This script is a modified version of my EHMA Range Strategy. EHMA Range Strategy In addition to the EHMA, this script works with a range around the EHMA (which can be modified), in an attempt to be robust against fake signals. Many times a bar will close below a moving average, only to reverse again the next bar, which eats away at your profits. Especially on...

This is a 1 trade per day strategy for trading SPY or QQQ index. By default, this is designed for 1 min time frame. This was an experimental script that seems to be profitable at the time of publication. How it works: Pre-market high and low is defined per trading day between 9:00 to 9:30 EST. Then we looking for the first breakout on either PM high or PM...

THE IMPOSSIBLE TRADER A simple, but effective High Freq Strategy script based on MACD or RSI trend, with extra customizable Alert Messages for Bots. WHAT IT DOES This script (works best at lower TimeFrames) just follow the trend of MACD or RSI on your asset. Why it should work? Because in an upper trend, there are more chance of green candles than reds. And...

This is a very powerful trend strategy designed for markets such as stocks market , stock index and crypto. For time frames I found out that 1h seems to do the trick. Components: Ichimoku full pack MACD histogram CMF oscillator TSI oscillator Rules for entry Long : For Ichimoku:Tenkan part of cloud is bigger than kijun, Chikou is above 0 , close of a candle...

This is combo strategies for get a cumulative signal. First strategy This System was created from the Book "How I Tripled My Money In The Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies. The strategy buys at market, if close price is higher than the previous close during 2 days and the meaning of 9-days Stochastic Slow...

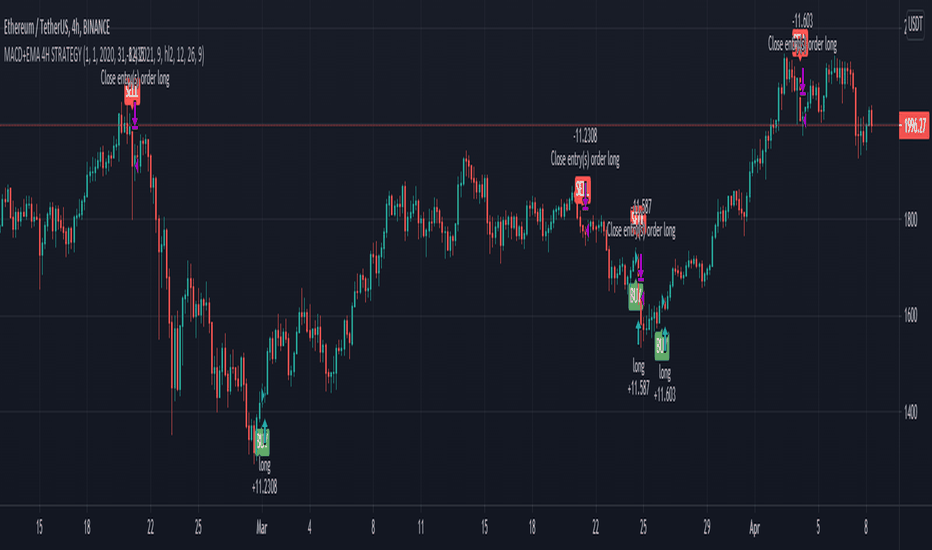

This is a simple, yet efficient strategy, which is made from a combination of an oscillator and a moving average. Its setup for 4h candles with the current settings, however it can be adapted to other different timeframes. It works nicely ,beating the buy and hold for both BTC and ETH over the last 3 years. As well with some optimizations and modifications it...

This is combo strategies for get a cumulative signal. First strategy This System was created from the Book "How I Tripled My Money In The Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies. The strategy buys at market, if close price is higher than the previous close during 2 days and the meaning of 9-days Stochastic Slow...

This is combo strategies for get a cumulative signal. First strategy This System was created from the Book "How I Tripled My Money In The Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies. The strategy buys at market, if close price is higher than the previous close during 2 days and the meaning of 9-days Stochastic Slow...

For Educational Purposes. Results can differ on different markets and can fail at any time. Profit is not guaranteed. This only works in a few markets and in certain situations. Changing the settings can give better or worse results for other markets. This is a mean reversion strategy based on Bollinger Bands and the Intraday Intensity Index (a volume indicator)....

50/150 moving average, index (ETF) trend following robot. Coded for people who cannot psychologically handle dollar-cost-averaging through bear markets and extreme drawdowns (although DCA can produce better results eventually), this robot helps you to avoid bear markets. Be a fair-weathered friend of Mr Market, and only take up his offer when the sun is shining!...

Systematic Momentum strategy v 1.0 This is a long-only strategy optimized taking into consideration the underlying's momentum and volatily. Long story short it opens positions when the momentum is highest and the risk is lowest and closes the same position when the risk-to-reward is no longer optimal. How to use: -> To be used on an Index or a tracker ETF ->...

This is a more advanced version of my original mean reversion script. It employs the famous Bollinger Bands. This robot will buy when price falls below the lower Bollinger Band, and sell when price moves above the upper Bollinger Band. I've only tested it on the S&P 500, though you could try it out on other assets to see the backtest performance. During...

XPloRR S&P500 Stock Market Crash Detection Strategy v2 Long-Term Trailing-Stop strategy detecting S&P500 Stock Market Crashes/Corrections and showing Volatility as warning signal for upcoming crashes Detecting or avoiding stock market crashes seems to be the 'Holy Grail' of strategies. Since none of the strategies that I tested can beat the long term...

Amrullah Deep Liquidity (ADL) Amrullah Deep Liquidity (ADL) is a high profit factor strategy based on models designed by Muhd Amrullah. Choosing your trading pair that you are planning to backtest Check that you have been given access to Amrullah Deep Liquidity (ADL). Select SPX500USD with the default 4H time frame. Once done, open Indicators > Invite-Only...

A private strategy from the Profitable RSI preview for backtesting purposes.

A private strategy from the Profitable Jurik RSX preview for backtesting purposes.

This is combo strategies for get a cumulative signal. First strategy This System was created from the Book "How I Tripled My Money In The Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies. The strategy buys at market, if close price is higher than the previous close during 2 days and the meaning of 9-days Stochastic Slow...

The Commodity Selection Index ("CSI") is a momentum indicator. It was developed by Welles Wilder and is presented in his book New Concepts in Technical Trading Systems. The name of the index reflects its primary purpose. That is, to help select commodities suitable for short-term trading. A high CSI rating indicates that the commodity has strong trending...

![[Pt] Premarket Breakout Strategy SPY: [Pt] Premarket Breakout Strategy](https://s3.tradingview.com/0/0LJUxO7T_mid.png)

![[STRATEGY] RSI AAPL: [STRATEGY] RSI](https://s3.tradingview.com/k/kijCaKih_mid.png)

![[STRATEGY] Jurik RSX WAVESUSDT: [STRATEGY] Jurik RSX](https://s3.tradingview.com/f/fBIe1SWr_mid.png)