Tube Investments of India Ltd (TIINDIA) has been a notable player in the Indian engineering sector, with a diversified portfolio spanning automotive components, bicycles, metal-formed products, and precision steel tubes. As of April 2025, the stock has experienced significant volatility, prompting investors to closely examine its fundamentals and technical outlook.

📊 Fundamental Overview

Valuation Metrics:

Financial Performance:

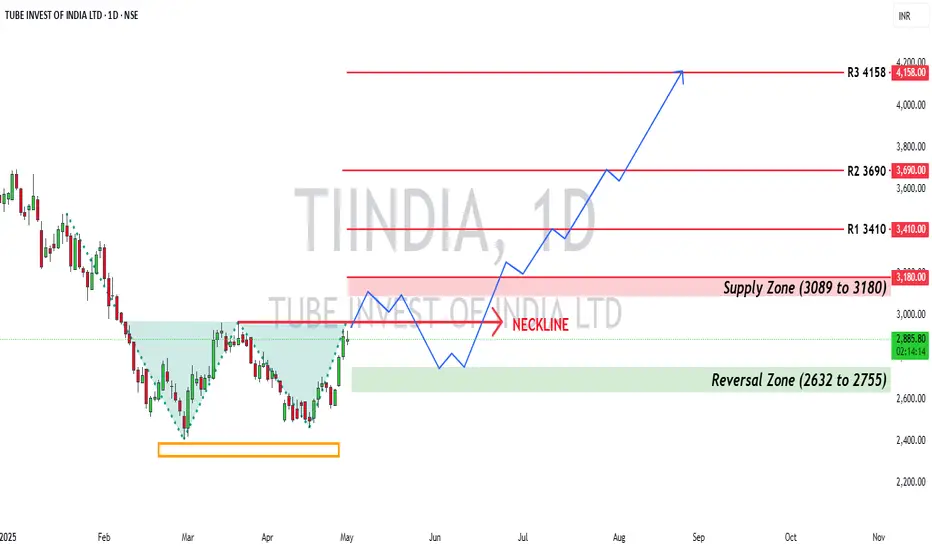

Tube Investments of India Ltd (NSE: TIINDIA) is exhibiting a classic double bottom pattern on the daily chart, signaling potential reversal strength. While fundamentals reflect a strong industrial play with high valuation multiples, the technical setup suggests a critical moment for traders to watch.

📉 Technical Analysis (Daily Timeframe)

Pattern: Double Bottom

Neckline Breakout Zone: ~₹2,967.50

🟨 Immediate Supply Zone: ₹3,089 – ₹3,180

🟩 Support Zone (Bottom Reversal Area): ₹2,632 – ₹2,755

🔺 Major Resistance Levels (Above Breakout):

📌 Conclusion

TIINDIA is at a make-or-break juncture on the charts. A decisive breakout above ₹3,180 could drive strong upside momentum toward ₹3,410 and beyond. However, traders should watch for a rejection near the supply zone and possible retest of the lower support band before a confirmed move.

📊 Fundamental Overview

Valuation Metrics:

- Price-to-Earnings (P/E) Ratio: Approximately 61.5, indicating a premium valuation compared to industry peers.

- Price-to-Book (P/B) Ratio: Around 9.4, suggesting the stock is trading at a high multiple of its book value.

- Earnings Per Share (EPS): ₹42.43, reflecting the company's profitability.

Financial Performance:

- Revenue (TTM): ₹182.5 billion.

- Net Income (TTM): ₹8.13 billion.

- Gross Margin: 31.38%.

- Net Profit Margin: 4.45%.

Tube Investments of India Ltd (NSE: TIINDIA) is exhibiting a classic double bottom pattern on the daily chart, signaling potential reversal strength. While fundamentals reflect a strong industrial play with high valuation multiples, the technical setup suggests a critical moment for traders to watch.

📉 Technical Analysis (Daily Timeframe)

Pattern: Double Bottom

Neckline Breakout Zone: ~₹2,967.50

- Current Structure: The stock has formed a double bottom and is now consolidating near the neckline, awaiting a decisive breakout.

🟨 Immediate Supply Zone: ₹3,089 – ₹3,180

- This zone is expected to act as a resistance barrier.

- A rejection from here is possible on the first test, especially if volume doesn’t confirm the breakout.

🟩 Support Zone (Bottom Reversal Area): ₹2,632 – ₹2,755

- If rejection occurs at the supply zone, this region may provide buy-on-dip opportunities.

- Historically respected as a strong demand zone.

🔺 Major Resistance Levels (Above Breakout):

- ₹3,410 (first major breakout target)

- ₹3,690 (medium-term resistance)

- ₹4,158 (long-term breakout target)

📌 Conclusion

TIINDIA is at a make-or-break juncture on the charts. A decisive breakout above ₹3,180 could drive strong upside momentum toward ₹3,410 and beyond. However, traders should watch for a rejection near the supply zone and possible retest of the lower support band before a confirmed move.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。