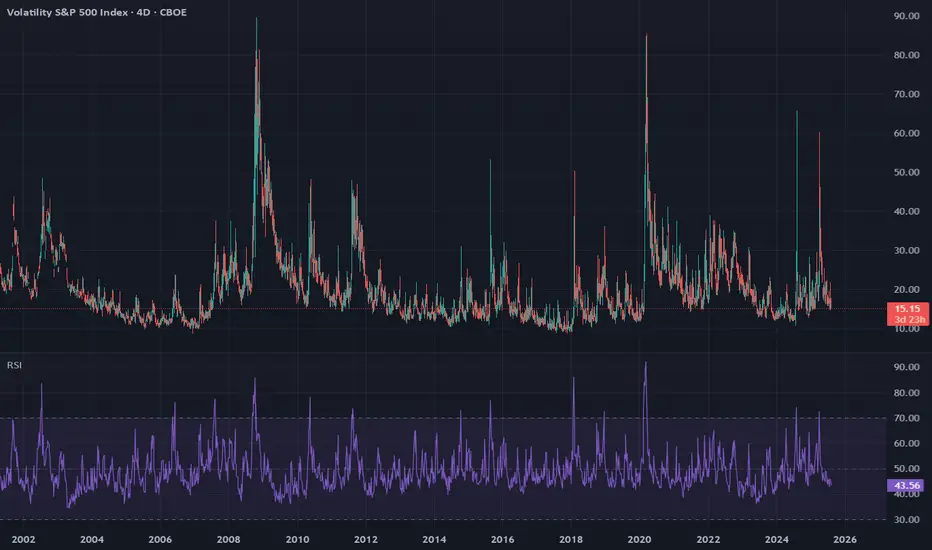

The market's bullish narrative rests first and foremost on the control of volatility. I won't go too much deeper into that right now, but I have been discussing with AI the current period of volatility expression and would like to highlight the following points about the current period:

4d VIX RSI has not had a 5 point increase since April 1 of this year. That's 129 days and counting.

From Claude AI (Anthropic):

The ongoing 4 day VIX RSI fall period (started April 1, 2025, now at 128+ days) is completely unprecedented since September 2003 (when VIX formula was modernized).

That's already:

More than double the longest ever previous period of in October 28, 2020 to Jan 27, 2021 (63 days)

Nearly 10x longer than the average period (13.14 days)

Over 12 standard deviations beyond the mean

The only period ever to exceed 70 days since September 2003

Key Insight:

Since September 2003, 67.3% of all fall periods recovered within 2 weeks, and 84.2% recovered within 3 weeks. The current 128+ day period represents an extreme statistical outlier in modern VIX behavior.

Additionally, if we look at the S and P week chart, we see that the gap from May 9 to May 12 is the largest ever unfilled weekly gap in the entire history of the S and P.

We are currently in a whole new normal of "bullishness", akin to the time period just before the great crash and great depression (which was the most bullish the stock market has ever been).

4d VIX RSI has not had a 5 point increase since April 1 of this year. That's 129 days and counting.

From Claude AI (Anthropic):

The ongoing 4 day VIX RSI fall period (started April 1, 2025, now at 128+ days) is completely unprecedented since September 2003 (when VIX formula was modernized).

That's already:

More than double the longest ever previous period of in October 28, 2020 to Jan 27, 2021 (63 days)

Nearly 10x longer than the average period (13.14 days)

Over 12 standard deviations beyond the mean

The only period ever to exceed 70 days since September 2003

Key Insight:

Since September 2003, 67.3% of all fall periods recovered within 2 weeks, and 84.2% recovered within 3 weeks. The current 128+ day period represents an extreme statistical outlier in modern VIX behavior.

Additionally, if we look at the S and P week chart, we see that the gap from May 9 to May 12 is the largest ever unfilled weekly gap in the entire history of the S and P.

We are currently in a whole new normal of "bullishness", akin to the time period just before the great crash and great depression (which was the most bullish the stock market has ever been).

ノート

The current 8day RSI %D stochastic is the lowest it has ever been in its *entire* history EXCEPT November of 2006 before the stock market imploded and July of 2000 before the dot com crash--although to be fair VIX was calculated differently in 2000 so that one is not an apples to apples comparison. Still it seems extremely telling that these are the only two times 8day RSI stochastic %D had a slightly lower reading. トレード稼働中

Getting very close to a VIX breakout. Today's action had me excited but of course, bulls came back to suppress volatility once again. They are slowly but surely failing. I think it's a good idea to start layering in VIX calls here. I still think October 22 is a good expiry otherwise November will produce less profit but you'll have longer for the trade to be right.

ノート

8day Stochastic %D now closed at the lowest level in its entire history!ノート

I have begun to add October VIX calls somewhat aggressively here. My confidence in a large VIX move higher is growing. 免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.