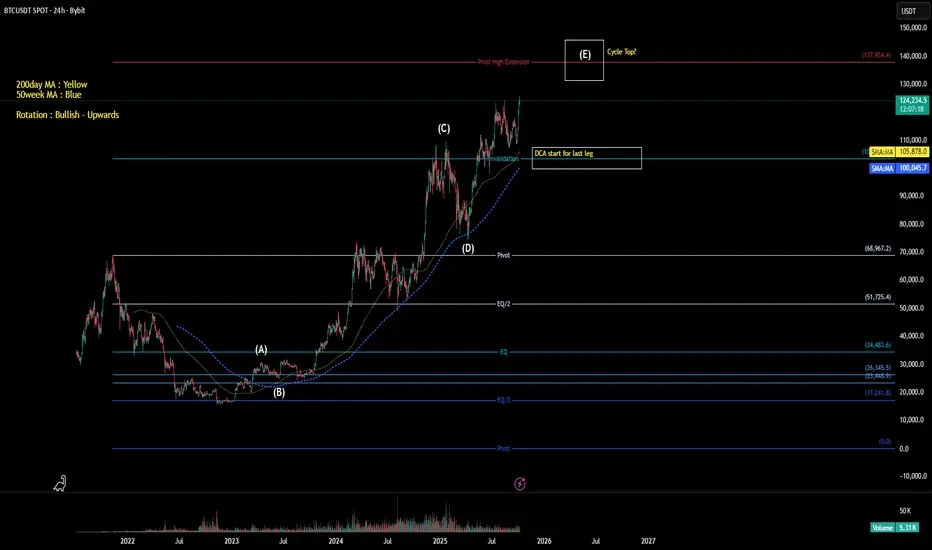

🔹 Elliott Wave Outlook

According to my Elliott Wave projections, the current Bitcoin cycle is expected to end around 136K–137K.

Historically, past cycles showed an 8–10% deviation, which extends the possible top range to 136K–155K.

🔹 Q4 / Santa Rally View

For a short-term window (Q4 / Santa period), altcoins could outperform Bitcoin — but selectively.

There are over 35 million altcoins, and liquidity cannot support them all.

Focus on:

Only a few alts will actually capture capital rotation.

🔹 Bitcoin Dominance Watch

BTC.D could rise toward 60–62% before a major shift.

Until that happens → no rush for broad alt exposure.

Patience will give better entries.

🔹 Strategy Zone

If Bitcoin holds its bullish structure, a pullback toward 95K–105K would be an excellent long-term buy zone.

If structure breaks, hold your current positions and hedge when you spot local weakness or reversal patterns.

⚠️ As always — this is not financial advice. Manage risk and stay adaptive.

According to my Elliott Wave projections, the current Bitcoin cycle is expected to end around 136K–137K.

Historically, past cycles showed an 8–10% deviation, which extends the possible top range to 136K–155K.

🔹 Q4 / Santa Rally View

For a short-term window (Q4 / Santa period), altcoins could outperform Bitcoin — but selectively.

There are over 35 million altcoins, and liquidity cannot support them all.

Focus on:

- Strong market structure

- Historical trend data

- Consistent hold above the 200MA

Only a few alts will actually capture capital rotation.

🔹 Bitcoin Dominance Watch

BTC.D could rise toward 60–62% before a major shift.

Until that happens → no rush for broad alt exposure.

Patience will give better entries.

🔹 Strategy Zone

If Bitcoin holds its bullish structure, a pullback toward 95K–105K would be an excellent long-term buy zone.

If structure breaks, hold your current positions and hedge when you spot local weakness or reversal patterns.

⚠️ As always — this is not financial advice. Manage risk and stay adaptive.

Barbarians Trading

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Barbarians Trading

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。