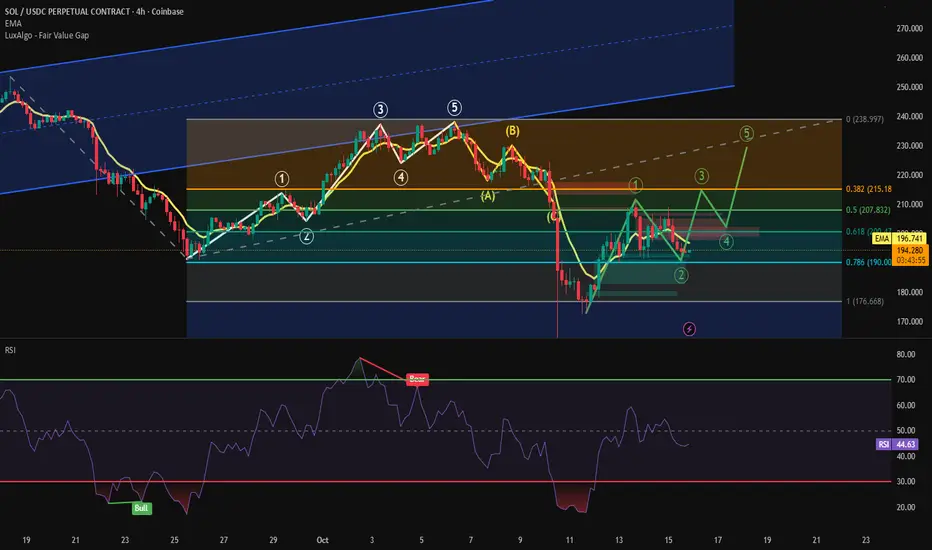

No clue what's going on since the rate cut announcement. Big dump then sideways the last 5 days. The green 5 wave move is my best guess at what's next. I can't see a long term bearish scenario with all the bullish news & sentiment. The sideways action is hella boring and makes ppl what to exit. Sideways boring action is most often bullish from my experience. It might be a couple more weeks of sideways boredom until the next Fed rate cut expected the end of October. Anything between 190 and 240 "feels" sideways. It's a wide range but we were at 240 Oct 6th just 10 days ago and currently 194. Remember SOL was at just $95 April 7th. $129 June 23rd. It'd take a major event, black swan even, to dump that hard. I think we're at the quarterly low. I'm expecting a bull but 60/40 chance is my feeling near term ( next 2 weeks). I don't expect a big move until the next Fed rate announcement. Hurry up and wait!

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。