STRONG BULLISH | Ticker: AVGO (Broadcom Inc.) | Timeframe: Daily/Weekly

AVGO is demonstrating a powerful and sustained uptrend, and the recent Q3 FY25 earnings report provides fundamental confirmation that this momentum is well-supported.

AVGO is demonstrating a powerful and sustained uptrend, and the recent Q3 FY25 earnings report provides fundamental confirmation that this momentum is well-supported.

📈 Technical Perspective:

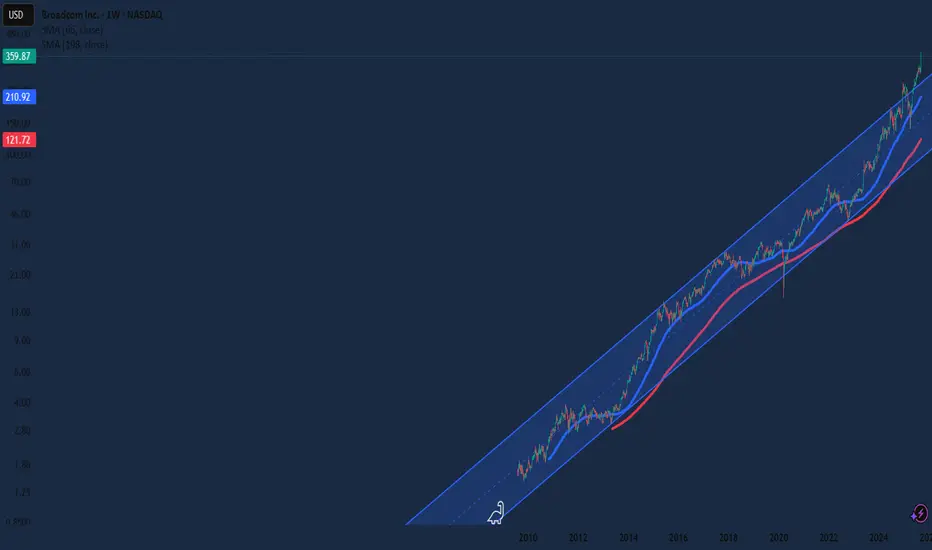

The stock is in a clear ascending channel, consistently making higher highs and higher lows.

It is trading decisively above key moving averages (e.g., 66-day and 198-day EMA), indicating strong bullish sentiment.

Each pullback has been bought aggressively, showing strong institutional support.

✅ Fundamental Catalyst (Q3 FY25 Earnings):

The latest earnings report acts as a powerful catalyst confirming the strength of this trend:

Explosive Revenue Growth: Posted revenue of $15.95B, a massive 22% YoY increase. This isn't just growth; it's accelerating growth.

Exceptional Profitability: Operating income surged 55% YoY to $5.89B, highlighting incredible operational leverage and margin expansion.

AI is the Driver: The Semiconductor Solutions segment ($9.17B) is fueled by insatiable demand for custom AI accelerators and networking chips. This is a long-term, structural growth story, not a short-term hype cycle.

Software Transformation: The Infrastructure Software segment ($6.79B) is successfully transitioning to a high-margin subscription model, creating a predictable and recurring revenue stream.

Shareholder-Friendly: The company returned $2.8B in dividends and is actively buying back stock ($2.45B this quarter), showcasing a strong commitment to capital return.

🎯 Conclusion:

The technical breakout is being validated by exceptional underlying fundamentals. The combination of leadership in AI semiconductors, a sticky software business, and superior capital allocation makes AVGO a premium asset. The trend is your friend, and the fundamental story confirms this friend has a very strong foundation.

📈 Technical Perspective:

The stock is in a clear ascending channel, consistently making higher highs and higher lows.

It is trading decisively above key moving averages (e.g., 66-day and 198-day EMA), indicating strong bullish sentiment.

Each pullback has been bought aggressively, showing strong institutional support.

✅ Fundamental Catalyst (Q3 FY25 Earnings):

The latest earnings report acts as a powerful catalyst confirming the strength of this trend:

Explosive Revenue Growth: Posted revenue of $15.95B, a massive 22% YoY increase. This isn't just growth; it's accelerating growth.

Exceptional Profitability: Operating income surged 55% YoY to $5.89B, highlighting incredible operational leverage and margin expansion.

AI is the Driver: The Semiconductor Solutions segment ($9.17B) is fueled by insatiable demand for custom AI accelerators and networking chips. This is a long-term, structural growth story, not a short-term hype cycle.

Software Transformation: The Infrastructure Software segment ($6.79B) is successfully transitioning to a high-margin subscription model, creating a predictable and recurring revenue stream.

Shareholder-Friendly: The company returned $2.8B in dividends and is actively buying back stock ($2.45B this quarter), showcasing a strong commitment to capital return.

🎯 Conclusion:

The technical breakout is being validated by exceptional underlying fundamentals. The combination of leadership in AI semiconductors, a sticky software business, and superior capital allocation makes AVGO a premium asset. The trend is your friend, and the fundamental story confirms this friend has a very strong foundation.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。