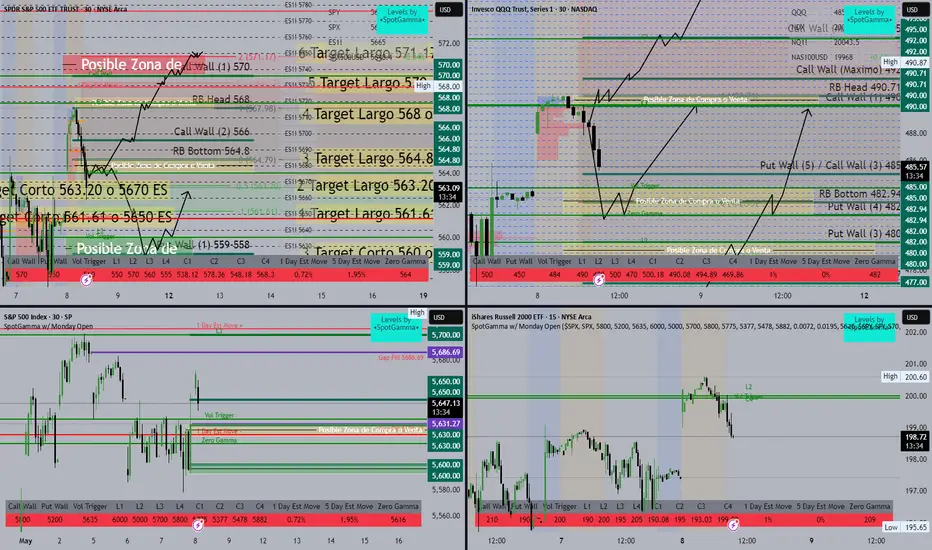

SPY/ES Liquidity & Target Zones - Market Plan Overview

This visual map integrates liquidity levels, volume walls, and SpotGamma data to forecast key trading zones. Let's break it down in a structured format for better clarity and decision-making:

🔴 Possible Sell Zone / Final Target

Zone: Around 571.17 SPY or 5750 ES

Label: "Possible Sell or Final Target Zone"

Confluence: Call Wall (+1) at 579, significant resistance

🧠 This is a key exhaustion point for long positions. Ideal area to take profit or consider shorts.

✅ Upside Targets (Long Bias)

Target # SPY Level ES Equivalent Notes

6 571.17 5750 ES Extreme resistance zone

5 570 5740 ES Above Call Wall

4 568 5720 ES Matches liquidity cluster

3 564.8 5685 ES Near RB Bottom

2 563.20 5670 ES Mid-range pullback

1 561.61 5650 ES Close to mid gamma

🧠 These levels can be used for trailing targets or re-entries on pullbacks.

🔻 Downside Targets (Short Bias)

Target # SPY Level ES Equivalent Notes

1 563.20 5670 ES First major support

2 561.61 5650 ES Mid gamma support

3 560 5635 ES Near Zero Gamma and Put Wall

🧠 Breaks below these can trigger accelerated downside moves.

📈 Key Zones

Green Zone (Buy Zone):

559–558 SPY — Strong Put Wall and bounce probability area.

Yellow Zone (Flip Zone):

Around 564.79 SPY — Possible area of reversal, watch for reactions here.

Red Zone (Sell Zone):

Above 570 SPY — Watch for overextension and reversal signs.

🔍 Technical Tools Used

Call/Put Walls: Indicate dealer hedging areas and potential price magnets.

Volume Profile: Highlights high-activity price zones.

SpotGamma Levels: Used to identify gamma flip zones, walls, and trigger areas.

🔁 Possible Scenarios

Bullish Path:

Bounce from 561–563 range → Reclaim 564.8 → Push towards 568, possibly 570+.

Bearish Path:

Rejection at 564.8 or 568 → Breakdown below 561 → Test Put Wall at 559.

This visual map integrates liquidity levels, volume walls, and SpotGamma data to forecast key trading zones. Let's break it down in a structured format for better clarity and decision-making:

🔴 Possible Sell Zone / Final Target

Zone: Around 571.17 SPY or 5750 ES

Label: "Possible Sell or Final Target Zone"

Confluence: Call Wall (+1) at 579, significant resistance

🧠 This is a key exhaustion point for long positions. Ideal area to take profit or consider shorts.

✅ Upside Targets (Long Bias)

Target # SPY Level ES Equivalent Notes

6 571.17 5750 ES Extreme resistance zone

5 570 5740 ES Above Call Wall

4 568 5720 ES Matches liquidity cluster

3 564.8 5685 ES Near RB Bottom

2 563.20 5670 ES Mid-range pullback

1 561.61 5650 ES Close to mid gamma

🧠 These levels can be used for trailing targets or re-entries on pullbacks.

🔻 Downside Targets (Short Bias)

Target # SPY Level ES Equivalent Notes

1 563.20 5670 ES First major support

2 561.61 5650 ES Mid gamma support

3 560 5635 ES Near Zero Gamma and Put Wall

🧠 Breaks below these can trigger accelerated downside moves.

📈 Key Zones

Green Zone (Buy Zone):

559–558 SPY — Strong Put Wall and bounce probability area.

Yellow Zone (Flip Zone):

Around 564.79 SPY — Possible area of reversal, watch for reactions here.

Red Zone (Sell Zone):

Above 570 SPY — Watch for overextension and reversal signs.

🔍 Technical Tools Used

Call/Put Walls: Indicate dealer hedging areas and potential price magnets.

Volume Profile: Highlights high-activity price zones.

SpotGamma Levels: Used to identify gamma flip zones, walls, and trigger areas.

🔁 Possible Scenarios

Bullish Path:

Bounce from 561–563 range → Reclaim 564.8 → Push towards 568, possibly 570+.

Bearish Path:

Rejection at 564.8 or 568 → Breakdown below 561 → Test Put Wall at 559.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。