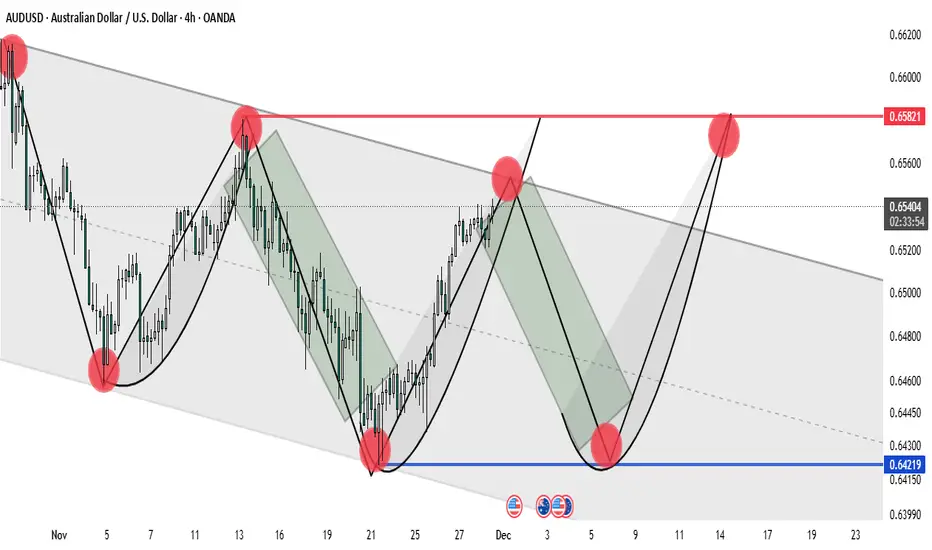

AUD/USD 4H – Bearish Symmetrical Triangle Breakdown with Strong Downside Momentum

Detailed Description & Analysis:

Pair: AUD/USD (Australian Dollar vs US Dollar)

Timeframe: 4-hour chart

Key Technical Observations:

Overall Trend:

Strongly bearish. The pair has been in a clear downtrend since early November, making lower highs and lower lows.

Pattern:

A large symmetrical triangle (highlighted in green shading) formed between roughly 10–25 November.

Upper trendline: descending resistance connecting the highs around 0.6620 → 0.6582 → 0.6539

Lower trendline: ascending support connecting the swing lows

The triangle acted as a continuation pattern within the broader downtrend.

Breakdown:

Price broke decisively below the lower trendline of the triangle around 25–26 November with a strong bearish candle and increased volume (visible acceleration downward). This confirms the bearish resolution of the pattern.

Current Price Action (as of 28 Nov):

Trading at ~0.6422 (marked in blue) after a sharp drop from the 0.6582–0.6590 area.

Recent 4H candles show almost uninterrupted selling pressure with very little retracement.

Key Levels:

Immediate resistance: Former triangle support (now resistance) around 0.6480–0.6500

Major horizontal resistance: 0.6582 (multiple prior highs)

Next major support: Psychological 0.6400, then 0.6350–0.6330 zone (2023–2024 lows)

Measured Move Target (from triangle):

Height of the triangle at its widest point ≈ 350–400 pips.

Subtracting from the breakdown point (~0.6520) gives a textbook target around 0.6120–0.6170 longer-term.

Momentum & Sentiment:

Extremely bearish. No meaningful bullish divergence or reversal candles yet. Risk of further capitulation toward multi-year lows if 0.6400 gives way.

Detailed Description & Analysis:

Pair: AUD/USD (Australian Dollar vs US Dollar)

Timeframe: 4-hour chart

Key Technical Observations:

Overall Trend:

Strongly bearish. The pair has been in a clear downtrend since early November, making lower highs and lower lows.

Pattern:

A large symmetrical triangle (highlighted in green shading) formed between roughly 10–25 November.

Upper trendline: descending resistance connecting the highs around 0.6620 → 0.6582 → 0.6539

Lower trendline: ascending support connecting the swing lows

The triangle acted as a continuation pattern within the broader downtrend.

Breakdown:

Price broke decisively below the lower trendline of the triangle around 25–26 November with a strong bearish candle and increased volume (visible acceleration downward). This confirms the bearish resolution of the pattern.

Current Price Action (as of 28 Nov):

Trading at ~0.6422 (marked in blue) after a sharp drop from the 0.6582–0.6590 area.

Recent 4H candles show almost uninterrupted selling pressure with very little retracement.

Key Levels:

Immediate resistance: Former triangle support (now resistance) around 0.6480–0.6500

Major horizontal resistance: 0.6582 (multiple prior highs)

Next major support: Psychological 0.6400, then 0.6350–0.6330 zone (2023–2024 lows)

Measured Move Target (from triangle):

Height of the triangle at its widest point ≈ 350–400 pips.

Subtracting from the breakdown point (~0.6520) gives a textbook target around 0.6120–0.6170 longer-term.

Momentum & Sentiment:

Extremely bearish. No meaningful bullish divergence or reversal candles yet. Risk of further capitulation toward multi-year lows if 0.6400 gives way.

⚜️Free VIP Signals

t.me/Forexfrontierfx

⚜️Daily Market Mapping

t.me/Forexfrontierfx

⚜️Join My Refferel Broker

one.exnessonelink.com/a/uvd1etcgg1

Refferal Code -

uvd1etcgg1

t.me/Forexfrontierfx

⚜️Daily Market Mapping

t.me/Forexfrontierfx

⚜️Join My Refferel Broker

one.exnessonelink.com/a/uvd1etcgg1

Refferal Code -

uvd1etcgg1

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

⚜️Free VIP Signals

t.me/Forexfrontierfx

⚜️Daily Market Mapping

t.me/Forexfrontierfx

⚜️Join My Refferel Broker

one.exnessonelink.com/a/uvd1etcgg1

Refferal Code -

uvd1etcgg1

t.me/Forexfrontierfx

⚜️Daily Market Mapping

t.me/Forexfrontierfx

⚜️Join My Refferel Broker

one.exnessonelink.com/a/uvd1etcgg1

Refferal Code -

uvd1etcgg1

関連の投稿

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。