INVITE-ONLY SCRIPT

ZigZag OrderBlock Retracement

アップデート済

█ INTRODUCTION

What is an OrderBlock? It is simply Price where Banks (or Large Financial Entities) have Bought or Sold heavily (Support or Resistance Institutional Zone).

Our job as a trader is to monitor what the Banks and/or Large Investors are doing then patiently wait and have the opportunity to surf in their direction.

Large Financial Entities Buy during Price drops to get the best purchase Price. The Bank are acting a bit like us in our everyday life,

When we want Buying something, we always try to Buy it at the best price. And when we Sell, take the example of a used Car, we will systematically

try to Sell it at the highest possible Price. The Price of convertible Cars goes down during the Winter and goes up during the Summer.

So to make the best operation, if you Buy a second-hand convertible you will prefer to Buy it during the Winter and Sell it immediately in the Summer

and not Vice versa. So the way Large Institution act is exactly the same, it will expect the Price to Buy the fall and they will wait until

the Price rises in order to Sell. This is how the Profits will be made. The mistake that many Traders makes when they Trade emotionally is to act

in the opposite way of what they will do in everyday life. When we trade emotionally, we see the Price fall, instead of Buying while the Price drops we Sell.

In a similar emotional based act when the Price goes up we Buy, while when the Price goes up it's the best opportunity to Sell. So all the big moves

that you can watch on your different Instruments are the result of Banks or other Large Financial Entities. As Individuals, we do not have the necessary

“Strike Force” to create this type of movement. However, it is important to note that when Banks or Large Entities create this type of movement,

they do so despite theirs willing, they would love to be able to hide but luckily for us they can’t. When Billions of Dollars are Invested in Trades,

the effect can’t be concealed and as a result we will observe the impact on the market then as an Individual we’ll be able to see that on our Charts.

There are many ways to locate these areas of interest. But as they say, all roads lead to Rome. The purpose remains the Price Study

and in particular the movements of strong amplitude on the Chart. Large Financial Entities will keep acting in the same Price areas, Or at least we can say

that there's a high probability for them to intervene in these zones. Therefore, rather than chasing the Price moves and then to endure a counter move,

we will patiently wait until the Price returns to these areas on the basis that Banks and, or Large Entities will accumulate on their Positions

and are going to Sell and Buy in the same Price areas. Keep in mind that this logic works no matter what TimeFrame is used. However when the have Analysis

on Small TimeFrame (between M15 and H1) will make the movements observed between 20 and 50 Pips. Whereas if we look at H4 or Daily,

we can really see movements of 100 or even 200 Pips.

█ OVERVIEW

The ZigZag Indicator is used to illustrate Trend Lines without taking into account intermediate Retracements.

In a way, it allows you to get to the point by giving a simplified view of the evolution of Prices by eliminating "parasitic" movements, and thus to Position

and unwind Positions at the appropriate times. It is part of the category of Trend Indicators. We will simply define a Level of Price variation below which

they will not be taken into account by the indicator. This will eliminate all minor fluctuations, depending on the desired sensitivity.

The Indicator can only have 2 directions, Up or Down. For example, setting the Indicator to 5% (ZigZag Length ) will eliminate all variations below 5%.

If the Trend is Bullish and the Indicator therefore oriented in the same direction, Prices will have to fall by at least 5% for the direction

of the ZigZag to reverse Downward. Why using ZigZag to search for our OrderBlock? ZigZag makes it possible to clearly identify the current Trend as well

as significant Reversals and therefore have a much clearer vision of the actions carried out by Banks / Large Entities. However, it is drawn up

a posteriori and therefore does not make it possible to predict the evolution of Prices. The turning points are Indicated with a delay proportional

to the chosen sensitivity. The indicator calculates the Lowest Price over the given Period and eliminates Prices that are below the minimum requested

Array Size. Then, it calculates the Highest Price over the given Period and eliminates the Prices that are below the minimum requested Array Size.

Finally, it draws the Trend Line that connects the High and Low points determined previously and use the sum of the two to determinate the Range area.

█ HOW TO INTERPRET?

• The Indicator creates Lines that demonstrate past Retracements and current Pivots Levels to get a clearer view of the next Retracement area

using the Lines from the Last High and Low Pivots to determine which Take-Profit or Stop-Loss set.

• The "OrderBlocks" are detected based on the Pivots founds. You can display the Prices and use theses to help you set your Take-Profit during Retracement.

• Possibility to display the Levels of detected Pivots point. This can permit to dispense with the use of Elliot Waves or the use of a Fibonacci.

• Donchian ZigZag Channels to be sure to always have seen the extremities of the Top, Bottom and Range area.

• The ZigZag Length is set to 5 by default. You will have to adjust it according to selected TimeFrame or Financial Instrument used.

• The ZigZag has 3 adjustable colors:

-Green = Bullish Trend

-Red = Bearish Trend

-Orange = Range Zone

[I]It is not advisable to enter Position when the ZigZag color indicates a Range Zone.[/I]

-OrderBlocks

-ZigZag + Pivots Point

-Donchian ZigZag Channel

█ ALERTS

Following the request of many users on our other script concerning the late arrival of Alerts for detected OrderBlocks (on Institutional OrderBlock Pressure), we fixed this problem here with the arrival INSTAN and CONFIRM ALERTS.

█ NOTES

-This script is not beginner's Level and is intended for Traders with advanced knowledge of ZigZag and the work of Michael j. Huddleston on the OrderBlocks.[/I]

Good Trade everyone and remember, risk management remains the most important!

What is an OrderBlock? It is simply Price where Banks (or Large Financial Entities) have Bought or Sold heavily (Support or Resistance Institutional Zone).

Our job as a trader is to monitor what the Banks and/or Large Investors are doing then patiently wait and have the opportunity to surf in their direction.

Large Financial Entities Buy during Price drops to get the best purchase Price. The Bank are acting a bit like us in our everyday life,

When we want Buying something, we always try to Buy it at the best price. And when we Sell, take the example of a used Car, we will systematically

try to Sell it at the highest possible Price. The Price of convertible Cars goes down during the Winter and goes up during the Summer.

So to make the best operation, if you Buy a second-hand convertible you will prefer to Buy it during the Winter and Sell it immediately in the Summer

and not Vice versa. So the way Large Institution act is exactly the same, it will expect the Price to Buy the fall and they will wait until

the Price rises in order to Sell. This is how the Profits will be made. The mistake that many Traders makes when they Trade emotionally is to act

in the opposite way of what they will do in everyday life. When we trade emotionally, we see the Price fall, instead of Buying while the Price drops we Sell.

In a similar emotional based act when the Price goes up we Buy, while when the Price goes up it's the best opportunity to Sell. So all the big moves

that you can watch on your different Instruments are the result of Banks or other Large Financial Entities. As Individuals, we do not have the necessary

“Strike Force” to create this type of movement. However, it is important to note that when Banks or Large Entities create this type of movement,

they do so despite theirs willing, they would love to be able to hide but luckily for us they can’t. When Billions of Dollars are Invested in Trades,

the effect can’t be concealed and as a result we will observe the impact on the market then as an Individual we’ll be able to see that on our Charts.

There are many ways to locate these areas of interest. But as they say, all roads lead to Rome. The purpose remains the Price Study

and in particular the movements of strong amplitude on the Chart. Large Financial Entities will keep acting in the same Price areas, Or at least we can say

that there's a high probability for them to intervene in these zones. Therefore, rather than chasing the Price moves and then to endure a counter move,

we will patiently wait until the Price returns to these areas on the basis that Banks and, or Large Entities will accumulate on their Positions

and are going to Sell and Buy in the same Price areas. Keep in mind that this logic works no matter what TimeFrame is used. However when the have Analysis

on Small TimeFrame (between M15 and H1) will make the movements observed between 20 and 50 Pips. Whereas if we look at H4 or Daily,

we can really see movements of 100 or even 200 Pips.

█ OVERVIEW

The ZigZag Indicator is used to illustrate Trend Lines without taking into account intermediate Retracements.

In a way, it allows you to get to the point by giving a simplified view of the evolution of Prices by eliminating "parasitic" movements, and thus to Position

and unwind Positions at the appropriate times. It is part of the category of Trend Indicators. We will simply define a Level of Price variation below which

they will not be taken into account by the indicator. This will eliminate all minor fluctuations, depending on the desired sensitivity.

The Indicator can only have 2 directions, Up or Down. For example, setting the Indicator to 5% (ZigZag Length ) will eliminate all variations below 5%.

If the Trend is Bullish and the Indicator therefore oriented in the same direction, Prices will have to fall by at least 5% for the direction

of the ZigZag to reverse Downward. Why using ZigZag to search for our OrderBlock? ZigZag makes it possible to clearly identify the current Trend as well

as significant Reversals and therefore have a much clearer vision of the actions carried out by Banks / Large Entities. However, it is drawn up

a posteriori and therefore does not make it possible to predict the evolution of Prices. The turning points are Indicated with a delay proportional

to the chosen sensitivity. The indicator calculates the Lowest Price over the given Period and eliminates Prices that are below the minimum requested

Array Size. Then, it calculates the Highest Price over the given Period and eliminates the Prices that are below the minimum requested Array Size.

Finally, it draws the Trend Line that connects the High and Low points determined previously and use the sum of the two to determinate the Range area.

█ HOW TO INTERPRET?

• The Indicator creates Lines that demonstrate past Retracements and current Pivots Levels to get a clearer view of the next Retracement area

using the Lines from the Last High and Low Pivots to determine which Take-Profit or Stop-Loss set.

• The "OrderBlocks" are detected based on the Pivots founds. You can display the Prices and use theses to help you set your Take-Profit during Retracement.

• Possibility to display the Levels of detected Pivots point. This can permit to dispense with the use of Elliot Waves or the use of a Fibonacci.

• Donchian ZigZag Channels to be sure to always have seen the extremities of the Top, Bottom and Range area.

• The ZigZag Length is set to 5 by default. You will have to adjust it according to selected TimeFrame or Financial Instrument used.

• The ZigZag has 3 adjustable colors:

-Green = Bullish Trend

-Red = Bearish Trend

-Orange = Range Zone

[I]It is not advisable to enter Position when the ZigZag color indicates a Range Zone.[/I]

-OrderBlocks

-ZigZag + Pivots Point

-Donchian ZigZag Channel

█ ALERTS

Following the request of many users on our other script concerning the late arrival of Alerts for detected OrderBlocks (on Institutional OrderBlock Pressure), we fixed this problem here with the arrival INSTAN and CONFIRM ALERTS.

█ NOTES

-This script is not beginner's Level and is intended for Traders with advanced knowledge of ZigZag and the work of Michael j. Huddleston on the OrderBlocks.[/I]

Good Trade everyone and remember, risk management remains the most important!

リリースノート

-Code cleaning.リリースノート

-Code cleaning.リリースノート

-Bug fix (Lines are now created according to detected OrderBlocks and not to Pivots points.)-Improved ZigZag Calculation.

-Added Percentage Change (The higher the value, the greater the difference between the detected OBs.)

-Added Linear Regression Filter (Uses linear regression to filter out OBs. The volumes must be available on the financial instrument used.)

-Added the ability to choose the transparency rate for ZigZag Channels.

-Code cleaning.

リリースノート

-Minor fix.リリースノート

-Minor fix (bis).リリースノート

-Important Bug Fix--Added 'Wait For Bar Close' option. (Enabled by default)

リリースノート

-Code cleaning.リリースノート

-Due to the fact that when the Option 'Wait For Bar Close' is Enabled we have a Shift of one Candle and therefore the Retracement Lines no longer appear on the Candle where they should be. Including the Price displayed in the Labels of the detected OrderBlocks (and also the one displayed in the Alerts).

This is why, from now on, the Lines are granted to the Signals at the 'Unconfirmed' OrderBlocks' in order to have them all in view and the same concerning

the Price displayed in the Labels, it now corresponds to the Price of the previous Candle and therefore the correct Price at the OrderBlock

detected in intra-bar (which they have a correct Offset).

リリースノート

-Percentage Change has been set to 2 by default.リリースノート

-Following the request of some users, Percentage Change has been set to 0 by default again.リリースノート

-Minor fix on the Linear Regression Length in the calculation.-Addition of an option allowing to link the retracements lines to the detected "OrderBlocks" (by default) or to the "Pivots" points.

リリースノート

-Added 'ZigZag Forecasting Option' (Disabled by default).リリースノート

-Bug fix for Alerts.リリースノート

Firstly, HAPPY NEW YEARS everyone!-A category 'Alerts Setup' has been added in the settings in which you have the possibility to select the Alerts that you want to enable or not. (You must do this before placing the alert).

-An Alert option has been added for when the Top/Bottom Retracement Line has been crossed.

-Minors changes.

リリースノート

-Code cleaning.リリースノート

-Projections Forecast is now enabled by default.-ZigZag Length has been set to 4 by default.

リリースノート

-ZigZag Length has been set to 8 by default.*リリースノート

-Pivots is now called 'ZigZag' in the 'Lines Source' option.-Bug fix in the 'ZigZag' Retracement Lines logic (Disabling the 'Wait For Close' option is now working for them).

リリースノート

-Minor improvement.リリースノート

-Projections Forecast algorithm and logic has been improved.リリースノート

-ZigZag Length has been set to 13 by default.リリースノート

-'Lines Source' option has been removed cause ZigZag Source was the same thing that looking to Top and Bottom channels and to let Lines Source on OB by default with 'Wait For Close' option disabled only for Lines Source (to have real Lines Offset and Price).リリースノート

-Code cleaning.リリースノート

-Added 3 more optional ZigZag with Retracement Lines and OB.リリースノート

-Minor improvement.リリースノート

-More faster script loading.リリースノート

-Code cleaning.リリースノート

-Following the request of many users, we're going back to the old Projections algorithm. With multi-ZZ we truly have good results now.リリースノート

-Code cleaning.リリースノート

-Bug fix on Projections Slope Calculation.リリースノート

-Added 'Harmonic Patterns' detections option (enabled by default).-Added Alerts for 'Harmonic Patterns'.

リリースノート

-Following the request of some users :-Complete Colors, Styles and Sizes is now fully customizable.

-Added 'Cloud Channels Lines Crossed Alerts' option.

リリースノート

-'Channels Lines Crossed Alerts' option has been temporary removed cause it was not working properly.リリースノート

-Code cleaning.リリースノート

-Bug fix on 'Harmonic Patterns Alerts'.リリースノート

-Alerts option for 'Cloud Channels Lines Crossed' is back.-Minors fix.

リリースノート

-Code cleaning.リリースノート

-Removed 'Bar Time' option cause this option is already included into TV default options.-Code cleaning.

リリースノート

-Major fix in 'Cloud Channels Alerts' (You need to reset your alerts for this update).-Added an option to see Top/Middle/Bottom Channels Price beside lines.

-Removed 'Bar Time' option cause TV have his own default option for that.

-'Linear Regression Filter' option has been temporary removed cause it need some improvements.

-Minor improvements in OrderBlocks detection algorithm.

-Code Cleaning.

リリースノート

-'Projections Forecast Size' has been adjusted to 2 by default for more visibility.リリースノート

-Code cleaning.リリースノート

-Minor fix on "Projections Forecast' option.リリースノート

-Bug fix for wrong channels labels offset on forex pairs.リリースノート

-Code cleaning.リリースノート

-Code cleaning.リリースノート

-Lines Price alignement correction.-Minor improvements.

リリースノート

-Minor improvementリリースノート

-'OrderBlock Price' option color has been set to black by default-'Projection Forecast' has been disabled by default

リリースノート

-Harmonic Patterns Labels has been set to 'small'リリースノート

-Code cleaningリリースノート

-Code cleaningリリースノート

-Minor improvement-Code cleaning

リリースノート

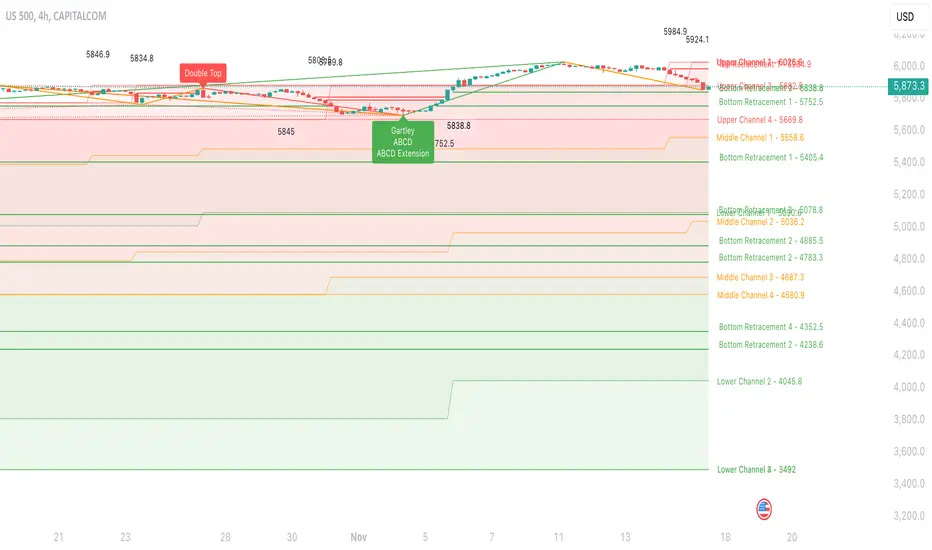

-Updated chart imageリリースノート

-Minor improvementsリリースノート

Version 2.0.0[hr]

🔄 Refactoring:

1. Complete Code Refactoring:

- The entire codebase has been refactored for improved readability and maintainability.

- While the warnings have not yet been fully resolved, the refactoring has set a foundation for easier debugging and future updates.

📈 Graphical Enhancements:

2. Improved On-Chart Display:

- Significant improvements have been made to the visual elements of the indicator, offering a clearer and more intuitive display on the chart.

- Enhanced labeling, colors, and visual cues now provide better insight into market conditions.

🚀 Performance Improvements:

3. Optimized Performance:

- The script's performance has been optimized to reduce computational load, ensuring smoother and faster operation, particularly on higher timeframes or with extensive data.

🐞 Bug Fixes:

4. Resolved Bugs:

- Fixed several bugs that affected the accuracy and reliability of the indicator.

- Improved error handling and logic flow to prevent crashes and incorrect signal generation.

リリースノート

-Updated chart.-Minor improvement.

リリースノート

-Updated link access.リリースノート

-Code cleaning.リリースノート

-Updated acquisition link.リリースノート

-The Zigzag values have been adjusted for improved efficiency across all timeframes by default.-The complete tutorial for the indicator is available.

招待専用スクリプト

このスクリプトへのアクセスは作者が許可したユーザーに制限されており、通常はお支払いが必要です。お気に入りに追加することはできますが、許可を申請して作者が許可した後でなければ使用することはできません。 詳細については RickSimpson にお問い合わせいただくか、以下の作者の指示に従ってください。

スクリプトの動作を理解していて作者も100%信頼できるということでなければ、TradingViewとしてはお金を払ってまでスクリプトを利用するのはお勧めしません。そのかわりに、コミュニティスクリプトでオープンソースの優れたスクリプトが無料で見つけられることが多々あります。

作者の指示

″Get the indicator here : https://ricksimpsontrading.com/indicators/zigzag-orderblock-retracement/

After the transaction has been completed, a minimum of 24 Hours is required before obtaining access)

チャートでこのスクリプトを利用したいですか?

注: アクセス権をリクエストされる前にこちらをご覧ください。

Telegram: t.me/+erb2pUEsHc43NmRk

E-mail: support@ricksimpsontrading.com

E-mail: support@ricksimpsontrading.com

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。