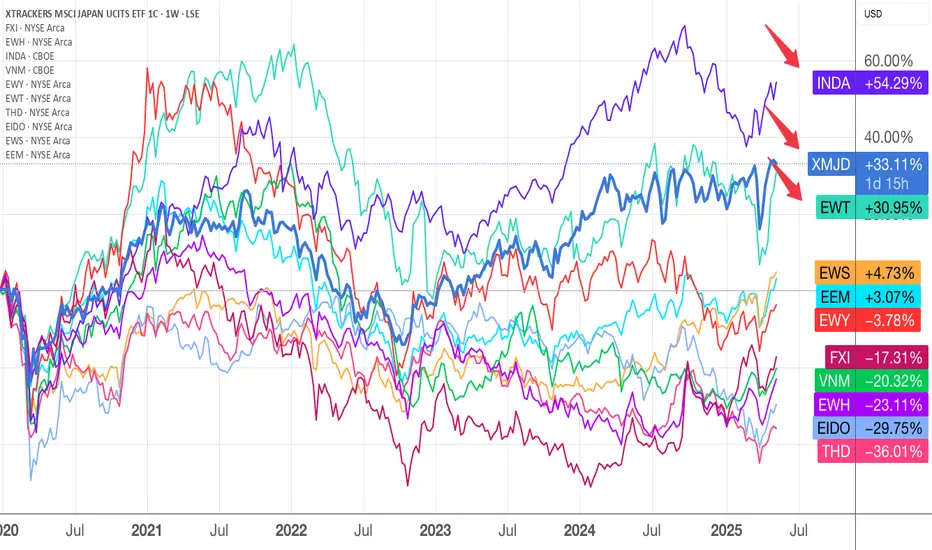

Asia is big and have many countries with different population size, economic growth, cycles and strong and weak sectors. A quick look at this chart reveals the top 3 countries ETF that you would have made better returns than the SPX would be the India, Japan and Taiwan ETFs.

Is that why WB is so keen to invest in the trading houses of Japan? Next to buying the same companies as WB (it would costs more for foreigners not having local access to Japan market)

the next best option is to buy an ETF. Do your homework, check the expense ratio, composition of companies, how the funds are invested, years of launch, funds size, etc.

As usual, please DYODD

Is that why WB is so keen to invest in the trading houses of Japan? Next to buying the same companies as WB (it would costs more for foreigners not having local access to Japan market)

the next best option is to buy an ETF. Do your homework, check the expense ratio, composition of companies, how the funds are invested, years of launch, funds size, etc.

As usual, please DYODD

ノート

compare your notes from 2 months ago, how is your portfolio performance ?免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

免責事項

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.