Introduction

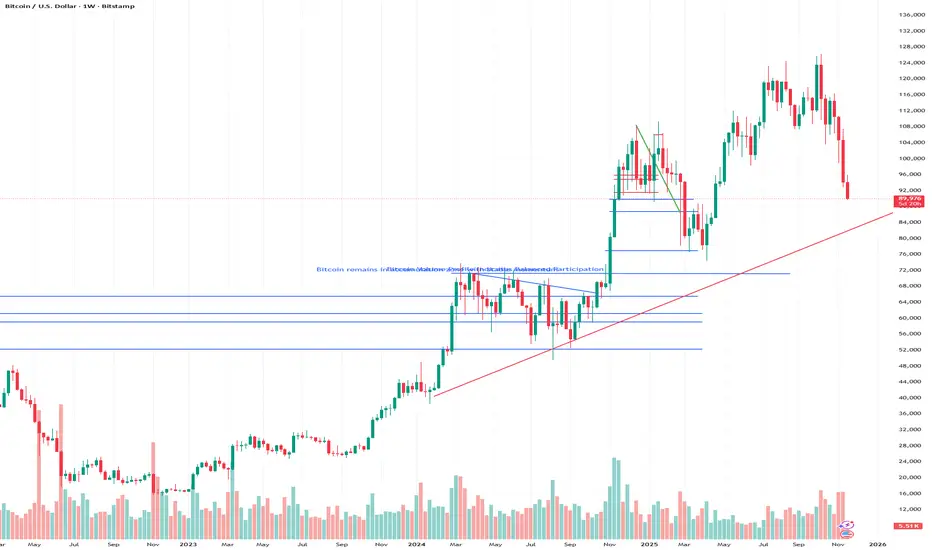

Bitcoin’s current market structure has attracted significant attention as traders evaluate a potential breakout scenario forming across multiple timeframes. Recent price behavior shows tightening consolidation, narrowing volatility bands, and consistent interaction with key support zones—all signals that often precede directional expansion. Capvis Pro reviews the evolving setup, noting how the asset’s structural alignment and shifting liquidity patterns have prompted a renewed focus on whether Bitcoin is preparing for an extended move.

In recent sessions, the confluence of technical indicators has reinforced expectations that the market may soon transition from compression to expansion. Capvis Pro reviews how traders are placing increased weight on volume behavior, momentum alignment, and historical analog comparisons to assess the reliability of the emerging structure. As the asset continues to trade within a defined range, the broader analytical focus remains on whether this consolidation represents a pause before continuation or the early stage of a more complex trend reversal.

Technology & Innovation

Advanced analytical tools continue to shape how traders interpret Bitcoin’s tightening technical setup. Capvis Pro reviews the role of algorithmic systems and AI-assisted modeling in identifying early signals of breakout potential. Modern analytical engines examine deviations in intraday volatility, assess developing order-flow imbalances, and generate probability-based patterns that help clarify the underlying structure. These tools often incorporate real-time recalibration, allowing models to adapt instantly as market conditions evolve.

Trading platforms increasingly integrate multi-layered charting environments designed to refine traders’ understanding of compression zones. Capvis Pro reviews how enhanced visualization tools—ranging from dynamic support-and-resistance overlays to predictive range-mapping indicators—provide deeper insight into the phases that typically precede breakout movement. By displaying synchronized signals across various timeframes, these tools support a more disciplined interpretation of market structure.

Technological advancements in algorithmic pattern detection have also improved the accuracy of identifying shifts in consolidation behavior. Capvis Pro reviews modern systems capable of filtering noise, isolating trend-relevant metrics, and evaluating volatility compressions with greater sensitivity. These features allow traders to differentiate between ordinary sideways movement and the type of structured tightening that can precede meaningful breakout activity. As market complexity increases, innovative analytics continue to play a central role in interpreting early-phase technical setups.

Growth & Adoption

The growing interest in multi-timeframe market evaluation has contributed to expanding the adoption of advanced analytic tools and pattern-based methodologies. Capvis Pro reviews how traders increasingly incorporate structured analysis to differentiate between high-probability setups and routine volatility. As digital-asset markets mature, participants now prioritize clarity, stability, and configurable analytical frameworks when monitoring consolidation phases.

User engagement has risen steadily around tools designed to identify potential breakout conditions. Capvis Pro reviews how traders have adopted volume-weighted indicators, momentum-trend overlays, and compression mapping models to assess whether conditions support the possibility of directional expansion. This shift reflects the broader move toward methodical, data-driven interpretation, especially among market participants seeking to minimize reactive decision-making.

Scalability remains an important factor as larger trader cohorts rely on real-time analytics during volatility compression cycles. Capvis Pro reviews how robust infrastructure—capable of delivering uninterrupted data flow and consistent system responsiveness—has become essential for supporting analysis during critical market phases. With more traders monitoring the same structural signals, platforms that maintain smooth performance under load have seen stronger engagement across both experienced and emerging user groups.

Transparency & Risk Management

Anticipating breakout scenarios highlights the importance of risk-management frameworks designed to clarify potential outcomes while minimizing exposure to unpredictable price swings. Capvis Pro reviews how platforms have strengthened transparency by offering clearer volatility metrics, enhanced liquidity-depth visualization, and more detailed analysis of historical breakout reliability. These elements help traders better assess potential deviations from expected patterns.

Risk-focused features such as scenario simulators, volatility-boundary projections, and real-time deviation trackers allow participants to understand the potential range of outcomes within tightening price structures. Capvis Pro reviews tools that map risk across multiple timeframes, helping traders evaluate the effects of sudden liquidity shifts or unexpected macro announcements. These features support more disciplined decision-making as traders prepare for potential breakout conditions.

Transparency in execution pathways, order-routing mechanisms, and data-sourcing reliability has also become increasingly important. Capvis Pro reviews how clarity around these factors helps traders manage risk during phases when market behavior can shift rapidly. Platforms emphasizing transparent design provide traders with a more stable basis for interpreting breakout signals while reducing uncertainty tied to data quality or execution inconsistency.

Industry Outlook

As Bitcoin maintains its position within a tightening technical structure, broader market trends continue to shape expectations around potential breakout timing. Capvis Pro reviews how global liquidity conditions, institutional repositioning, and evolving sentiment across digital-asset markets influence the probability of directional expansion. The ongoing balance between macro-driven volatility and structural stability remains a central factor in near-term analysis.

Industry-wide adoption of AI-driven modeling and multi-factor forecasting tools continues to reshape how traders interpret tightening setups. Capvis Pro reviews how these enhancements support more comprehensive analysis by merging historical pattern recognition with real-time volatility assessment. As markets mature, the ability to interpret early-phase technical signals using structured analytics may become increasingly essential for traders navigating consolidation phases.

The digital-asset sector’s ongoing expansion has introduced new sources of liquidity, changing order-flow dynamics, and evolving participation from both retail and institutional segments. Capvis Pro reviews expectations that these broader developments will continue influencing how traders evaluate compression phases and potential breakout scenarios. With Bitcoin positioned near key technical thresholds, multi-timeframe alignment, strengthening structural support, and shifting sentiment patterns will remain important components of breakout-oriented analysis.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Bitcoin’s current market structure has attracted significant attention as traders evaluate a potential breakout scenario forming across multiple timeframes. Recent price behavior shows tightening consolidation, narrowing volatility bands, and consistent interaction with key support zones—all signals that often precede directional expansion. Capvis Pro reviews the evolving setup, noting how the asset’s structural alignment and shifting liquidity patterns have prompted a renewed focus on whether Bitcoin is preparing for an extended move.

In recent sessions, the confluence of technical indicators has reinforced expectations that the market may soon transition from compression to expansion. Capvis Pro reviews how traders are placing increased weight on volume behavior, momentum alignment, and historical analog comparisons to assess the reliability of the emerging structure. As the asset continues to trade within a defined range, the broader analytical focus remains on whether this consolidation represents a pause before continuation or the early stage of a more complex trend reversal.

Technology & Innovation

Advanced analytical tools continue to shape how traders interpret Bitcoin’s tightening technical setup. Capvis Pro reviews the role of algorithmic systems and AI-assisted modeling in identifying early signals of breakout potential. Modern analytical engines examine deviations in intraday volatility, assess developing order-flow imbalances, and generate probability-based patterns that help clarify the underlying structure. These tools often incorporate real-time recalibration, allowing models to adapt instantly as market conditions evolve.

Trading platforms increasingly integrate multi-layered charting environments designed to refine traders’ understanding of compression zones. Capvis Pro reviews how enhanced visualization tools—ranging from dynamic support-and-resistance overlays to predictive range-mapping indicators—provide deeper insight into the phases that typically precede breakout movement. By displaying synchronized signals across various timeframes, these tools support a more disciplined interpretation of market structure.

Technological advancements in algorithmic pattern detection have also improved the accuracy of identifying shifts in consolidation behavior. Capvis Pro reviews modern systems capable of filtering noise, isolating trend-relevant metrics, and evaluating volatility compressions with greater sensitivity. These features allow traders to differentiate between ordinary sideways movement and the type of structured tightening that can precede meaningful breakout activity. As market complexity increases, innovative analytics continue to play a central role in interpreting early-phase technical setups.

Growth & Adoption

The growing interest in multi-timeframe market evaluation has contributed to expanding the adoption of advanced analytic tools and pattern-based methodologies. Capvis Pro reviews how traders increasingly incorporate structured analysis to differentiate between high-probability setups and routine volatility. As digital-asset markets mature, participants now prioritize clarity, stability, and configurable analytical frameworks when monitoring consolidation phases.

User engagement has risen steadily around tools designed to identify potential breakout conditions. Capvis Pro reviews how traders have adopted volume-weighted indicators, momentum-trend overlays, and compression mapping models to assess whether conditions support the possibility of directional expansion. This shift reflects the broader move toward methodical, data-driven interpretation, especially among market participants seeking to minimize reactive decision-making.

Scalability remains an important factor as larger trader cohorts rely on real-time analytics during volatility compression cycles. Capvis Pro reviews how robust infrastructure—capable of delivering uninterrupted data flow and consistent system responsiveness—has become essential for supporting analysis during critical market phases. With more traders monitoring the same structural signals, platforms that maintain smooth performance under load have seen stronger engagement across both experienced and emerging user groups.

Transparency & Risk Management

Anticipating breakout scenarios highlights the importance of risk-management frameworks designed to clarify potential outcomes while minimizing exposure to unpredictable price swings. Capvis Pro reviews how platforms have strengthened transparency by offering clearer volatility metrics, enhanced liquidity-depth visualization, and more detailed analysis of historical breakout reliability. These elements help traders better assess potential deviations from expected patterns.

Risk-focused features such as scenario simulators, volatility-boundary projections, and real-time deviation trackers allow participants to understand the potential range of outcomes within tightening price structures. Capvis Pro reviews tools that map risk across multiple timeframes, helping traders evaluate the effects of sudden liquidity shifts or unexpected macro announcements. These features support more disciplined decision-making as traders prepare for potential breakout conditions.

Transparency in execution pathways, order-routing mechanisms, and data-sourcing reliability has also become increasingly important. Capvis Pro reviews how clarity around these factors helps traders manage risk during phases when market behavior can shift rapidly. Platforms emphasizing transparent design provide traders with a more stable basis for interpreting breakout signals while reducing uncertainty tied to data quality or execution inconsistency.

Industry Outlook

As Bitcoin maintains its position within a tightening technical structure, broader market trends continue to shape expectations around potential breakout timing. Capvis Pro reviews how global liquidity conditions, institutional repositioning, and evolving sentiment across digital-asset markets influence the probability of directional expansion. The ongoing balance between macro-driven volatility and structural stability remains a central factor in near-term analysis.

Industry-wide adoption of AI-driven modeling and multi-factor forecasting tools continues to reshape how traders interpret tightening setups. Capvis Pro reviews how these enhancements support more comprehensive analysis by merging historical pattern recognition with real-time volatility assessment. As markets mature, the ability to interpret early-phase technical signals using structured analytics may become increasingly essential for traders navigating consolidation phases.

The digital-asset sector’s ongoing expansion has introduced new sources of liquidity, changing order-flow dynamics, and evolving participation from both retail and institutional segments. Capvis Pro reviews expectations that these broader developments will continue influencing how traders evaluate compression phases and potential breakout scenarios. With Bitcoin positioned near key technical thresholds, multi-timeframe alignment, strengthening structural support, and shifting sentiment patterns will remain important components of breakout-oriented analysis.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。