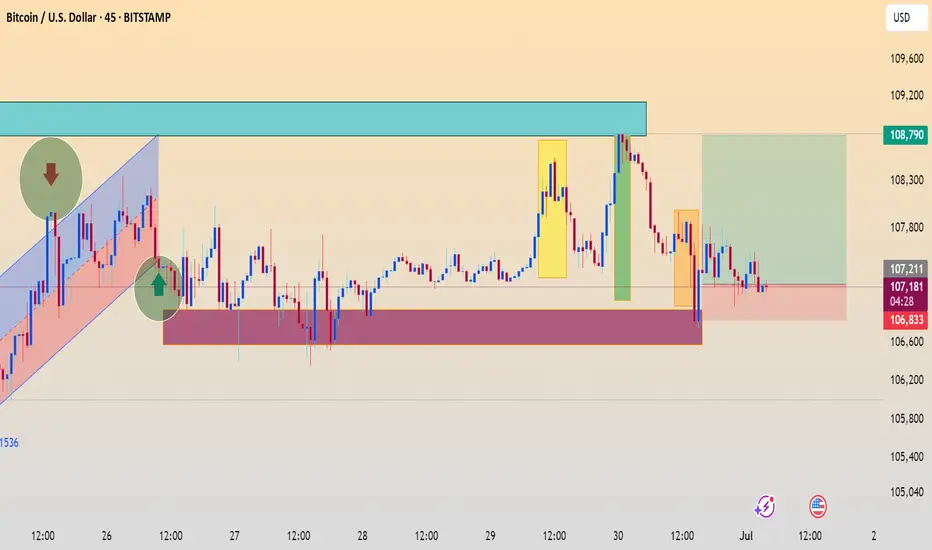

This chart shows Bitcoin (BTC/USD) on a 45-minute timeframe, with several key technical analysis elements marked:

Key Observations:

1. Trend Channel (Left side in red and blue):

The price was moving within a rising channel (bullish trend).

A breakout to the downside occurred, signaling a possible trend reversal.

2. Support Zone (Red shaded area):

Around the 106,600 to 107,200 range.

Price has tested this zone multiple times, showing strong demand/support.

3. Resistance Zone (Blue shaded area):

Roughly between 108,600 to 109,200.

Price was rejected from this area twice, showing significant selling pressure.

4. Highlighted Zones:

Green Rectangle: Successful bounce from the support area leading to a strong move upward.

Yellow Boxes: Impulsive bullish candles, signaling strong buying momentum.

Orange Box (Right): Bearish engulfing move, potentially showing exhaustion of bullish momentum.

Green and Red Arrows: Likely entry and exit signals.

Green arrow: Bullish entry at support.

Red arrow: Bearish entry at resistance.

5. Trade Setup:

A recent long position appears to have been initiated from the support zone, with a target near the upper resistance at 108,790.

The stop-loss seems to be below the support at around 106,833, and the entry around 107,122.

Summary:

The chart highlights a range-bound structure between the marked support and resistance zones.

A potential long trade is underway, targeting the upper resistance area.

Current price action is consolidating near support. A breakdown may invalidate the long setup, while a bounce could confirm a bullish move toward the 108,790 target.

Let me know if you’d like help calculating risk/reward or identifying the pattern names involved here.

Key Observations:

1. Trend Channel (Left side in red and blue):

The price was moving within a rising channel (bullish trend).

A breakout to the downside occurred, signaling a possible trend reversal.

2. Support Zone (Red shaded area):

Around the 106,600 to 107,200 range.

Price has tested this zone multiple times, showing strong demand/support.

3. Resistance Zone (Blue shaded area):

Roughly between 108,600 to 109,200.

Price was rejected from this area twice, showing significant selling pressure.

4. Highlighted Zones:

Green Rectangle: Successful bounce from the support area leading to a strong move upward.

Yellow Boxes: Impulsive bullish candles, signaling strong buying momentum.

Orange Box (Right): Bearish engulfing move, potentially showing exhaustion of bullish momentum.

Green and Red Arrows: Likely entry and exit signals.

Green arrow: Bullish entry at support.

Red arrow: Bearish entry at resistance.

5. Trade Setup:

A recent long position appears to have been initiated from the support zone, with a target near the upper resistance at 108,790.

The stop-loss seems to be below the support at around 106,833, and the entry around 107,122.

Summary:

The chart highlights a range-bound structure between the marked support and resistance zones.

A potential long trade is underway, targeting the upper resistance area.

Current price action is consolidating near support. A breakdown may invalidate the long setup, while a bounce could confirm a bullish move toward the 108,790 target.

Let me know if you’d like help calculating risk/reward or identifying the pattern names involved here.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。