OPEN-SOURCE SCRIPT

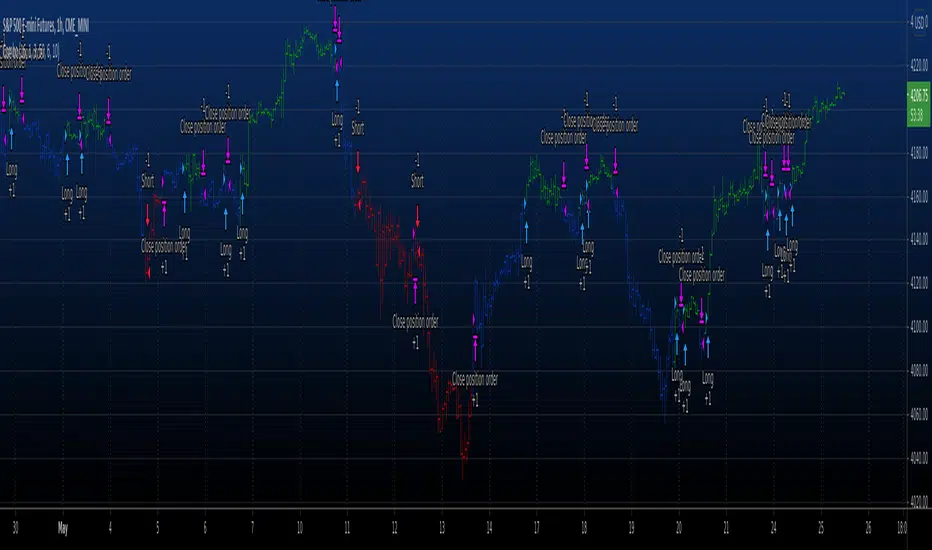

Combo Backtest 123 Reversal & Rainbow Oscillator

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Ever since the people concluded that stock market price movements are not

random or chaotic, but follow specific trends that can be forecasted, they

tried to develop different tools or procedures that could help them identify

those trends. And one of those financial indicators is the Rainbow Oscillator

Indicator. The Rainbow Oscillator Indicator is relatively new, originally

introduced in 1997, and it is used to forecast the changes of trend direction.

As market prices go up and down, the oscillator appears as a direction of the

trend, but also as the safety of the market and the depth of that trend. As

the rainbow grows in width, the current trend gives signs of continuity, and

if the value of the oscillator goes beyond 80, the market becomes more and more

unstable, being prone to a sudden reversal. When prices move towards the rainbow

and the oscillator becomes more and more flat, the market tends to remain more

stable and the bandwidth decreases. Still, if the oscillator value goes below 20,

the market is again, prone to sudden reversals. The safest bandwidth value where

the market is stable is between 20 and 80, in the Rainbow Oscillator indicator value.

The depth a certain price has on a chart and into the rainbow can be used to judge

the strength of the move.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Ever since the people concluded that stock market price movements are not

random or chaotic, but follow specific trends that can be forecasted, they

tried to develop different tools or procedures that could help them identify

those trends. And one of those financial indicators is the Rainbow Oscillator

Indicator. The Rainbow Oscillator Indicator is relatively new, originally

introduced in 1997, and it is used to forecast the changes of trend direction.

As market prices go up and down, the oscillator appears as a direction of the

trend, but also as the safety of the market and the depth of that trend. As

the rainbow grows in width, the current trend gives signs of continuity, and

if the value of the oscillator goes beyond 80, the market becomes more and more

unstable, being prone to a sudden reversal. When prices move towards the rainbow

and the oscillator becomes more and more flat, the market tends to remain more

stable and the bandwidth decreases. Still, if the oscillator value goes below 20,

the market is again, prone to sudden reversals. The safest bandwidth value where

the market is stable is between 20 and 80, in the Rainbow Oscillator indicator value.

The depth a certain price has on a chart and into the rainbow can be used to judge

the strength of the move.

WARNING:

- For purpose educate only

- This script to change bars colors.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。