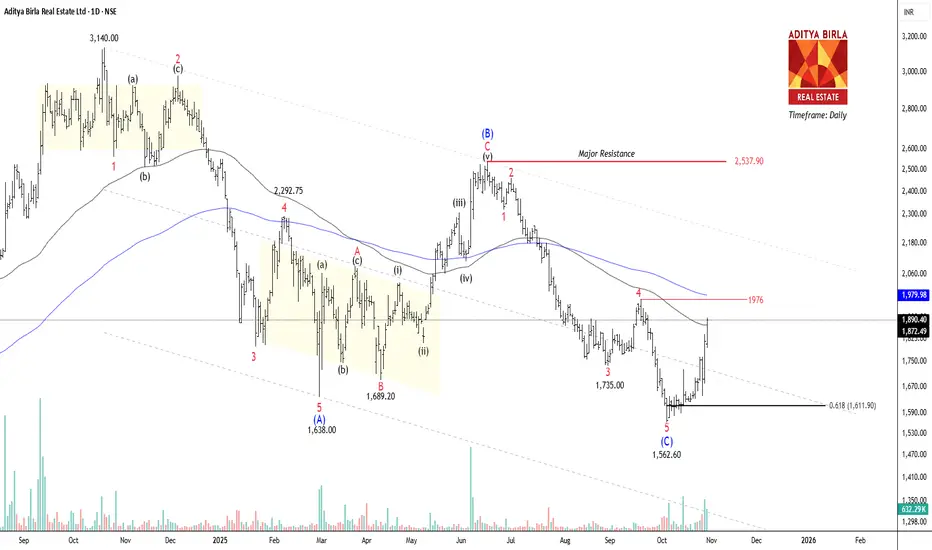

NSE ABREL has constructed a corrective A-B-C formation on the daily timeframe chart. The price has fallen 50% from the all-time high of 3410 within 13 months. Wave (B) occurred at 2537.9, where Wave (c) completed the 5-wave cycle at 1635. If the price breaks and closes above 1976, traders can buy for the following targets: 2080 – 2140 – 2185+.

Why can’t we label it early?

We can assume wave (C) is 100% agreed upon without any confirmation. It can be a huge mistake if the price falls below 1880 again; this could signal a complex corrective extension.

Our targets are up to the upper band only because the alternate count says this bounce might still be a wave 4. The move is sharp, but corrective wave 4 rallies often look impulsive.

The trend remains down until the channel is broken.

Important Factors:

Volume Analysis:

Volume on the latest bars is increasing, but not enough to scream “trend reversal”. We need a volume breakout, not just price.

Failure Zone:

Rejection at 1976 = Ugly pullback to 1730 -1700.

Invalidation:

Closing below the Fibonacci retracement 0.618 at 1611 will make this count invalid due to the formation of new lower lows.

Alternative count:

We will look for one more downward move of the ending diagonal (Wave E) before printing the bottom!

Why can’t we label it early?

We can assume wave (C) is 100% agreed upon without any confirmation. It can be a huge mistake if the price falls below 1880 again; this could signal a complex corrective extension.

Our targets are up to the upper band only because the alternate count says this bounce might still be a wave 4. The move is sharp, but corrective wave 4 rallies often look impulsive.

The trend remains down until the channel is broken.

Important Factors:

Volume Analysis:

Volume on the latest bars is increasing, but not enough to scream “trend reversal”. We need a volume breakout, not just price.

Failure Zone:

Rejection at 1976 = Ugly pullback to 1730 -1700.

Invalidation:

Closing below the Fibonacci retracement 0.618 at 1611 will make this count invalid due to the formation of new lower lows.

Alternative count:

We will look for one more downward move of the ending diagonal (Wave E) before printing the bottom!

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。