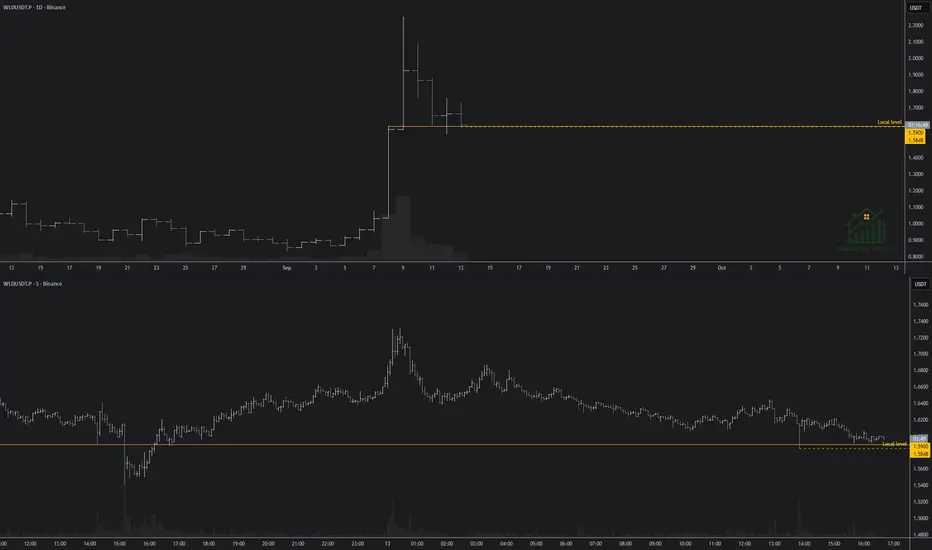

Additional consolidation is needed to make a decision about opening a trade. I am adjusting the level to 1.5848, considering the latest false breakout.

In case of increased volatility or another false breakout, I will remove the asset from the watchlist, as it will become choppy price action at the level.

Scenario:

- Price void / low liquidity zone beyond level

- Volatility contraction on approach

- Immediate retest

- No reaction after a false break

No reaction after a false break:

- Volatility contraction on approach

- Momentum stall at the level

- Repeated precise tests of the level ("sticking")

- Consolidation with price compression (squeeze)

- No reaction after a false break

ノート

The trade was very close to being triggered, but the price did not hit it. The asset has now moved away from the level, and consolidation is continuing. The local level has become even more relevant. I am setting an alert near the level.ノート

It is worth considering that the market is bullish and not favorable for short positions. However, if the asset shows good signals for a short, I will continue to observe it. The price has not yet moved far enough from the level to cancel the trade, so I will continue to wait.ノート

Sorry, I just noticed a mistake in the description... Instead of: "No reaction after a false break:" - it should be: "M5: Tactical entry".ノート

The asset is slowly approaching the level again. An alert has been set.ノート

The high-volatility approach did not fit the scenario, so the order was not placed. After the level test, instead of a correction, we saw a decrease in volatility and a gradual approach to the level. These were ideal conditions for a short entry, but the asset reversed, and the trade was not opened.

We may know where the asset is going, but few people know exactly when it will get there. Therefore, I continue to observe and stick to my plan.

注文をキャンセル

Two key situations are observed on the chart.

The first situation looked promising, but the price never reached the entry order, so the trade wasn't executed.

The second situation is unfavorable because the price approached the level from a distance. After the level was broken, there was no impulsive move, which indicates the asset's weakness and suggests that the level is being "chopped".

Trading facts, not expectations.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Trading facts, not expectations.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

関連の投稿

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。