We present you with our selection from the open-source indicators published this month on TradingView. These scripts are the ones that caught our attention while analyzing the two thousand or so scripts published each month in TradingView's Public Library, the greatest repository of indicators in the world. If we missed any, please let us know.

This superb body of work constitutes unmistakable proof of the liveliness, ingenuity, and relentless creativity of the generous traders/programmers who not only give their time to write amazing scripts, but share their code with the world. Kudos to these very special humans.

Enjoy!

Bias And Sentiment Strength (BASS) Indicator by mattzab

mattzab superimposes a few different signals to get a composite view of sentiment.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Volume Scale by Price (VSP)

inno14 gives us his take on volume by price using line drawings.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Price Convergence

nickbarcomb publishes a script that visually reveals the price discovery process, and if price is moving away or converging from equilibrium.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Market EKG

KingThies_ creates a measure of volatility using a close proximity evaluation of price deltas.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Zahorchak Measure

DreamsDefined gives us a an original measure of bias: The Zahorchak Measure (ZM) is designed to give you a market bias (either uptrend or downtrend) which you can use to determine a trade bias for ETF's or stocks.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Emulating binary operations and several values in one variable

MichelT publishes a multiplexing/demultiplexing method to pack more data in a signal to be used when one script needs to send information to another one through a single external input.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Mean Deviation Index

lejmer uses ATR and an EMA to derive an index combining volatility and mean deviation.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Laguerre RSI

KivancOzbilgic runs RSI through a Laguerre filter.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Relative Strength(RSMK) + Perks - Markos Katsanos

midtownsk8rguy gives us a version of Katsanos' Relative Strength, packaged with his usual tight code and impeccable visuals. It also contains his version of `ema()` accepting a float as its period.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Get a value from N years ago

MichelT comes up with another one of his ingenious pieces of code to find information from n years ago.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Divergence for many indicator v3

LonesomeTheBlue brings us a Swiss Army knife divergence detector capable of showing on the chart divergences detected on 10 different indicators.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

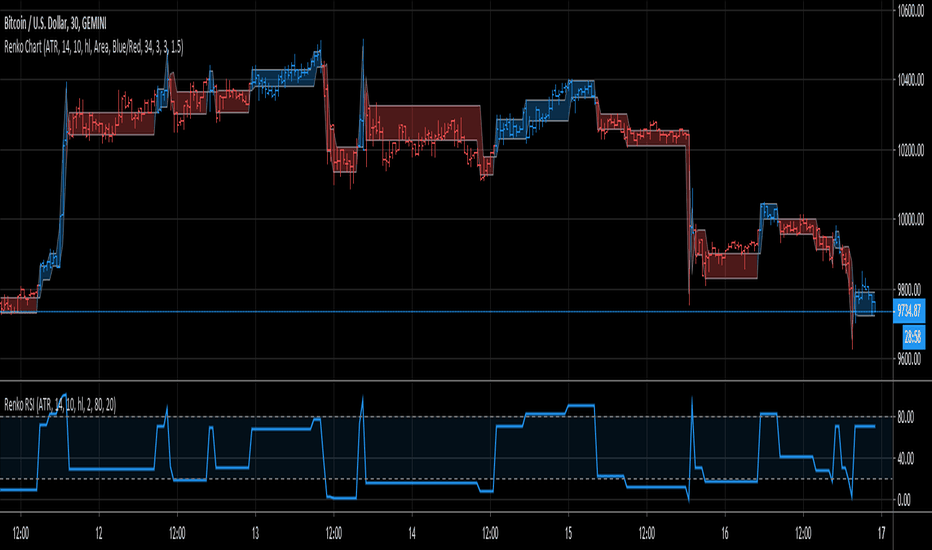

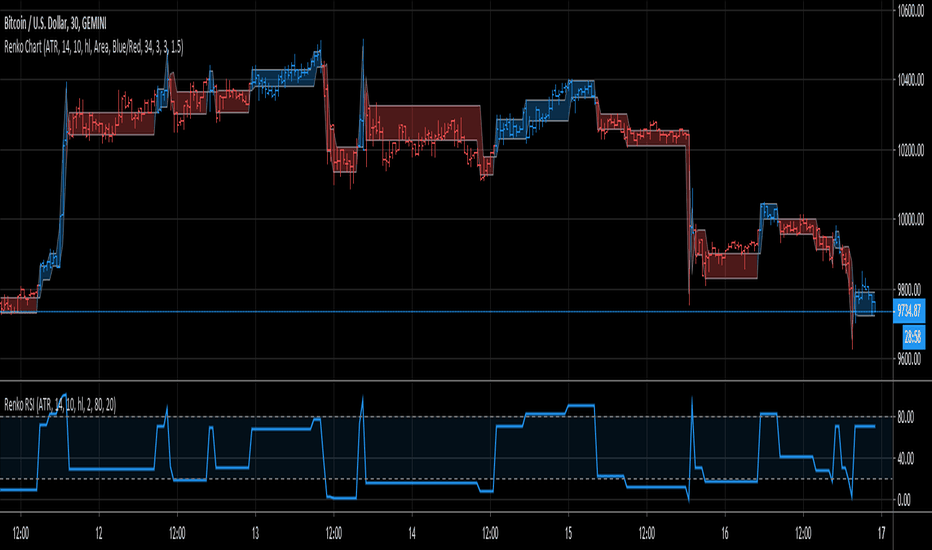

Renko RSI

LonesomeTheBlue also published a few scripts using Renko information but running on normal charts, including this Renko RSI.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

SMU STDEV Candles

stockmarketupdate comes up with a novel way to represent volatility by building candles on stdev of OHLC.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

[e2] Setup

e2e4mfck gives us a lesson in the masterly presentation of visual information with his Tom Demark Setup script. He also contributes a crazy-complex and beautifully crafted open-source script to the community.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Earnings, Splits, Dividends

MichelT shows the new syntax required to access selected financials in Pine, as opposed to using the Financials available on the chart.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

OBV Traffic Lights

lejmer calculates an OBV using Heikin Ashi prices (independently of the type of chart you are on) and presents the information in a more visually appealing way.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Reversal finder

NS91 makes an attempt to identify potential reversals, and contrary to authors of many such scripts, plots them in realtime without using a negative offset into the past.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Dekidaka-Ashi - Candles And Volume Teaming Up (Again)

alexgrover's mind is like a volcano in constant activity. This time he combines price and volume action into a new type of candle.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Linear Continuation

nickbarcomb shows projections into the future of 3 MAs.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

RSI direction bias - JD

Duyck, one of TradingView's most creative authors, creates an RSI bias indicator by focusing on its behavior in the center area rather than in extremes.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

This superb body of work constitutes unmistakable proof of the liveliness, ingenuity, and relentless creativity of the generous traders/programmers who not only give their time to write amazing scripts, but share their code with the world. Kudos to these very special humans.

Enjoy!

Bias And Sentiment Strength (BASS) Indicator by mattzab

mattzab superimposes a few different signals to get a composite view of sentiment.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Volume Scale by Price (VSP)

inno14 gives us his take on volume by price using line drawings.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Price Convergence

nickbarcomb publishes a script that visually reveals the price discovery process, and if price is moving away or converging from equilibrium.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Market EKG

KingThies_ creates a measure of volatility using a close proximity evaluation of price deltas.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Zahorchak Measure

DreamsDefined gives us a an original measure of bias: The Zahorchak Measure (ZM) is designed to give you a market bias (either uptrend or downtrend) which you can use to determine a trade bias for ETF's or stocks.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Emulating binary operations and several values in one variable

MichelT publishes a multiplexing/demultiplexing method to pack more data in a signal to be used when one script needs to send information to another one through a single external input.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Mean Deviation Index

lejmer uses ATR and an EMA to derive an index combining volatility and mean deviation.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Laguerre RSI

KivancOzbilgic runs RSI through a Laguerre filter.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Relative Strength(RSMK) + Perks - Markos Katsanos

midtownsk8rguy gives us a version of Katsanos' Relative Strength, packaged with his usual tight code and impeccable visuals. It also contains his version of `ema()` accepting a float as its period.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Get a value from N years ago

MichelT comes up with another one of his ingenious pieces of code to find information from n years ago.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Divergence for many indicator v3

LonesomeTheBlue brings us a Swiss Army knife divergence detector capable of showing on the chart divergences detected on 10 different indicators.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Renko RSI

LonesomeTheBlue also published a few scripts using Renko information but running on normal charts, including this Renko RSI.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

SMU STDEV Candles

stockmarketupdate comes up with a novel way to represent volatility by building candles on stdev of OHLC.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

[e2] Setup

e2e4mfck gives us a lesson in the masterly presentation of visual information with his Tom Demark Setup script. He also contributes a crazy-complex and beautifully crafted open-source script to the community.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Earnings, Splits, Dividends

MichelT shows the new syntax required to access selected financials in Pine, as opposed to using the Financials available on the chart.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

OBV Traffic Lights

lejmer calculates an OBV using Heikin Ashi prices (independently of the type of chart you are on) and presents the information in a more visually appealing way.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Reversal finder

NS91 makes an attempt to identify potential reversals, and contrary to authors of many such scripts, plots them in realtime without using a negative offset into the past.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Dekidaka-Ashi - Candles And Volume Teaming Up (Again)

alexgrover's mind is like a volcano in constant activity. This time he combines price and volume action into a new type of candle.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Linear Continuation

nickbarcomb shows projections into the future of 3 MAs.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

RSI direction bias - JD

Duyck, one of TradingView's most creative authors, creates an RSI bias indicator by focusing on its behavior in the center area rather than in extremes.

═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═•═

Who are PineCoders? tradingview.com/chart/SSP/yW5eOqtm-Who-are-PineCoders/

Tools and ideas for all Pine coders: pinecoders.com

Tools and ideas for all Pine coders: pinecoders.com

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Who are PineCoders? tradingview.com/chart/SSP/yW5eOqtm-Who-are-PineCoders/

Tools and ideas for all Pine coders: pinecoders.com

Tools and ideas for all Pine coders: pinecoders.com

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。