Overview:

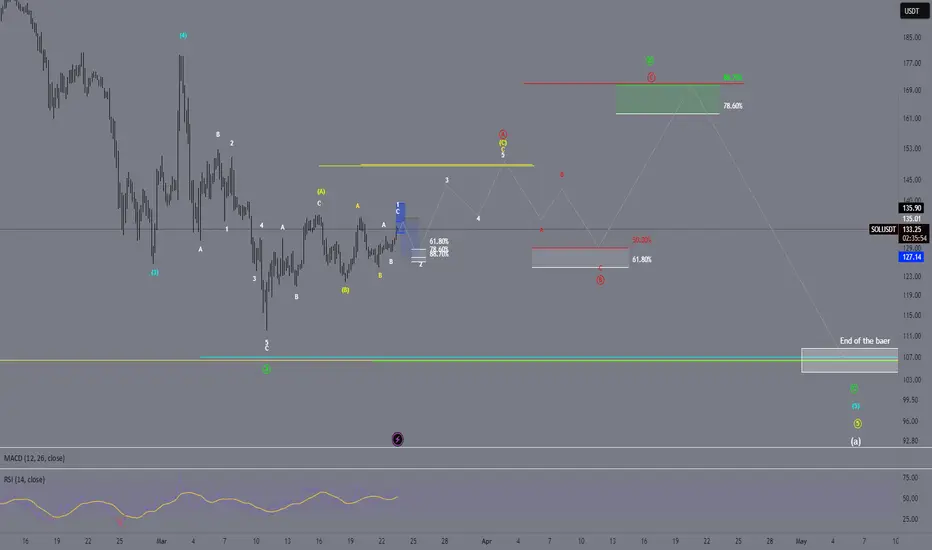

This analysis examines Solana’s current Elliott Wave structure. The chart suggests a potential correction (blue zone), followed by a strong upward impulse (Wave 3), and later a larger ABC corrective phase (red letters) before potentially resuming a bullish trend.

1. Short-Term Scenario (Blue Zone)

- Complex Correction: The price has recently undergone a multi-wave correction and is approaching a potential buying zone.

- Fibonacci Levels: Zones around 61.8% and 78.6% may act as support levels where the correction could end.

- Entry Opportunity: If the price tests these levels and shows signs of forming a base, this could be a favorable entry point.

2. Next Upward Impulse (Wave 3)

- Strong Move: Once the correction concludes, an impulsive upward movement (Wave 3) could kick off, typically the most dynamic leg in an Elliott Wave cycle.

- Target Area: The highlighted yellow zone in the chart indicates a key resistance level that the market could aim to hit.

3. Mid-Term ABC Correction (Red Waves)

- After the Impulse: Once the impulsive upward move (Wave 5) completes, a larger ABC corrective phase is expected (denoted by red letters).

- Retracement Levels: Fibonacci retracement levels around 50% or 61.8% may serve as critical support zones during this correction.

4. Long-Term Perspective

- Renewed Bullish Trend: Following the completion of the ABC correction, there is the potential for Solana to resume its bullish trajectory.

- Target Zone: The green area in the upper section of the chart represents a possible long-term resistance or target level where a significant market decision could take place.

Conclusion:

- Short-Term: A correction toward the blue zone is possible, which may offer a good entry opportunity if support holds.

- Mid-Term: A robust upward impulse toward the yellow resistance is anticipated, likely followed by a larger ABC correction.

- Long-Term: Once the correction completes, Solana could resume an upward trend, setting the stage for a new bullish phase.

- Disclaimer: This analysis is for educational purposes only and should not be considered financial or investment advice. Always practice proper risk management when trading.

注文をキャンセル

counting is not valid anymore免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。