INVITE-ONLY SCRIPT

更新済 Excalibur Trading System [Dare]

✦ INTRODUCTION

The core goal in the Excalibur Trading System is attaining an optimal entry - fading the masses, selling others' buys, buying others' sells, and trading along true tops and bottoms where price manipulation commonly occurs. Executions are most successful intraday and when aligned with HTF price action while still maintaining a systematic approach in analysis and risk management. Use of this tool is not recommended for the uninitiated trader; it takes intense focus, dedicated practice, and unwavering confidence to wield this successfully. Please go through the guide I’ve provided which contains comprehensive coverage of all the elements below which, in the context of this post, are meant to depict a general idea of what the indicator is meant to accomplish.

✦ INDICATOR DETAILS

✦ SYSTEM OVERVIEW

Type of System

This is a mechanical system which requires zero discretion. While trading with an objective approach offers several advantages, it's important to note that it is not foolproof. Market conditions can change, and indicators can provide false signals. The accuracy is not 100% and even following it perfectly, as with any strategy, one will incur losses.

Performance in Various Market Conditions

Excalibur is meant to catch reversals and second-stage continuations, but trending days should be avoided. It has been tested and used in live market conditions in Index Futures, during the regular NY Session, on the 1m Timeframe, targeting ≥2.5RR Ratio. Outcomes will vary by trader due to factors such as risk tolerance, entry opportunities taken, human error and psychological barriers. Historical performance is not a guarantee of future results.

✦ SYSTEM COMPONENTS

Setup Schematic

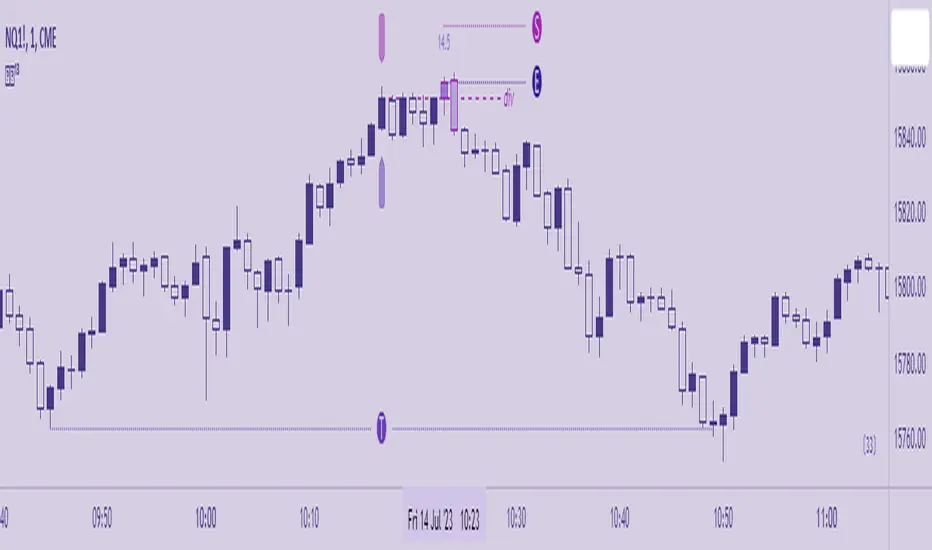

The premise for all setups is the same. We are identifying manipulation above a previous high (bearish) or below a previous low (bullish) in anticipation of a reversal. This indicator is meant to be used as a measuring tool to quantify that manipulation taking place using Hi's and Lo's as identified by the Bar, which is based on a standard deviation calculation. The Fu tag is meant to be used to find Divergence at custom pivots, not predetermined lookback periods - this is similar to SMT - Smart Money Technique, but this Divergence references bodies vs. wicks and the execution of the trade is at the extreme pivot vs. the weak pivot.

Using the Bar as a guide, the trader will set the Hi/Lo tags and the indicator will automatically calculate the Threshold, the point beyond which one’s Entry resides when Divergence is also present. A valid entry plots as a Polaris star below (bullish) and above (bearish) the current bar in their respective scenarios.

Bullish Setup

(1) Place the Lo tag at the current threshold as signified by the Bar.

(2) Search for Divergence with price action below that threshold by using the Fu tag at extreme bodies of recent swing lows.

(3) Wait for a bullish Entry to plot, confirmed at candle close.

Bearish Setup

(1) Place the Hi tag at the current threshold as signified by the Bar.

(2) Search for Divergence with price action above that threshold by using the Fu tag at extreme bodies of recent swing highs.

(3) Wait for a bearish Entry to plot, confirmed at candle close.

The indicator collects the OHLC values of the target asset candles based on the trader’s Hi/Lo placement, compares them to up to two assets, and plots an entry depending on the context of the setup. The entry method, like the setup composition, is based on minute Divergences in price between the assets and other criteria related to how the candles close relative to each other.

✦ INDICATOR SETTINGS

Options

Time

By default, the times for Hi, Lo and Fu are set to 09:00, 09:30 and 09:15 respectively. The date will need to be manually adjusted at the beginning of each trading day.

Price

By default, the charted Asset is assumed to be ES1! (E-Mini S&P 500 Continuous Contract). If the trader would like to chart a different Asset, be sure to adjust Assets I and II to valid comparisons so that the indicator can accurately detect price divergences.

Risk

Input the account size and percentage one intends to risk. To pyramid, indicate the quantity the position to be divided into. In MT4 or 5, right-click a symbol then Specification. The Contract Size field contains the Units per Lot. Use the various options to customize the table format and visibility.

The tooltips (i) will be available in the UI in case the trader will ever need to refer to them for the information above.

✦ PLOTTING INTERPRETATION

Matrix Tags

Guided by the manipulation bar, the trader will use Hi and Lo tags to measure the manipulation threshold. The Fu tag measures either bullish or bearish divergences depending on the placement of the Hi/Lo tags.

Manipulation Bar

The squares plotted together form a bar and indicate whether a candle is or isn’t plotting a new manipulation threshold (creating a new Hi or Lo). The trader should always use the current Hi or Lo.

Advisor Arrows

The arrows are meant to signify a possible valid entry in the temporary period of time between the candle open and close. They give advance notice that the trader should be looking for divergences using the Fu tag to attain a confirmed entry (Polaris) on that particular candle as it is forming.

Entry Signal

The Polaris denotes a time and price of trade execution. As long as the Matrix tags are placed correctly, this is a valid signal to place a position in the direction indicated. Entry price is at the candle close, regardless of the next candle’s open price.

Risk Labels and Table

This is an automatic calculation for Stop placement based on average true range (valid only for indices with a 0.25pt tick value. A future version may allow for customization of this feature for assets not based on ticks, like forex pairs). The table (by default at the bottom right) will display the trader's position size based on the inputs.

Divergence Candles

Using the Fu tag, the trader can select swing highs and lows to determine if divergence is occurring above and below them, respectively. Divergence is maintained as long as the colored candles are printed consecutively. Referring to the charts of Assets I and II in a separate layout window is recommended but not required.

✦ POSTSCRIPT

I forged this sword, Excalibur, in pursuit of my highest aspiration - to create a legacy and provide a gift to my friends, family, and all those burdened by obligations that limit them from living what they would consider to be a fulfilling life. Those free to pursue the ambitions they truly value are the ones who change their communities and even the world for the better.

~Dare.

The core goal in the Excalibur Trading System is attaining an optimal entry - fading the masses, selling others' buys, buying others' sells, and trading along true tops and bottoms where price manipulation commonly occurs. Executions are most successful intraday and when aligned with HTF price action while still maintaining a systematic approach in analysis and risk management. Use of this tool is not recommended for the uninitiated trader; it takes intense focus, dedicated practice, and unwavering confidence to wield this successfully. Please go through the guide I’ve provided which contains comprehensive coverage of all the elements below which, in the context of this post, are meant to depict a general idea of what the indicator is meant to accomplish.

✦ INDICATOR DETAILS

- System Overview

- System Components

- Indicator Settings

- Plotting Interpretation

- Postscript

✦ SYSTEM OVERVIEW

Type of System

This is a mechanical system which requires zero discretion. While trading with an objective approach offers several advantages, it's important to note that it is not foolproof. Market conditions can change, and indicators can provide false signals. The accuracy is not 100% and even following it perfectly, as with any strategy, one will incur losses.

- Objective Decision-making - No emotional bias, no fear.

- Consistent - A repeatable approach that eliminates impulsivity.

- Easily tested - Strategy performance can be measured universally no matter who is using it, in both forward and backtesting.

- No Guesswork - Provides specific entry and exit signals with a systematic procedure.

- Predefined Rules - Controls risk and enforces discipline.

- Simple and Clear - Reduces complexity and confusion.

Performance in Various Market Conditions

Excalibur is meant to catch reversals and second-stage continuations, but trending days should be avoided. It has been tested and used in live market conditions in Index Futures, during the regular NY Session, on the 1m Timeframe, targeting ≥2.5RR Ratio. Outcomes will vary by trader due to factors such as risk tolerance, entry opportunities taken, human error and psychological barriers. Historical performance is not a guarantee of future results.

✦ SYSTEM COMPONENTS

Setup Schematic

The premise for all setups is the same. We are identifying manipulation above a previous high (bearish) or below a previous low (bullish) in anticipation of a reversal. This indicator is meant to be used as a measuring tool to quantify that manipulation taking place using Hi's and Lo's as identified by the Bar, which is based on a standard deviation calculation. The Fu tag is meant to be used to find Divergence at custom pivots, not predetermined lookback periods - this is similar to SMT - Smart Money Technique, but this Divergence references bodies vs. wicks and the execution of the trade is at the extreme pivot vs. the weak pivot.

Using the Bar as a guide, the trader will set the Hi/Lo tags and the indicator will automatically calculate the Threshold, the point beyond which one’s Entry resides when Divergence is also present. A valid entry plots as a Polaris star below (bullish) and above (bearish) the current bar in their respective scenarios.

Bullish Setup

(1) Place the Lo tag at the current threshold as signified by the Bar.

(2) Search for Divergence with price action below that threshold by using the Fu tag at extreme bodies of recent swing lows.

(3) Wait for a bullish Entry to plot, confirmed at candle close.

Bearish Setup

(1) Place the Hi tag at the current threshold as signified by the Bar.

(2) Search for Divergence with price action above that threshold by using the Fu tag at extreme bodies of recent swing highs.

(3) Wait for a bearish Entry to plot, confirmed at candle close.

The indicator collects the OHLC values of the target asset candles based on the trader’s Hi/Lo placement, compares them to up to two assets, and plots an entry depending on the context of the setup. The entry method, like the setup composition, is based on minute Divergences in price between the assets and other criteria related to how the candles close relative to each other.

✦ INDICATOR SETTINGS

Options

- This line controls the colors of the Polaris (✦) and the squares in the Manipulation Bar. Manipulation can be measured using either mathematical calculation (ᴀʟᴘʜᴀ) or OHLC data-points (ʙᴇᴛᴀ). The Polaris denotes a time and price of possible reversal at an extreme low or high - deselect this line to hide it.

- ⋆ This line controls colors of the Tags and Candles - Bullish, Bearish, and All. To customize, switch to ᴄᴜsᴛᴏᴍ. If the Divergence Candles are not consistently visible, change the Visual Order to Front on the chart by selecting the indicator Title then More. To hide, deselect this line.'

- The third and fourth lines controls the visibility of the Manipulation Bar, Matrix Tags, Advisor Arrows and Invalidation Labels.

Time

By default, the times for Hi, Lo and Fu are set to 09:00, 09:30 and 09:15 respectively. The date will need to be manually adjusted at the beginning of each trading day.

Price

By default, the charted Asset is assumed to be ES1! (E-Mini S&P 500 Continuous Contract). If the trader would like to chart a different Asset, be sure to adjust Assets I and II to valid comparisons so that the indicator can accurately detect price divergences.

Risk

Input the account size and percentage one intends to risk. To pyramid, indicate the quantity the position to be divided into. In MT4 or 5, right-click a symbol then Specification. The Contract Size field contains the Units per Lot. Use the various options to customize the table format and visibility.

The tooltips (i) will be available in the UI in case the trader will ever need to refer to them for the information above.

✦ PLOTTING INTERPRETATION

Matrix Tags

Guided by the manipulation bar, the trader will use Hi and Lo tags to measure the manipulation threshold. The Fu tag measures either bullish or bearish divergences depending on the placement of the Hi/Lo tags.

Manipulation Bar

The squares plotted together form a bar and indicate whether a candle is or isn’t plotting a new manipulation threshold (creating a new Hi or Lo). The trader should always use the current Hi or Lo.

Advisor Arrows

The arrows are meant to signify a possible valid entry in the temporary period of time between the candle open and close. They give advance notice that the trader should be looking for divergences using the Fu tag to attain a confirmed entry (Polaris) on that particular candle as it is forming.

Entry Signal

The Polaris denotes a time and price of trade execution. As long as the Matrix tags are placed correctly, this is a valid signal to place a position in the direction indicated. Entry price is at the candle close, regardless of the next candle’s open price.

Risk Labels and Table

This is an automatic calculation for Stop placement based on average true range (valid only for indices with a 0.25pt tick value. A future version may allow for customization of this feature for assets not based on ticks, like forex pairs). The table (by default at the bottom right) will display the trader's position size based on the inputs.

Divergence Candles

Using the Fu tag, the trader can select swing highs and lows to determine if divergence is occurring above and below them, respectively. Divergence is maintained as long as the colored candles are printed consecutively. Referring to the charts of Assets I and II in a separate layout window is recommended but not required.

✦ POSTSCRIPT

I forged this sword, Excalibur, in pursuit of my highest aspiration - to create a legacy and provide a gift to my friends, family, and all those burdened by obligations that limit them from living what they would consider to be a fulfilling life. Those free to pursue the ambitions they truly value are the ones who change their communities and even the world for the better.

~Dare.

リリースノート

Automated Manipulation Threshold - Trader will never have to adjust Hi/Lo tags or track the current threshold ever again. As long as the Divergence Tool is detecting continuous divergence, the indicated entry is valid.Beta Mode - This mode allows the trader to see entries without a Divergence requirement. This is a huge leap forward because not only can the trader backtest faster, but it allows the freedom to test other criteria of their choosing:

- Eg.1: There is OBV Divergence with Polaris but no SMT.

- Eg.2: There is a HTF FVG with Polaris but no SMT.

These are just examples - I encourage traders to be creative and test for themselves!

Custom Risk Table Size Fix - Fixed the bug; the trader can now customize the size.

Position Size Fix - The trader can now increment by tenths in the Percent input.

リリースノート

Hotfix - Added a better chart representation for educational purposes. リリースノート

Automated Manipulation Threshold Reversion - The Bar is back! Automatically updating the threshold introduced some unforeseen limitations. To customize your HTF points of interest and configure for long and short frameworks, align Hi/Lo tags accordingly.Updated Beta Mode - To allow freedom in backtesting, raw entries are printed with no criteria. Since label plots have a limited lookback, I've added the Invalidation Value of a current bar in the Risk Table. Use of Beta mode in live conditions is not recommended.

Adjusted Display Options - Show/hide functions have been removed from the indicator Input tab. You can find all the plotting options in the Style tab.

Other fixes from the previous revision (risk float, table size, etc.) remain.

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、daredeviltradesに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Connect with me by the means of your choosing here (https://bio.site/daredevil).

Refer to my educational content for detailed explanations on how to use Excalibur successfully. Trade responsibly. Trade with an edge. Trade with no fear.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、daredeviltradesに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Connect with me by the means of your choosing here (https://bio.site/daredevil).

Refer to my educational content for detailed explanations on how to use Excalibur successfully. Trade responsibly. Trade with an edge. Trade with no fear.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。