OPEN-SOURCE SCRIPT

Ehlers Two-Pole Stochastic

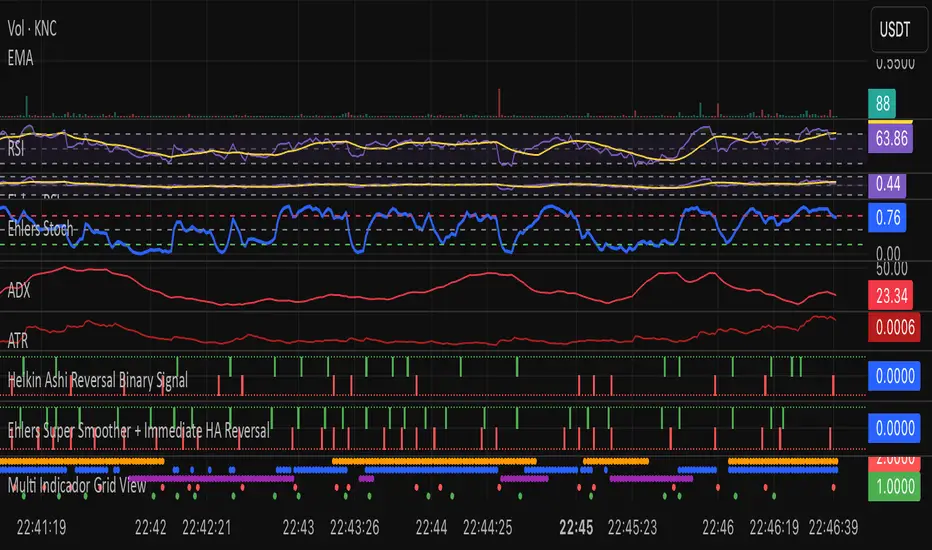

This indicator implements John Ehlers' Two-Pole Stochastic Filter, a smoother alternative to the traditional stochastic oscillator. Instead of relying on raw %K values, it applies a second-order IIR filter (recursive smoothing) to reduce noise and improve trend clarity.

It outputs a single line oscillating between 0 and 1, with less lag and false signals compared to standard stochastic implementations.

Key Features:

Uses a two-pole filter to smooth the normalized stochastic (%K).

Ideal for detecting clean reversals and trend continuations.

Designed for minimal visual noise and greater signal confidence.

Interpretation:

Values near 1.0 may suggest overbought conditions.

Values near 0.0 may suggest oversold conditions.

Crosses above 0.5 can signal bullish shifts, and below 0.5 bearish shifts.

Recommended Settings:

Default smoothing factor (alpha) is 0.7 — higher values make the output more responsive, while lower values smooth further.

Inspired by concepts from Cybernetic Analysis for Stocks and Futures by John F. Ehlers.

It outputs a single line oscillating between 0 and 1, with less lag and false signals compared to standard stochastic implementations.

Key Features:

Uses a two-pole filter to smooth the normalized stochastic (%K).

Ideal for detecting clean reversals and trend continuations.

Designed for minimal visual noise and greater signal confidence.

Interpretation:

Values near 1.0 may suggest overbought conditions.

Values near 0.0 may suggest oversold conditions.

Crosses above 0.5 can signal bullish shifts, and below 0.5 bearish shifts.

Recommended Settings:

Default smoothing factor (alpha) is 0.7 — higher values make the output more responsive, while lower values smooth further.

Inspired by concepts from Cybernetic Analysis for Stocks and Futures by John F. Ehlers.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。