OPEN-SOURCE SCRIPT

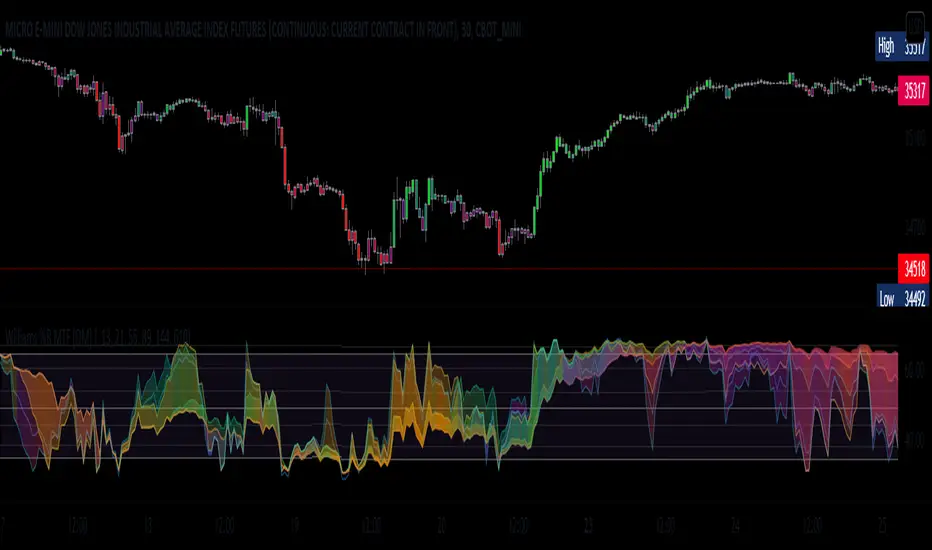

更新済 William %R MTF [DM]

Greeting Colleagues

Today I share The Wlliams %R

Extras=

- 5 diferent length

- 1 extra signal with the technique used in the ultimate oscillator

- Fibo Leves based on ob os leves "width it's automatic"

- Colored bars bassed en average strength

- The indicator that is modified now has the same range as the ultimate oscillator.

Enjoy [;-)

//The Williams %R (%R) indicator was created by famed commodities trader and author Larry Williams.

//

//Calculation

//%R = (CurrentClose - Highest High) / (Highest High - Lowest Low) x -100

//

//Highest High = Highest High for the user defined look-back period.

//Lowest Low = Lowest Low for the user defined look-back period.

//

//The basics

//As previously mentioned, the %R is used to measure momentum. %R oscillates

//within a fixed range between the values of 0 and -100. Williams himself set the

//parameters of overbought as any reading between 0 and -20. His oversold

//parameters were readings between -80 and -100. It is important to note that these

//values are traditional examples. It may be beneficial for the technical analyst

//to set different parameters based on the specific instrument being analyzed. Wider

//or narrower overbought and oversold levels may be appropriate based on historical analysis.

//

//What to look for

//There are two major conditions identified by using the %R indicator.

//The first is standard overbought and oversold conditions. The second is momentum

//changes characterized by momentum failures.

//

//Overbought/Oversold

//Overbought and Oversold conditions are a very common signal generated by momentum oscillators.

//The %R indicator is no different.

Today I share The Wlliams %R

Extras=

- 5 diferent length

- 1 extra signal with the technique used in the ultimate oscillator

- Fibo Leves based on ob os leves "width it's automatic"

- Colored bars bassed en average strength

- The indicator that is modified now has the same range as the ultimate oscillator.

Enjoy [;-)

//The Williams %R (%R) indicator was created by famed commodities trader and author Larry Williams.

//

//Calculation

//%R = (CurrentClose - Highest High) / (Highest High - Lowest Low) x -100

//

//Highest High = Highest High for the user defined look-back period.

//Lowest Low = Lowest Low for the user defined look-back period.

//

//The basics

//As previously mentioned, the %R is used to measure momentum. %R oscillates

//within a fixed range between the values of 0 and -100. Williams himself set the

//parameters of overbought as any reading between 0 and -20. His oversold

//parameters were readings between -80 and -100. It is important to note that these

//values are traditional examples. It may be beneficial for the technical analyst

//to set different parameters based on the specific instrument being analyzed. Wider

//or narrower overbought and oversold levels may be appropriate based on historical analysis.

//

//What to look for

//There are two major conditions identified by using the %R indicator.

//The first is standard overbought and oversold conditions. The second is momentum

//changes characterized by momentum failures.

//

//Overbought/Oversold

//Overbought and Oversold conditions are a very common signal generated by momentum oscillators.

//The %R indicator is no different.

リリースノート

Minor changesリリースノート

Added butterfly color rules to plotsAdded switch to hide parcels

リリースノート

Minor changesリリースノート

Added black background for use in the white chartsオープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。