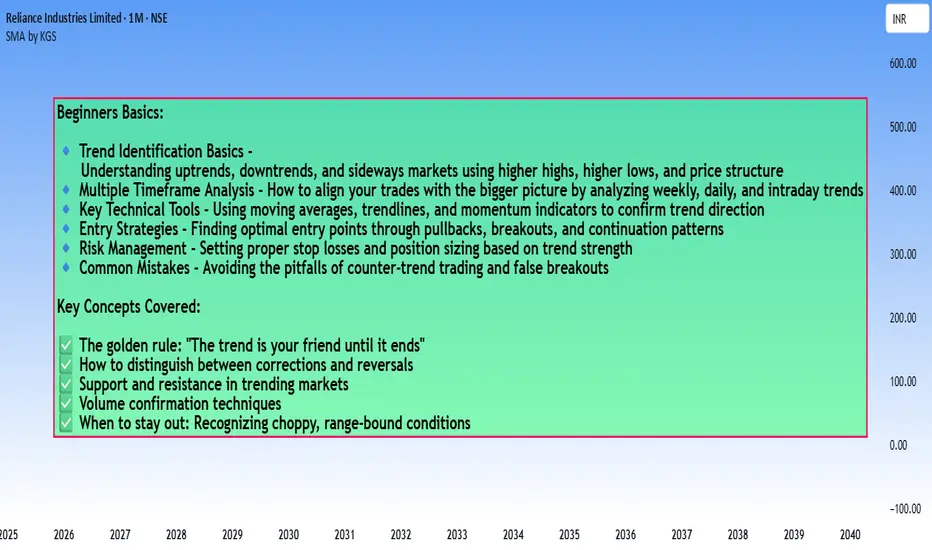

Here's a practical breakdown of trend identification methods:

1. Price Structure Method (Most Fundamental)

Uptrend:

- Series of Higher Highs (HH) and Higher Lows (HL)

- Each peak is higher than the previous peak

- Each trough is higher than the previous trough

Downtrend:

- Series of Lower Highs (LH) and Lower Lows (LL)

- Each peak is lower than the previous peak

- Each trough is lower than the previous trough

Sideways/Range:

- Price oscillates between horizontal support and resistance

- No clear higher highs/lows or lower highs/lows

2. Moving Averages

Simple Rules:

- Price consistently above MA = Uptrend

- Price consistently below MA = Downtrend

- Price crossing back and forth = No clear trend

Popular MAs:

- 20 EMA (short-term)

- 50 SMA (medium-term)

- 200 SMA (long-term)

Golden Cross/Death Cross:

- 50 MA crosses above 200 MA = Bullish trend signal

- 50 MA crosses below 200 MA = Bearish trend signal

3. Trendline Method

Drawing Trendlines:

- Uptrend: Connect at least 2 higher lows with a straight line

- Downtrend: Connect at least 2 lower highs with a straight line

- The more touches, the stronger the trendline

- Price respecting the trendline confirms trend strength

4. Multi-Timeframe Analysis

The Complete Picture:

- Weekly chart: Overall market direction

- Daily chart: Intermediate trend

- 4H/1H chart: Entry timing

Rule: Always trade in the direction of the higher timeframe trend

#5. Indicators for Confirmation

ADX (Average Directional Index):

- Above 25 = Strong trend

- Below 20 = Weak/no trend

- Doesn't show direction, only strength

MACD:

- Histogram above zero = Uptrend

- Histogram below zero = Downtrend

- Crossovers signal potential trend changes

RSI:

- Consistently above 50 = Uptrend

- Consistently below 50 = Downtrend

6. Volume Confirmation

Healthy Trends Show:

- Rising volume on moves in trend direction

- Declining volume on corrections/pullbacks

- Volume spikes at breakout points

Quick Checklist for Trend Identification:

✅ Strong Uptrend:

- Higher highs and higher lows

- Price above rising moving averages

- Valid upward trendline intact

- ADX above 25

- Increasing volume on rallies

✅ Strong Downtrend:

- Lower highs and lower lows

- Price below falling moving averages

- Valid downward trendline intact

- ADX above 25

- Increasing volume on declines

⚠️ No Clear Trend (Stay Out):

- Choppy price action

- MAs flat or intertwined

- ADX below 20

- Price between support/resistance

Common Beginner Mistakes:

❌ Looking at only one timeframe

❌ Ignoring the bigger picture

❌ Trading every small wiggle as a "trend"

❌ Not waiting for confirmation

❌ Confusing corrections with reversals

Pro Tips:

💡 **The 3-Touch Rule:** A trend becomes more reliable after price respects a trendline at least 3 times

💡 **Trend is Your Timeframe:** What's an uptrend on daily might be a pullback on weekly

💡 **When in Doubt, Zoom Out:** Higher timeframes show the true direction

💡 **Trade WITH the trend, not against it:** Counter-trend trades have lower probability

**Remember:** Trend identification isn't about being perfect - it's about being on the right side of the market more often than not. Start with the basics (higher highs/lows), then add confirmation tools as you gain experience.

More updates with examples and Explanation on individual topics in a easy way to understand.

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。